Hey, thanks so much for the detailed answer. Much appreciated!

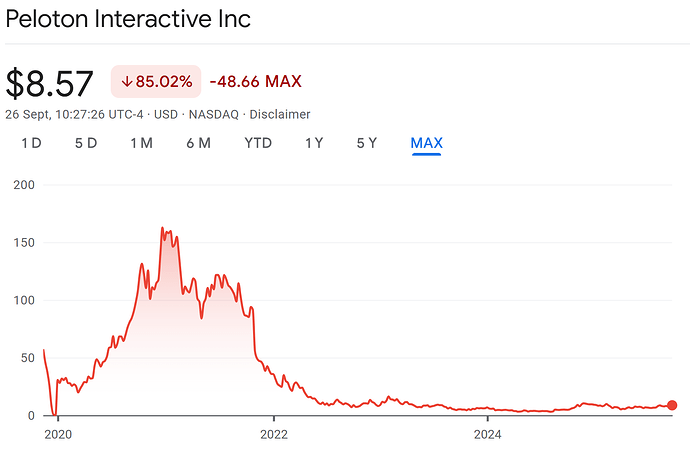

Just got myself a bit of exercise: PTON

It’s much lower than before the COVID bull run started. Bombed out. Now there are more users than before, new products in the pipline and cost reduction done. No reason why it cannot rise a bit.

Sold off the rest of BTU today after it went up another 7% also sold off HCC. Kept AMR.

I like coal as an unloved sector, but find it hard to stomach these multiples.

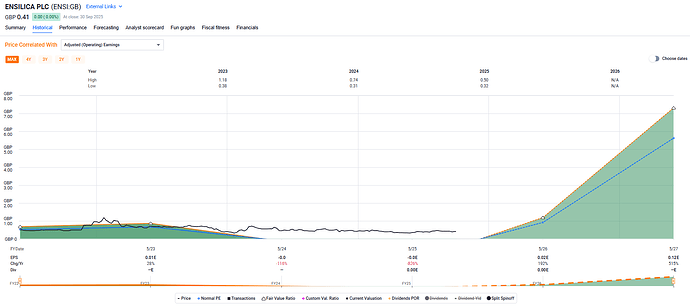

There’s a coal story for you: GCM Resources PLC. Bangladesh is considering energy autarchy. Instead of buying coal from India, they could develop their own mine. Interim government with Nobel laureate Mohammed Yunnus can’t take decisions, hence everyone is waiting for elections in early 2026. Could become a 5-to-10-bagger.

Thanks. That’s perhaps a little too speculative for my tastes! ![]()

And in other news, I own 3 gold miners, guess which one I don’t own ![]()

Wow, all of them are up at least 100% in 2 years. Nice investment!

Taste is singular. Or you mistyped an A for an E? It would make sense..

![]()

Are you a native English speaker?

Taste has a singular and plural form which have subtly different usages.

![]()

I just wanted to introduce my “joke”.. But anyway tastes as verb is clear but I didn’t know that english had this smal difference.

I hope the joke was at least clear ![]()

tastes > testes > balls > courage

A week of missed opportunities. I looked at buying more PFE, MRK and NVO. I held off on PFE as there was already a buy order in 22.xx range. Mistake as buying in 24.xx range was a 16%+ return.

NVO I looked at yesterday and hoped for a lower price today which didn’t materialize.

On the plus side, I did buy MRK which is surprising as it is the least favourite of the three.

I. Other brews, dead money AES up 15% on potential take private transaction.

And of course it goes up another 8% after I sell…

Sorry to repeat myself: Money and position management should be automated. Always! There is too much danger in a case-to-case decision system. You always end up in the slower queue…

Money and position management tells you how much to buy, how much to add, how much to sell and most important… when to sell.

Trimmed URNM and WAF. Bought FMC.

My absolute idol. Many of my rules are based on his books and I hope by the time I do my top performing strategy 20 years I reach his 29% CAGR; I’m at 27.57% after 5 years and 9 months, but I don’t have to adhere similar rules a fund manager has to.

I love what he says in the interview. I often use the phrase “you have to pick up a lot of stones to find a diamond, but there are diamonds”. He says “the person that picks up the most stones in the stock market wins”.

After quiet a long bull run many younger investors do not understand that they can lose 50% or more any time. And that they will almost surely lose a lot if they invest for longer periods of time, decades. He says the average stocks moves 100% per year. You can not only lose money but you will surely lose money. Once you got this into your mind you can work out how to not fall to all those errors investors commit in that situation. Lynch says the most money in the stock market is lost by preparing (trying to avoid) that situation. Once you understand that you cannot you are better off.

Thanks for sharing that!

Good one, I need to get his book, meaning to for a while but it’s my wife who’s the modern art (and consumer goods) expert in our house.

(wonder who’ll get this bad joke).

I had to look it up to see if he was actually still alive.

If it’s a “buy stocks of companies you personally like” joke maybe ask your wife for a fun paper trading account for you at her brokerage? If I misunderstood, please accept my apologies.

![]()

Actually, I apologize any which way.

Anyway, Sir Young Padawan, Mr Lynch published not just one book.

Not sure I understand what you are trying to say.

Since this is a FIRE forum: Peter Lynch FIREd at 46. As he recounts (also in the referenced interview) his dad died at 46. Peter thought this was a good age to retire at and spend more time with his family.

This is a guy who did great, knew when enough was enough and was actually able to pull the cord.

Hope many people on this forum will be able to do the same (even as I have not seen lots of evidence of it yet).