Funny. I was thinking to myself “hey, at least I sold CI before this ‘crash’, only to discover that I actually hadn’t!”

It looks like I had a buy order on CHTR…

Why do you still hold this trade? You made 85% of the maximum profit in two months (out of 7). And you stand to gain less than 1% of your blocked capital in 4 months… I usually aim for 1% in two weeks. Much better to close this trade and enter a new, much more profitable one…

Great question.

I have not really answered it for myself with the explanation I am comfortable with, but have instead copied (somewhat blindly) the approach of who I would call my mentor, who will still hold on to a Put if it’s generating at least a dollar a day (mostly in time decay).

That put is still below the sell threashold and – admittedly speculatively – is luring me in to let it expire worthless, even though I understand there is capital at risk and diminishing return for the remainder of the options lifetime.

Convince me further why I should buy it back!

(only half joking, as I am in limbo myself)

What do you make of EL then? This has bounced now.

Not sure if this is the right thread to discuss option strategies… but I’m happy to answer your question.

Closing out short options is not an exact science for me, but it depends primarily on the return target. In my options thread, I once said that I aim for a return of around 1% of the capital invested per two weeks (=> 25-30% per year).

If an option is performing well and I achieve this target ahead of schedule, I weigh up the return already received per day against the expected return per day for the remaining term. If the residual return is well below my goal, I buy back the option and sell a new put option that again meets my return target.

In your example (85% return after 30% of the option’s term), the case would be crystal clear to me. Your friend’s 1 dollar per day target is completely arbitrary and ignores your risk appetite, strike price and portfolio size.

In addition, closing a short option also allows you to reset the risk (underlying, term, return). Imagine how annoyed you would be if UNH shares really tanked in the autumn and you ended up owning the shares after all.

Because I’m interested: what return target have you set yourself? And what terms do you typically choose (apparently much longer than me)?

Another way to evaluate an open short put:

Would you sell a short put on UNH today with a strike price of $160 19Dec25 for a premium of $135?

I certainly wouldn’t. The option has a delta of only 0.033…

As I said before, UNH passes my tests for the dividend strategy now, which came quite as a surprise. The cash flow and the reduced price do that.

Now Estée Lauder is another story. Quiet nice price movement since April, but not really cheap. Goodwill is higher than equity. It basically means you buy a company that consists entirely of other companies and debt.

Cash flow is OK, but it would not make it into my dividend strategy because of the low dividend yield.

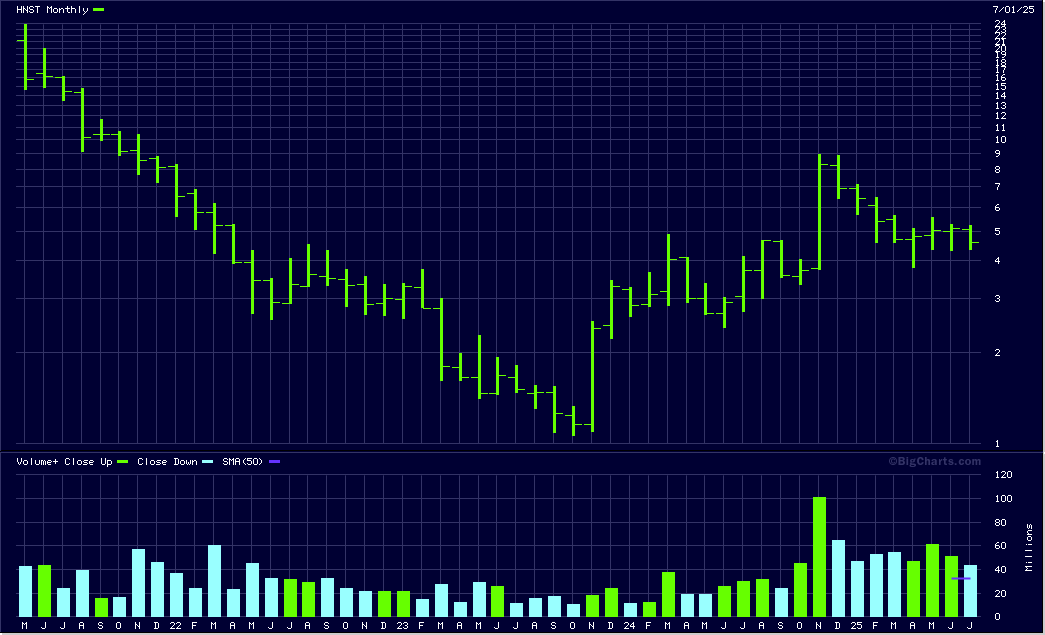

Anyhow, from that industry I own stocks of “the honest company” (HNST) and who could beat that name. Bought them when they were still cheap and started to rise, but quiet a roller coaster ride. Who knows, maybe EL wants to upper it’s goodwill a bit and buy it from me. ![]()

I’m afraid you’ve caught me swimming naked.

No real target except for “making some extra money” on that cash – now Treasuries – sitting on those sidelines.

You’re completely right. Who would? Bought the Put back now.

Bought HNST today as well, I either expect the competitors to buy them out or the share price to increase to USD 10-14.

Regarding EL; I bought ELF some time ago, instead. Might reevaluate EL this weekend.

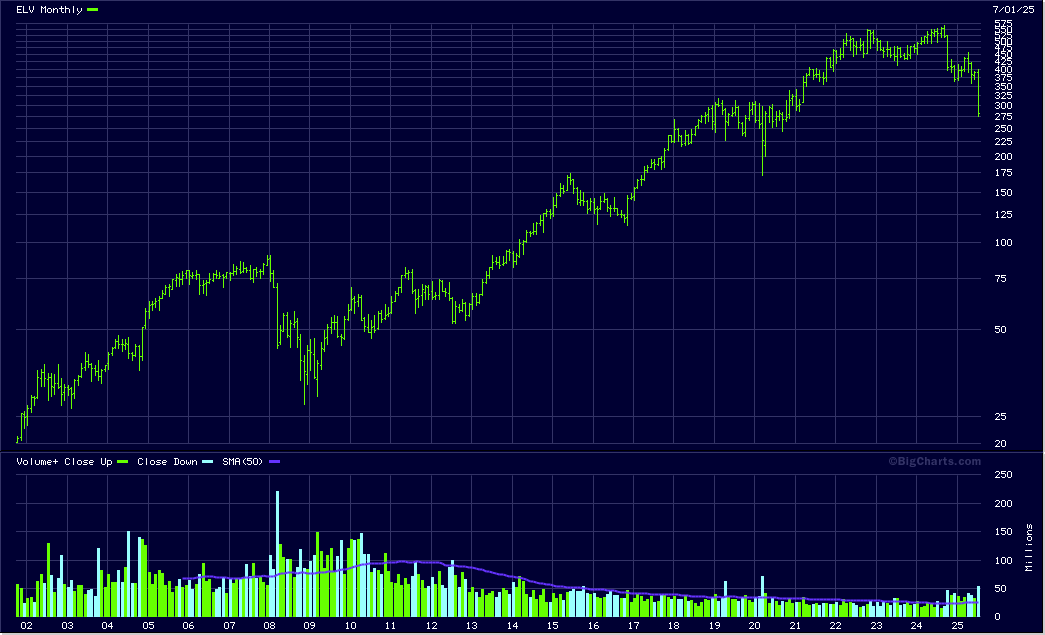

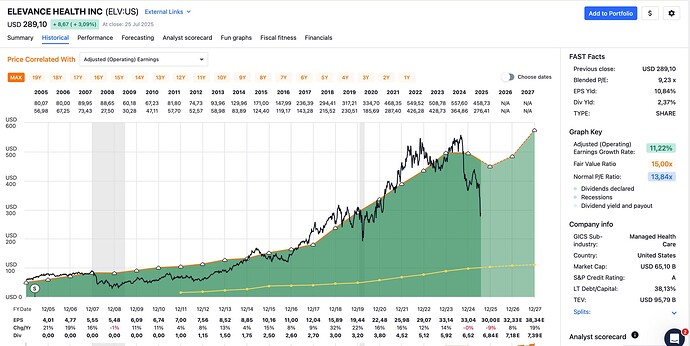

Anyone bought elevance health? Looks underpriced.

![]()

Just checked, bought in January 2024 at $3.12. As I said, quiet a roller coaster ride.

Was bought for my mechanical momentum strategy. I try to publish transactions near-time in the mechanical strategies thread. Hope I can hold a long time, but I just do what my capt’n (my mechanic) says…

Elevance does not look expensive now, that is true. But it seems to be on the way down. I usually wait until it starts rising. It is kind of a tightrope walk; I want it to have momentum, but I still want it to be kind of cheap.

The long term chart shows that it is quiet common for the stock to take such dips:

It’s been on my radar for a while, but alas, the dividend is too low for my portfolio (although it’s getting close now …).

Bought it for my son’s portfolio (of course before the recent nice drop in price) as his time horizon is several decades and divvies don’t matter.

Chuck Carnevale did a recent (yesterday!) FASTgraph analysis on it: https://youtu.be/OFL5U3IwZGQ?si=kjjropvYUlHFa1jG

(haven’t watched it yet but I expect it’s the usual Carnevale high quality content)

I bought. Take that as a warning ![]()

I added to my Pepsi position this week and came across this today:

In the 1980s, Pepsi owned 17 submarines and a destroyer. Seriously.

(Source)

The hell with Novo?!

How Novo Nordisk lost its lead in the weight loss race

In short Lilly has better products and better strategy at the moment.

I know the space very well, actually work on it ![]()

Can recommend the book “The world for sale” by blas and farchy. This and many other interesting stories from the commodities world are featured.

Bought yesterday aftermarket and today after opening.

In my eyes, it is hefty undervalued. And if I’m wrong, it generates at least nice dividends, haha