Shhhhh stock buybacks and dividends are the same thing minus taxes!!!1

That’s what makes a market! ![]()

According to Gemini, the stock-based comp was $399 million in 2024 and $239 million in 2025 so far. Their buybacks were $5.5 billion in 2024 and $4.4 billion in 2025 so far. Seems (to me) stock-based comp wasn’t a major part for the additional debt taken on ($1.37 billion in 2024 and $4.4 billion in 2025 so far).

I actually like that they seemingly do more buybacks when their stock price has come down to more reasonable levels … as I likewise dislike that they did large buybacks in 2024 when their stockprice was still way above (my) fair value.

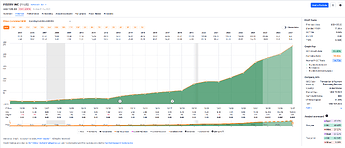

Here’s their OCF over time:

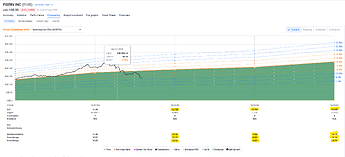

and the analyst[★] estimates going forward

(while analyst[★★] estimates have come down a bit, the growth still looks fine to me)

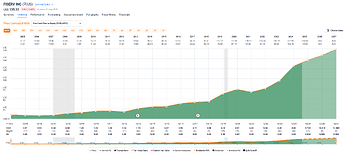

And here’s their FCF:

and analyst[★★★] estimates going forward

I guess I like looking at the balance sheet and cash flow statements (and 10-K and -Q filings) as well, but I like extending the snapshot view by how these things have evolved in the past and how they are expected to do in the future, and I draw a different conclusion. Also, it’s not my money, it OPM. ![]()

Also, I’ve probably never dug as deep for an investment in my son’s portfolio, where I do tranches of about $200 per position, i.e. I’ll probably initiate a single share/$130 position next week and might add to it when further cash arrives in his portfolio (via dividends). ![]()

★ Analyst scorecard for earnings looks pretty good:

★★ Analyst scorecard for OCF is still fine:

★★★ Analyst scorecard for FCF is still acceptable:

Not exactly, at least from the viewpoint of management. Dividends are gone, lost forever. Stock buyback however lowers the number of shares in circulation and therefor the remaining shares and especially the options are worth more. That means it goes directly to the management options.

So with dividends we pay tax, with stock buyback we pay the management. If there are no management options stock buyback is better of course.

… and shareholders.

For companies – do these even exist? ![]() – that don’t do stock based comp, we pay only the shareholders with buybacks.

– that don’t do stock based comp, we pay only the shareholders with buybacks.

Add some lingo here about how to incentivize management with stock based comp to have the stock price do well given their vesting schedule.

Exactly. But buying up stock in the free market is kind of cheating, I want to see organic growth, not managers borrowing money to lift the stock price. What did not work anyhow in the case mentioned, it seems they bought at the top.

As I said, if there are no management stock options all that money from treasury buys goes to the stockholders, as dividends do. But without tax.

Potato, Potahto.

IMO.

YMMV, of course.

If you – as the company, including your treasury – cannot invest capital on hand better than buybacks, why not do buybacks? Even Warren does this with BRK …

Anyway, we’re haggling about personal preferences.

It’s a free market, luckily, and nobody has to buy or sell anything (except for those pension funds relentlessly at the bid each month buying into indices … but I digress).

To shift the discussion away from seemingly highly dividing FI here’s the position I’ve added to my own candidates list:

Community Financial System Inc. (CBU)

FASTgraphs analysis by Chuck here: Undervalued and Overlooked: This Dividend Aristocrat Offers Big Upside | FAST Graphs

I’m a little on the fence given the low (earnings) growth rate, but I like the stable and forever growing dividend. I’ll need to look at it a little more, but I like it so far.

I like how small it is (not buyable for many professional investors), it’s only in the RUT.[$] It has raised their dividend for 33 consecutive years. It’s currently slighty undervalued and the next couple of years are supposed to be double digit % growth years in earnings.

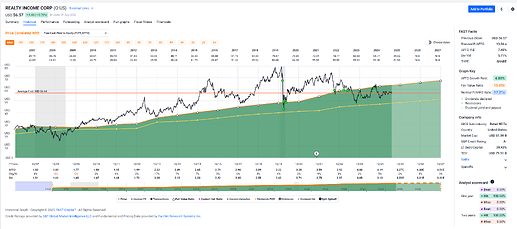

The other company – already on my candidates list and greenlighted for further buying into – is Realty Income (O).

My position is kind of full already, but that almost 6% dividend yield, their AFFO continuing to grow and their current undervaluation (not that often looking at AFFO history) sure look tempting to me.

And their payout is monthly!

Anyway, just food for thought.

$ Yes, the RUT is the Russell 200 Index, the one that's done so abysmally well over the past few years ... ;-)

Agree, but in the case at hand they borrowed money to buy back their stock at the top. So if they wanted to lift price it did not really work.

CBU is kind of small, but looks good. Would make its way into my mechanical dividend strategy, but it is somehow not a member of the U.S. dividend 100 index. Probably the finance sector was already full.

Maybe slightly different thought I’ll share today.

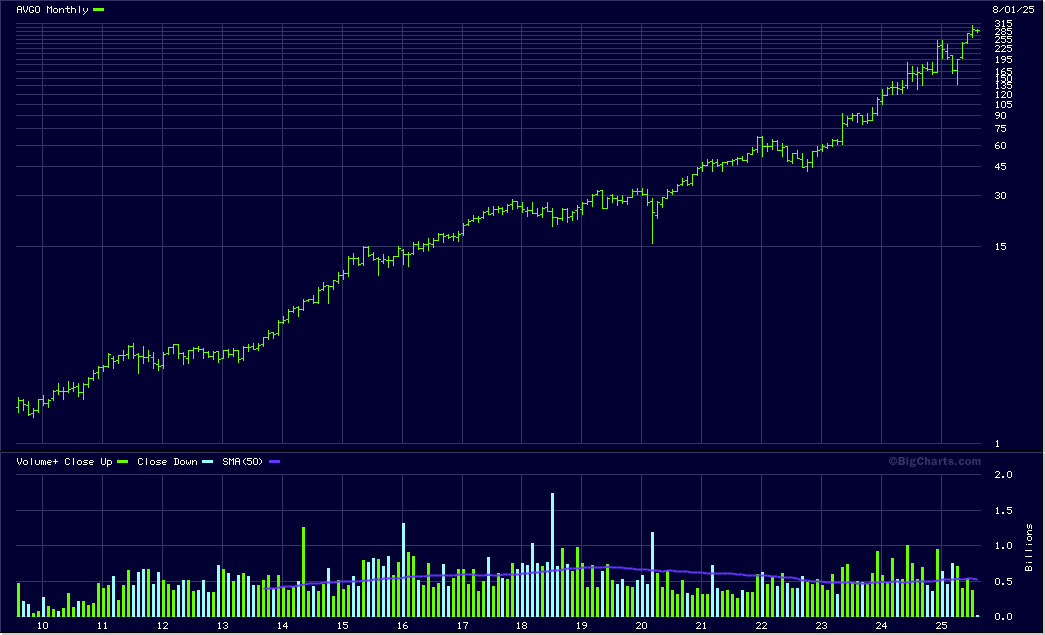

I built an AVGO position when it was still cheap back in '22. Already sold a small slice about a year ago. Probably going sell another small slice next week as the valuation looks just eye watering.

Perhaps – if I wait a little longer with not selling – this could be the position I’ll retire on … oh, wait, I’ve already retired. All I want is additional reliable cash flow. Getting some from capital gains in lucky investments is great, but I still prefer the steady quarterly dividend cash flow.[$]

This sell will thus probably finance some of the potential buys discussed above (CBU) and some the ones already greenlighted on my watchlist (ARE, CHCT, CMCSA, CSWC, CVX, EIX, GIS, MET, MG, O, PEP, and PRU).[ℱ]

I’ll (likely) give up a hundred bucks or so in dividends from AVGO to buy maybe 4 to 6 times that amount in the dividends (in the companies mentioned above).

Chalk it up to cutting the flowers and watering the weed … ![]()

$ For the record: AVGO provides that, too, and raises its dividend at a very steep cliff.

Unfortunately, if you invest a hundred dollars today, your dividend paid out will only be 82 cents with the current dividend.

ℱ Some of these positions are already “full” in my portfolio, so I’ll hesitate more buying into them. “Sizing is more important then entry level” is how one of my heroes (Harley Bassman) puts it.

Mine is a bit older, 2014 I think. Mucho dinero, already took out multiple times my entry…

It did help a lot to build up my dividend portfolio. Actually my “market dividend” concept did. Whenever a position reaches 6% of portfolio value I sell down to 5% and call that Mr. Markets dividend. Usually I buy then stocks I own already and that are worth less than 4% of portfolio value and are still on “buy” of course. All completely mechanical and does automatic “buy low, sell high”. Of course this works better on real cyclical stocks than with this multibagger.

At the moment Broadcom is too expensive for my taste. But I have a momentum filter and will not sell therefor. What is already expensive may get much more expensive as the Broadcom example shows.

But I have a gut feeling that the best times for AVGO are over. VMWare was way too expensive and Dell already took out probably all important clients before selling it.

Re-Balancing is part of the position management. Position management should be always mechanical, too much risk for behavioral errors. And once you own a stock it is difficult to stay neutral (at least for me).

The FOMO is here!

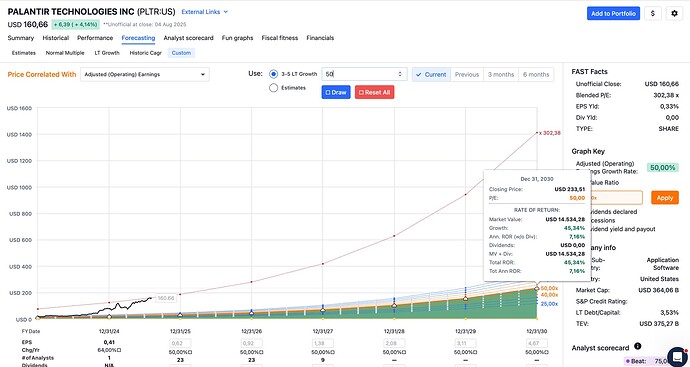

I’ve been wondering over many months whether to drop some money to Palantir and let it ride, first by remembering a quote by the good Prof Damodaran several months ago that “Palantir may be the single company that will really do AI” (what does he know? probably little more than most, for one though he’s not an idiot TikTok Finflue…the word is too stupid to commit to print…he’s not a hype bro, rather he’s a rational value investor and an actual expert in valuations), second by a friend who’s drilling my head that he only holds nVidia and Palantir because “There’s nothing else worth it” (sounds silly but he’s done REALLY well on it…). Third reddit saying “Amazon ran at 1000 P/E for years, look at what happened next”. Yeah the FOMO is real!

@Your_Full_Name when you get a moment would you mind running a FASTgraph so we see how many thousands of years it’d take to recoup any money at the 5000 P/E PLTR is running at?

Edit: I bought nVidia, one of my few single stock purchases, back in end of 2022, sold in end of 2023 with 2x profit, thought - idiotically - “it’s run its run”, “everybody knows about it”, “no steam left”, went on to do another ~4x on top of that… so yeah, pure FOMO.

Edit 2: that nVidia trade fully funded a nice 5-day family trip to Paris over Christmas so there was something good out of it!

There is absolutely nothing we can do against FOMO. At least I cannot, that is why I use exclusively mechanical strategies.

Maybe this helps: you did already miss out. Try to find something a bit earlier. Warning: you have to pick up a lot of stones to find a diamond… but there are diamonds.

At the moment I hold 3 stocks with over 500% gain in my momentum portfolio: SMCI (+1013%), CEG (+504%) and VIST (+846%). They all came as surprises. I mean a company that screws hardware, a utility company and an explorer in Mexico and Argentina… come on! Nobody could have known that. When everybody knows it is already too late.

But it pays to pick up a lot of stones. Stocks can only go down 100% what never happened to me. But they can go up many many 100%, what happened quiet a lot to me.

This is always the challenge. What strategies do you have for selling. My biggest ‘losses’ were always from selling too much and too early, so I try to figure out ways of selling less and selling later.

Selling is part of the position management. There is no perfect solution I’m afraid, you always sell too early or too late. I try to do “hold as long as possible, but not longer”. Tools for that trade are partial sales after some time or after some benchmark reached. But don’t put the benchmark too low!

Position management should always be mechanical. There is no reason to decide on a case level because you probably end up always in the slower queue. Once you understand that you cannot constantly pick highs except for pure luck, just write down rules.

Some ideas for complete sales are when you need money for a new purchase (I do that in my momentum strategy) or when some of your rules are not fulfilled any longer (that I do in the dividend strategy).

At the time I didn’t have any strategy other than feels, with big and documented (in my own hands) opportunity cost. I don’t consider opportunity cost money lost (possibly another massively naive stance), I only consider money lost when going into absolute negative values, which hasn’t happened to me yet.

To be honest I still don’t have any strategy for selling as, and however naive this may sound, selling is something I find very stressful regardless of whether the market or a position is going up or down, so my long-term plan is to transition to a model of never ever selling and relying on dividend growth and monetizing movements by trader-for-hire AKA covered call funds.

All these posts could be moved to another thread though as they are not about stock picking.

Yeah, I bought PLTR yesterday right before the results, haha

I have a good feeling about AMD, I hope, they will be the next Nvidia or Palantir ![]()

Of course, if you extrapolate the growth, you’re going to make $$$ over the next 3 years!

Well there’s nothing wrong with “selling after gains” itself,

it’s risk management (since you don’t know the future),

and more a matter of “how much” (close position or just part of it).

I personally trimmed my (what I see as a small personal betting, very lucky) PLTR position as I reached certain thresholds,

returned 2-3x my original investment,

but now letting it run without caring much where it goes.

(I know it’s also partially just psychology / mental accounting).

And of course I have thoughts of “oh but what if I didn’t trim it, I would have way more now” - but fully aware I’m more content with eliminating any loss vs. keeping the potential of twice-or-so the gain.

(In any direction not life-changing amounts)

Currently at ~2000% gain (thanks to FIFO),

struggling to keep it below some of my smaller ETF positions. ![]()

Not sure I will be selling it any time soon,

as I am firsthand convinced they have the absolute best product on their market.

(Which of course doesn’t mean the stock will perform as good)

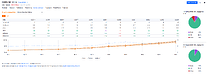

I went into the forecasting tool within FASTgraphs and modeled 50% annual earnings growth going forward (warranting a 50x P/E as the “fair” / orange line):

If the price returns to the “fair” 50x multiple, this results in a CAGR of over 7% at the end of 2030!

You basically can’t go wrong with this one …

Edit:

I’m similar with my AVGO investment, but I can’t bring myself to letting it run as the mental accounting in my head calculates “sell another tranche to exchange the 0.79% cash flow (dividend) it generates into 4 or 5 times that with a different company.” ![]()