After seeing what >27% CAGR does in 5+ years, wow 29% over 20 years is a real stack of cash. I suppose he invested in his own fund…

I meant that he’s such a GOAT/Legend and was around such a long time ago, in my mind, I always assumed he’d passed on already, so I was surprised to see him doing an interview.

EDIT: also great quote “America creates. China duplicates. Europe legislates.”

Support.

By that age I would likewise plan to - at the very least - reduce my pensum % significantly (for the same reasons - spending more time with loved ones).

But first I hope I’m still alive then. ![]()

Aware, it’s the “One up on Wall st” I am looking at. And…my bad joke…but I can’t unsee it for years now, now it’ll infect you too ![]()

I do respect that he quit to spend time with family when he could have made much more, even if it probably wasn’t much of a financial sacrifice for him.

Isn’t there some statistic that retiring increases the chance of you dying? Esp. the first few years right after retirement?

Hey stockpickers

I do read this thread and usually like your picks or the reasoning behind it. I need your help.

Let’s asume I’ll have some spare cash CHF (from an undsiclosed investment) and I’d like to pick 3-5 Swiss stocks to keep for ca. 15-20yrs. It should be solid and pay some dividends. It doesn’t need to grow 3x a year. Every few years I’d like to add to them.

My short list rn: KNIN, NESN, UHRN, UBSN, SIGN.

What are your top 5 picks and with which weight would you go in (the next several weeks)? Any good killer reason against my short list? Thanks.

Hi Stojano,

I had asked a similar question (not sure if it was in the same chapter or maybe in the dedicated thread) and @Your_Full_Name provided an awesome response with Fastgraphs. Far may it from me to recommend you stocks. However, I have only NESN from your list and added some NOVN, ROG, HOLN and ZÜRN to the mix.

I do not like KNIN because it’s very cyclical, UHRN seems to me that the best days are over, UBSN would not touch it because of personal distaste, some of the insurance companies like SREN or SLHN maybe.

however, I assume you want that side of the portfolio to balance out your crypto to I guess all of the Swiss companies are not in the tech/crypto/AI space so should be a good diversification.

SLICHA or CHDVD.

Problem solved.

Thanks. My long list is mostly based on discussions here (and some digging through internet and talking with friends). UHRN because my kids still love the Swatches. KNIN because I lived not far away from the headquarter and every morning I passed by train I dreamed about being an Onassis. (You know now why I need more sophisticated opinions from you guys).

I’d like to avoid ETFs. I think it’s similar to thinking “not your keys, not your coins”.

(btw SLICHA is not on Saxo… I suppose it’s under symbol UBSLI, the price is the same).

Mate, other than UBS these look catastrophic by the 5 year charts, why these?

When Goofy FASTgraphed the top 10 (or so, only has 20) positions of CHDVD, the top 5 are 70% of the weight of the ETF, and IIRC maybe 4 of them had good growth prospects according to the tool. I decided “good enough for me” and put some money there, which I’ll continue to do, maybe adding UBS too.

Edit: there’s the post: FIRE at 50 - Optimizing liquidity, risks and taxes - #14 by Your_Full_Name , you could possibly look there and make a selection yourself without using an ETF.

Probably I’m used to BTFD. And I ask: will it be still there 20yrs from now. If probably yes than why not. Do I think wrong here?

Thanks, I was there on the post and read though Goofy’s comments. Maybe you are right to pick from the ETF. I choose SIGN for not having only “big” ones.

Not knowledgeable enough to answer on the “will it be still there 20yrs from now”. Some companies seem to have some magic sauce that allows them to continue plugging and raising dividends and earnings in all situations, including pharma companies with all the complexities of drug development and marketing. I say this because the cyclicality or consistence of earnings growth (“price will follow earnings” is a mantra) seems to be sticky: some companies maintain one or the other.

Regarding buying TFD, you’re essentially saying buying undervalued companies, ie trading below several metrics that suggest the stock price should be higher but isn’t for reasons. I believe BTFD is harder to do “right” on securities, but it does need conviction, just like it does for BTC, that you’re buying something worthwhile which will persist in X years from now. So circled back to not being knowledgeable enough ![]()

ok, I see… If I’m not an expert or at least have some experiance in evaluating stocks, it’s just like lottery. Maybe it’s better to just stick to an ETF or pick some top from the ETF.

(I really don’t want to spend all the time questioning my decisions or reevaluating… maybe all 2 yrs or so).

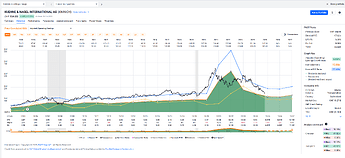

KNIN: Slightly overvalued, unsteady dividend, high payout ratio (~80% of the earnings go into the dividend).

Side note: The founder – Mr. Klaus-Michael Kühne – was one of the big time investors into Benko’s Signa holding but apparently managed to pull out before Signa went into bankrupcy.

NESN: it’s been discussed recently somewhere above in this topic.

UHR: ditto, though the discussion is a little more dated (but is probably still accurate today).

Here’s a fresh FASTgraph:

UBSG: Slightly overvalued, but the earnings trajectory looks fine (since the GFC).[§, §§]

If they move out of Switzerland (or let themselves be acquired by a foreign bank) I’d expect the stock price to go through the roof.

SIGN: Looks like a bond with occasionally missing coupon dividend payments. ![]()

Conclusion: the only ones investable to me would be UBSG and probably NESN (given your 20 year horizon and their portfolio of strong brands I feel that they’ll eventually recover from their current issues).

I would additionally look into (assuming your universe is Swiss companies only):

ZURN: Reliable albeit somewhat slow grower (since the GFC). Only slightly overvalued.[§§]

RO: Slow but steady. Currently fairly valued.[§§]

NOVN: ditto. Currently fairly valued.[§§]

If limited to 5 picks I’d pile into UBSG, NOVN, ZURN, RO and NESN.

I’d personally just do equal weights,[V] but you could also sector equal weight (Finance: 1/6 UBSG, 1/6 ZURN; Pharma: 1/6 RO, 1/6 NOVN, Consumer Staples: 1/3 NESN).

Good luck![§§§]

§ I own them (bought them in January 2020).

§§ I bought them for my son’s portfolio.

V None are currently crazily over- or undervalued, otherwise you might adjust your weights to buy a little more of the undervalued ones and a little less of the overvalued ones.

§§§ If you follow this advice, I expect Two and Twenty.

(I’ll DM you my Bitcoin address)

Many thanks for the checks. I think I’ll set for NESN, UBSG and NOVN and then soon RO and ZURN next. I think I’ll keep KNIN on my watchlist and flush SIGN.

I have this odd feeling that I need to add some smaller, industrials… something like Geberit or Straumann. But I think I’ll wait for the next occasion.

2 & 20 - Uiii… that’s too complicated for me to calculate ![]()

What a great idea that would be to maintain a short list of (long term investment) stock picks within the community. MPForum ETF! 0%TER! Mustachian after all ![]()

Given the expertise here, history and experience, a set of 10-15 of wisely selected Swiss and US stocks could do it and gather a large public.

Buffet will not last much longer, we need a new story. Let’s build it here.

Totally get the urge to own stuff below the radar (outside the large indices). I personally truly enjoy owning some micro and mini-caps that I know the pros can’t own because the companies are too small (e.g. CTBI[1] or WEYS[2] or NVDA … ok, just checking on whether you’re still awake with the last one).

For Geberit and Straumann: both viable businesses, able to continually grow their earnings, but chronically overvalued. Probably more my personal flaw, but I just cannot bring myself to buying an over-priced company.

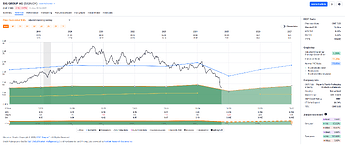

GEBN: Somewhat only moderately fast growing business (maybe like RO above). Currently quite overvalued even against the valuation the market has historically attributed (a 23xP/E, the blue line).

If it just returns from its current valuation (of 33xP/E) to its normal valuation you’ll be looking at negative returns over the next couple of years. If it returned to its fair valuation (attributed given its growth, the orange line), you’d loose almost half of your investment.

I admit I keep thinking about buying Geberit everytime I see their logo in some public toilet … but when I look at FASTgraphs I just piss away forget about that impulse.

I could be talked into buying them below the blue line, but only if there were no other more beautiful undervalued brides/grooms available.[$]

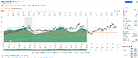

STMN: Man, I dunno … Slightly better deal if it returned to its “normal” valuation of 29xP/E (and assuming earning projections are correct – which, given the analysts’ track record are a bit iffy) you might look at making some money …

but if somehow the valuation would return to its fair multiple (given the company’s growth), this investment looks uppercase iffy.

When there are more beautiful brides and grooms like RO, NOVN, NESN, UBSG and ZURN on the market, I’d stick to those for now.

As mentioned, I like the smaller names as well, but I’m not well versed in the Swiss companies to name any that seem attractive currently.

1 CTBI: Community Trust Bancorp, regional bank with an USD 1B market cap.

2 WEYS: Weyco Group, shoes distributor an USD 280M market cap.

$ I have bought so-called overvalued companies before, e.g. Coca-Cola

or more recently Pepsico

and most recently Keurig Dr. Pepper

but these are really only the exception to the rule (and because I miss Dr. Pepper, the soft drink

Here’s the thing, though …

Let me – within a day – look twice over my proposed list and I’ll disagree with half of my first round suggestions.

Bring in other forum participants and the short list of wisely selected securities is nilled within a day.[![]() ]

]

![]() Ok, bring @cubanpete_the_swiss into the mix and we’ll have a reliable and stable list for centuries to come based on the mechanical investment rules he established.

Ok, bring @cubanpete_the_swiss into the mix and we’ll have a reliable and stable list for centuries to come based on the mechanical investment rules he established.

However, given Goofy eventually figures out those mechanical rules, he’ll front run them and ruins everyone’s profits.

This is why we can’t have nice things …