I sold ABBV between 2021 and 2022 so missed out on an average gain of 20% plus lost dividends for 3-4 years…

Did @Cortana pass “The Oracle” baton to you? ![]()

I think so… I need to hand it over to the next person…

Pretty please pick a mag 7 aficionado* as the next baton hero …? ![]()

* Though not quite sure any exist on this forum …

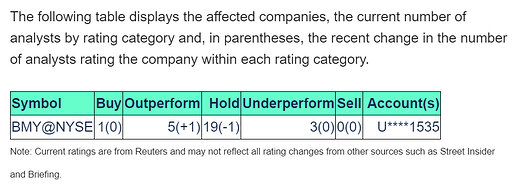

IBKR sends me updates on analyst rating updates on companies. In today’s news from a couple of hours ago:

The market’s already made its move on Monday and today an analyst changes his mind from “Hold” to “Outperform” …?

Thoughts on Petrobras?

Analysts are on the whole worthless. I listed to a few earnings call and there are one or two who are sharp and know there stuff but it is obvious that a lot of them are pretty clueless.

I’m long PBR, but obviously you take country/political risk as well as all the risks of the oil industry.

@Joe_Coconut Better short the hell out of it ![]()

Sunrise returned to the swiss market yesterday. UPC took over Sunrise in 2020 and the owner of UPC (Liberty Global) decided to spin off the combined business named Sunrise in 2024.

Revenue growth is almost flat. Deleveraging is taking place from 5.9x (H1 2024) Net Debt / Adj. EBITDAaL (wow what a nice abbreviation, aL stands for after leases I imagine) to 4.5x at EoY 2024 and mid-term 3.5-4.5x. Deleveraging should lower interest expense, since 50-60% of EBITDAaL is interest.

Up to 70% of FCF paid out as dividend, so ≥ CHF 240 mio. in 2025, which is around CHF 3.4 per share and 8.1% yield on the closing price from Friday. Additionally the dividend is not subject to withholding tax for 5+ years.

Sounds interesting for people looking for a company exclusively operating in Swiss market and thus generating CHF earnings, with attractive dividend. What do you think?

70% of FCF paid out as dividend is not at all healthy, especially with flat earnings, in my opinion. Means they will hit a wall where they can’t grow their dividends, so they’ll need to suspend or cut them, then the stock will tank hard.

Yes, I quite like these boring companies as long as the price is right. Though, I’d rather they pay no dividend and use the money to de-leverage quickly. I sold all my Swiss shares a while back, but wish I’d held onto them now: Holcim, Zurich airport, Swisscom, etc.

Quickly compared it to swisscom, which had a 5y average of 77% of FCF paid out as dividends. If FCF grows slowly (2-3%) it should be ok, no? Besides, the dividend yield is already quite high anyway so not increasing for some years would also be fine?

Its a mature industry with limited growth potential, reflected by the higher dividend yields of Sunrise (8%) and Swisscom (4%). Still unsure why Sunrise yield is so much higher than Swisscom.

First maturity (20% of debt) is due in 2028, 60% in 2029. I guess Sunrise decided to pay dividends rather than keep the cash until maturities come around.

I noticed Dollar General is down a lot. Time to practice your knife-catching skills?

Been working with them withy company. The internal organisation is so messy I would rather be tempted to short it ![]()

May I join the crowd here? I’m not really a stockpicker, but I have had some stocks for a long time. I just inherited the stocks from my late father (who used to work in private banking), and he was quite good with money overall (I hope I don’t fare too bad, either, but I’m really a beginner - learning a lot here!).

Among the stocks I inherited, there are good apples (the traditional Roche), bad ones (INTEL, because purchased before the drop), but there is one that gets me confused.

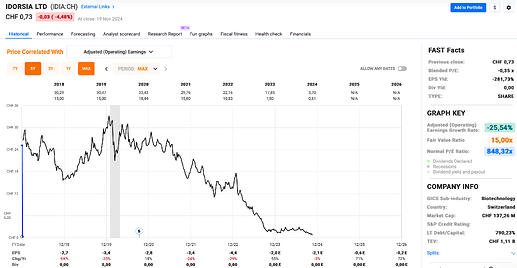

This is IDIA (Indorsia). My father bought the shares at @15.36, when I got them this summer they were at 2.28, and now they felt around 0.70. I don’t have a lot of them, and anyway the loss is already digested. However, I don’t know if it is actually an opportunity to buy more or if I should just avoid it like the pest ![]()

What is your take on that?

I know nothing about their business, but this seems like pure speculation.

Negative earnings since they went public and negative earnings expected for the next couple of years. Their long term debt is 790% (?!?) of their capital.

I know it looks bad - and maybe it is. But on the other hand, some analysts suggest to keep it, It’s a biotech and their product just launched in the USA (hypertension drug), UBS detains 10% of the shares (Vanguard 4%); there are good (albeit not guaranteed) prospects.

To be clear, I would never have bought these shares in the first place (I can’t ask anymore to my father why he did it).

According to Bloomberg, this is what analysts think:

That’s great, but it seems this still won’t generate any positive earnings at least in the next couple of years.

According to Bloomberg, Jean-Paul & Martine Clozel own >25%, UBS “owns” about 5%, Vanguard a little over 2%.

Those UBS, Vanguard, etc “ownerships” are UBS, Vanguard, etc issued funds (likely benchmarked to some index that includes Idorsia), so it’s not “smart institutions/professionals” picking Idorsia, but rather non-discriminating buyers of funds offered by UBS, Vanguard, etc. who basically want to buy some index that happens to include Idorsia.

I personally would not know how to arrive at this conclusion without understanding a lot more about this biotech company.

YMMV, of course.