Invested funds on Friday and Monday. It feels like setting money on fire!

You have to embrace the loss of control. The price for better long term return

Or simply follow “the @Cortana indicator” like the rest of us.

Not bad, it’s already working

More money on fire. I wish I’d not bothered doing anything the last week! ![]()

Updated. REITs now making appearance in Top 10.

| Previous | Nov.01.2023 |

|---|---|

| Bonds | Bonds |

| BTI | Short SPY |

| VIRT | BTI |

| MMM | VIRT |

| MPW | MMM |

| KAP.IL | KAP.IL |

| AWE.L | O |

| LNC | MPW |

| VDY.TO | MO |

| AMLP | AWE.L |

2023 is coming to an end and I thought I’d provide an update here for those interested.

TL;DR: the snowball is picking up mass and speed as it’s rolling down the hill.

As always, an overview of positions held (and some other portfolio evaluations) here.

Stockpicking portfolio now contains 108 securities. Bought some, sold a couple, increased a bunch of positions, details see below.

2023 Main Stats

- low six figure cash flow (aka dividends)

- 5% increased weighted dividends versus 2022 (had all positions remained frozen)

- made more with passive than with active income - yay!

2023 Transactions

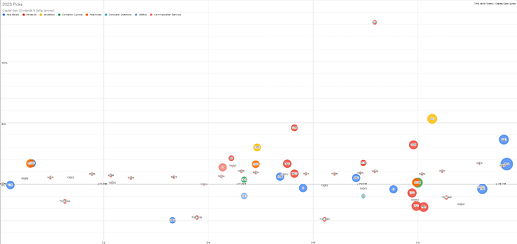

Capital Gains (and Losses) from 2023 transactions:

(bubble diameter translates to investment amount)

New 2023 positions (in order of time of positions initiated):

-

$DLR: Digital Realty Trust

Datacenter REIT, finally fairly valued. Nice dividend growth history (though no increase this year).

-

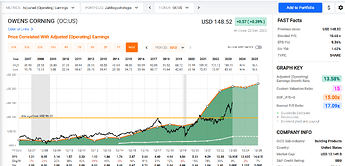

$OC: Owens Corning

Building Products, substantially undervalued. Nice recent divident growth.

-

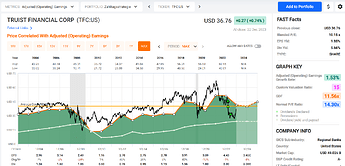

$TFC: Truist Financial Corp

Regional Bank. Bought it before the crisis in March and added to it as it tanked. Undervalued.

-

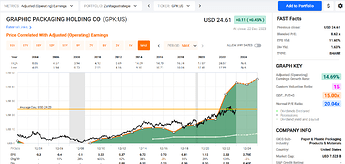

$GPK: Graphic Packaging Holding

Paper & Plastic Packaging. Looked undervalued in March and April, still looks that way.

-

$ARE: Alexandria Real Estate Equities

Office REIT. Undervalued (got thrown into the bucket of Office REITs which all tanked, but it’s in fact a specialized Office REIT that mostly requires office presence, i.e. life science stuff). Nice dividend growth.

-

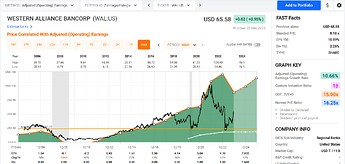

$WAL: Western Alliance Bancorp

Regional Bank, tanked heavily in the Spring 2023 regional bank crisis (for no fundamental reason as far as I could tell, i.e. no bond duration risk, etc).

-

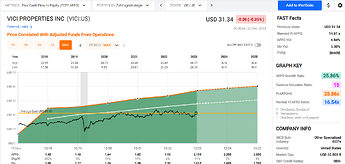

$VICI: VICI Properties

“Casino” REIT. Undervalued, nice yield, nice dividend growth.

Increased 2023 positions:

- $NSA, $MAIN, $IMB, $IIPR, $OXSQ, $BNS, $JNJ, $OZK, $MO, $MTB, $GPN, $BK, $T, $LGEN, $CVS

Sold 2023 Positions:

- $STOR

Reason: acquired by Brookfield.

P&L: capital gain of 25% (bought a full size position in June/July 2022, sold it in February 2023), additionally $725 in dividends. - $HOPE

Reason: disappointed by no raise in dividends since 2019 despite their cash flow allowing for it.

P&L: capital gain of about 13% (bought smallish positions in March and September 2020, sold it in August 2023), additionally $782 in dividends. - $CAH

Reason: overvalued and it was a small position that I felt woud benefit from trimming.

P&L: capital gain of about 96% (bought the position in December 2020, sold it on Nov 29 2023, additionally $592 in dividends.

Awesome ![]() how much is that in CHF if I may ask? And from how much net worth did you generate that income?

how much is that in CHF if I may ask? And from how much net worth did you generate that income?

Thanks for sharing. It seems we were looking at very similar selection of stocks. I also was buying WAL as it was tanking. It felt like I spent a whole day glued to IBKR buying as the automatic circuit breakers kicked-in and out. I was lucky to get a lot around $8.

Unfortunately, I wasn’t able to hold onto my original sell target of $60 and chickened out around $35-$40 leaving a further doubling on the table.

This shows exact figures but includes ETFs and other stuff in addition to my stockpicking selection: Mein Depot - Depot Übersicht | DivvyDiary

(it’s only really useful forward looking, as I use the tool with position size but I don’t track purchases or sells with it)

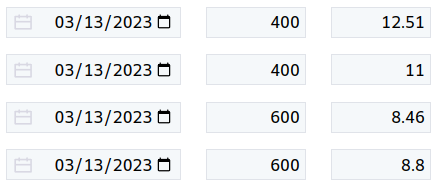

I also was buying WAL as it was tanking. It felt like I spent a whole day glued to IBKR buying as the automatic circuit breakers kicked-in and out. I was lucky to get a lot around $8.

Nice.

Didn’t realize that it went as low as $8 … (probably Swissquote couldn’t keep up with the market in those times).

It was between $8-$9. It felt like setting money on fire at the time as I’d buy at $11-$13 and it would tank by $3 as I refreshed to buy the next lot. I can’t remember whether it dipped below $8 as it was very volatile and price was moving very quickly. I was watching it continuously in real-time. I was literally issuing a buy order, and then as soon as it completed (subject to trading halts) issuing another one and I still didn’t manage to catch the exact bottom. I stopped after it recovered to over $9.

With hindsight, I’d wish I’d bought more, but I was concerned that there was a possibility of collapse due to deposit flight. So I kept them as small speculative bets.

Lol, you make more dividends than I earn ![]() congrats on your portfolio!

congrats on your portfolio!

Wow. That’s a huge number of positions! Do you ever think of consolidating some into ETFs? How long does it take you to fill out your tax return?! ![]()

I did consolidate my Canadian positions into VDY but now pay a 0.22% managment fee for this convenience.

Wow ![]() This is my goal for retirement, being paid by dividend instead of the montly shitty 2nd pilar conversion

This is my goal for retirement, being paid by dividend instead of the montly shitty 2nd pilar conversion ![]()

Wow. That’s a huge number of positions! Do you ever think of consolidating some into ETFs? How long does it take you to fill out your tax return?!

I did consolidate my Canadian positions into VDY but now pay a 0.22% managment fee for this convenience.

Tax returns are actually fairly easy as I can import the previous year’s holdings and then only have to enter the new purchases (and sells, if any).

The biggest challenge in the past couple of years was uploading the PDFs of dividends received (for DA-1) as the corresponding section in the online tax tool limited the number of pages for DA-1 to 200 while I have well over a 1000 … ![]() (I resorted to uploading them in different sections like Lohnausweis, pillar 2/3a receipts, etc).

(I resorted to uploading them in different sections like Lohnausweis, pillar 2/3a receipts, etc).

ETFs … yeah, I resort to them in my retirement accounts and mainly for my non-US investments in my non-retirement account.

I could probably shed some of my smaller positions but overall I kind of dislike moving to ETFs mainly because

- they typically hug an index and buy and sell based on flows regardless of prices

- I am focused on cash flow (partly for consumption) and I like picking the companies that reliably pay dividends (and ideally increase them over time)

It’s probably more of a psychological thing, though.

How do you manage the tax on the income? You just pay it or offset it or shield it in some way?

Wow

This is my goal for retirement, being paid by dividend …

That’s pretty much the motivation for my portfolio construction as well. ![]()

And when I’m senile towards the end I’ll buy a bunch of Lambos with the hitherto unslain goose that laid the golden eggs … or I’ll pass the goose on to my loved ones.

… instead of the montly shitty 2nd pilar conversion

Though, to be fair, the conversion rate of the pillar 2 is actually very nice - it’s just that during the accumulation phase, the compound return on “your” pillar 2 is IMO not that great. At the least, it’s downside protected, which my pillar 2 in the Freizügigkeitskonto is not.

I just pay it.

Some more characters to reach the posting limit.

17 posts were merged into an existing topic: FI(RE), pulling the trigger likely in 2020: ~50, male, married, one kid