Then you tell us! ![]()

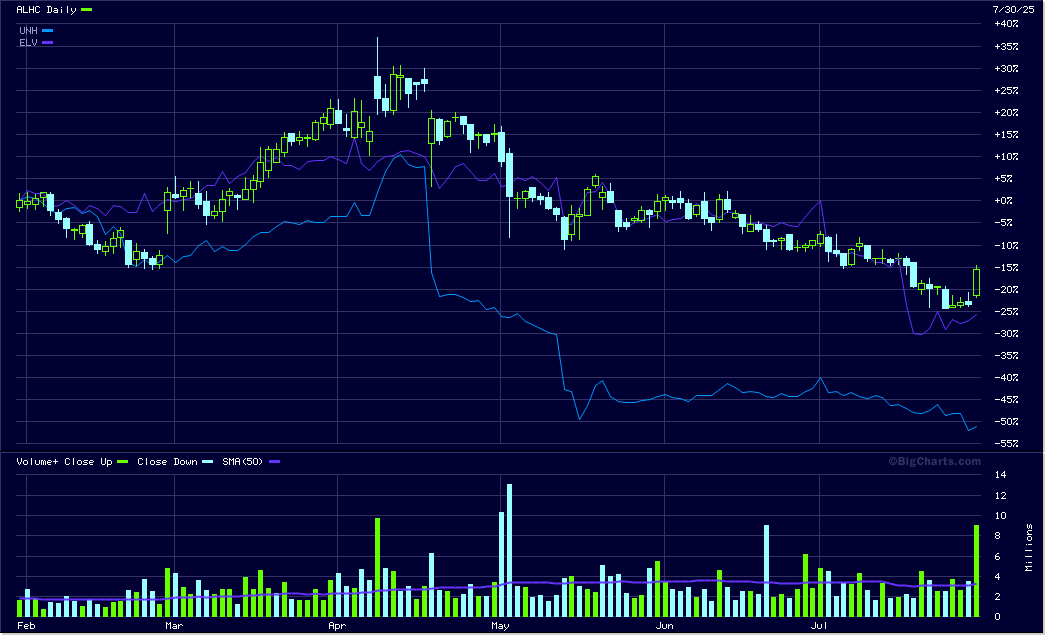

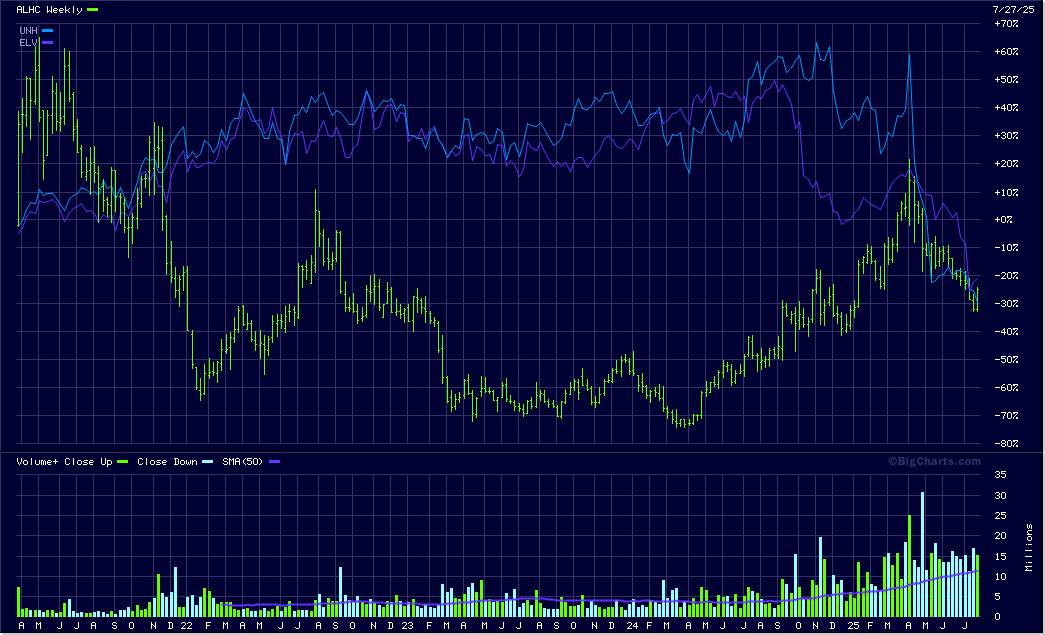

Alignment Health Care, one of my momentum stocks, made 30% yesterday on good numbers. Comparing with the other two health insurance stocks discussed here lately it seems that UNH has left the path while ELV moves quiet similar to ALHC, just the latest lift is still missing. They report their next numbers in October.

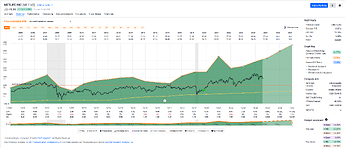

One way I like to look at charts is comparing. UNH is way off, more than sector problems it seems…

I think cutting medicaid and medicare will help those stocks in general. But the question is what they do with it. Alignment spent quiet some money on ads, especially for the ever growing Spanish speaking people.

short-time chart comparison:

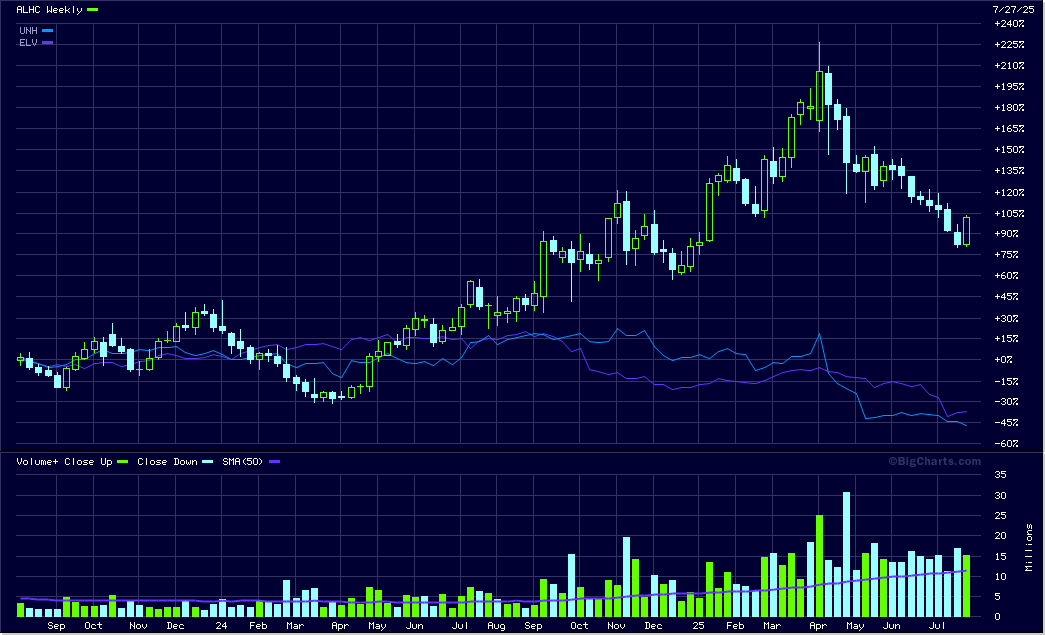

Now, long-term one can see why I prefere Alignment:

At the monthly chart one can see that the momentum probably was just a comeback:

According to the “undercover economist” this sector is doomed anyhow. But why not take a slice when there is some money to be made…

Addentum: the ad with Louis Miguel:

BTW: most of the rise occurred after market close, so it is still not visible on the charts.

WSJ doesn’t like UNH, either.

Under Medicare Advantage, payments to insurers increase with the number and severity of patient diagnoses, a structure that creates strong incentives to document as many conditions as possible. A Wall Street Journal investigation last year found UnitedHealth had collected billions in extra payments tied to questionable diagnoses.

Source: WSL article

Actually the arguments from the undercover economist are quiet good: there is an information deficit for health insurers, because every person knows his health situation himself better than any external place. So it is a losing game for insurers.

But then over a period of 30 years only a very little percentage of stocks make money at all. Most of the companies just go bankrupt, that is the way of the world, death and birth. The 2% best stocks made always up for that in the past.

But for me that means I don’t do buy-n-hold, I do “hold as long as possible, but not longer”. A small but important difference. Otherwise I could never invest in like healthcare insurers or even utilities (because of their cash flow situation).

BTW: I always say “I do”, but actually it is my captain, the mechanical investment strategy, that does.

One of my favourite books, literally changed the way I see the world!

On my (buy/sell) candidates list[BS] MET lit up today (-3.25%) and I bought a few shares into the dip as the company pays an above 3% dividend now while fundamentals mostly continue to look solid.

Free cash flow is a different picture (and is projected to not even cover the dividend in the next few years), but operating cash flow is still fine.

Their S&P credit rating of A- and long term debt / equity at a manageable 40% makes me think they’ll continue to pay their dividend and even raise it further given their history of 12 years of raising it.[D]

Reminds me of Pepsi: couple of capital heavy investments planned in the next couple of years, but IMO not a fundamentally deteriorating business.

BS The BS list – pun intended – is a roughly weekly updated list of companies worth buying given the FASTgraphs fundamentals (or selling, same criterion).

D They didn’t even cut their dividend during the Great Financial Crisis (like most financial institutions) but instead held it steady until 2012 after which they started raising it again.

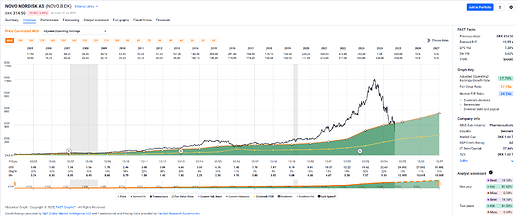

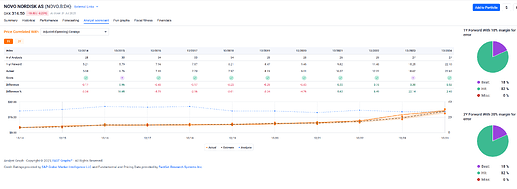

How is Novo Nordisk Fast Graphs looking like? Forward P/E looks interesting

Adjusted Operating Earnings:

(Goofy thinks: Slighty undervalued given their growth over the past 20 years)

Zooming in …

(Goofy thinks: Well, only really slightly undervalued given their growth over the past 7 years plus projected growth in the next couple of years)

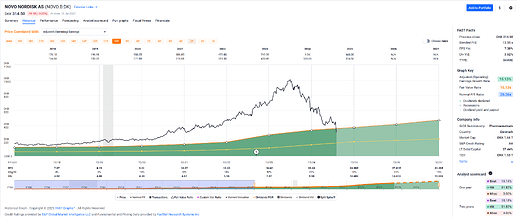

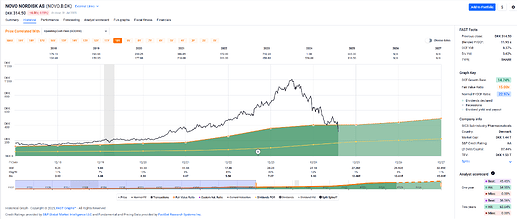

Operating Cash Flow:

(Goofy thinks: Well, only really slightly undervalued given their growth over the past 7 years plus projected growth in the next couple of years. Dividend seems to covered well, payout ratio seems ok, perhaps on the higher end than what I would like to see for a dividend growth company)

Free Cash Flow:

(Goofy thinks: Well, a little more iffy … seems they’ll be paying out their entire free cash flow as a dividend this year. At least the projections going forward by the analysts seem to paint a rosier picture).

Forcasting:

(Goofy thinks: Hm. Earnings are expected to grow, but analysts’ expectations of earning in this and coming years have consistently be trending down. …)

Analyst scorecard: seems fine.

Pretty good return expectation if the company returns to the projected fair 15x multiple:

Flabbergasting return expectations if the company returns to its historic “normal” multiple:

With this 5 minute look Goofy is neither a buyer nor a seller, but thinks there’s equally beautiful brides / brooms out there that might be worth a closer look.

Finance stocks are difficult in that field. Their trading good is money, so investments are not always clearly investments in my sense. I usually try to filter out all business activity that is not like an investment into the business infrastructure.

MET looks still OK to me, even the free cashflow (the investmets) are difficult to identify. I think I did use only “other - net” of 173 millions as of last year.

I hold Metlife for many years, over a decade I think, loaded up a big chunk in 2020 at $27.20. Hope to be able to hold much longer…

How do you guys calculate the investment cash flow of finance stocks?

Anytime, buddy.

So, IIUC, with your idiosyncratic background (and the flying broom just now), you’re basically issuing a “strong buy” (“broom level” buy) on this one?

Did I get this right?

Quite honestly … I was going to say “above my pay grade”, but that would really be a euphemism for saying “I don’t know at all”. So, I really don’t know.

Long term, I believe even financials (and their stock price) bend to earnings’ multiples and (operating and free) cash flow, so while short term things might look like voodoo for some financials, longer term, I feel you can evaluate them like other companies.

Do you have (very) differing thoughts on this?

Yes, I do. Normally free cash flow equals operating cash flow minus investment cash flow. Now if money is the trading good in my humble opinion one cannot call it investment; it is normal business. Therefor I do not count the financial “investments” in the investing cash flow. Probably a too simple view, but I could not find anything better.

They buy a new office complex: investment. They buy computers: investment. They buy bonds: no investment, it is their business.

My view is very simplistic but served me OK until now.

Of course, who doesn’t want a flying broom?!

What about idiosyncratic background ![]() ?

?

None, of course, that I would know of. But since you’re asking why you might have one, this proves that you actually have one … ![]()

This trade didn’t go too well…

I guess with the wheel strategy you wouldn’t consider buying it back before expiry, either?

The stock dropped so quicky that buying back the put was no longer a viable option. Now I’ll have to wait for the stock to recover…

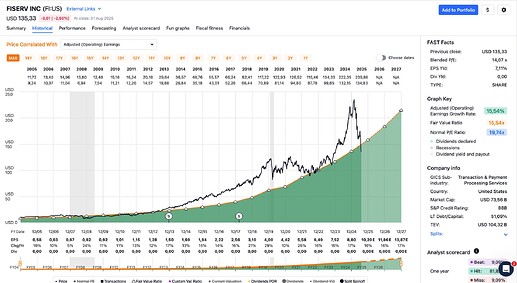

Came across Fiserv (FI) today.

This is a company I’ll likely add to my son’s portfolio next week. No dividend (great if your time horizon is long), nice growth expected, acceptable level of debt, historical earnings look almost perfect.

If you’d like to see Chuck Carnevale discuss the company, check out https://youtu.be/WZRQvOIhh54?si=ijhKHrngB7qe88nH&t=1212

FI:

There is no dividend, but they bought 5.8 billion in own stock, financed partially with new debt. I don’t like that, especially because it is to cover employees options I suppose.

The main difference to dividends: management does not profit from dividends. That is almost the whole operating cash flow and results in a negative FCF to treasury stock payout ratio. Does not seem very sustainable to me… at that point I already stop analyzing.

![Comercial Luis Miguel 2023 Completo.[Alignment Health Plan]](https://forum.mustachianpost.com/uploads/default/original/3X/5/0/50c38d4f78d39bceb4a8f2a8bc8980eea9d798de.jpeg)