One thing I will do going forward is not to close it completely. Instead, I will close maybe 70% and then 70% again if it meets the next milestone.

I this week’s edition of Phil Moves Markets we have:

- Decided not to buy BLZE last week so it went up 25%

- Wanted to buy XOM but didn’t want to put more money in so sold half of EQNR holdings to buy XOM. XOM up 5%, EQNR up 11%

- Decided to gamble on ASPI and it is down 26%

- Got bored waiting for G to do something so sold. It went up 15%.

- If you’re wondering why INTC tanked, it was because I closed my shorts wanting the share price to go higher before shorting it again. It did go higher, but I got greedy and wanted it to go even higher, and I didn’t pay attention that the earnings call was coming (otherwise I would have put the short back on)

Absolutely!

Came across an interesting article today in the WSJ: Wall Street’s Trash Contains Buried Treasure

The basic idea is to buy the stocks of companies after they’ve been kicked out of the index and then outperform the index with thosed kicked out companies. ![]()

It’s an idea I have heard of before, and I believe studies have been done on this to support the claim, but this week an index – cleverly named NIXT – will be launched that does this for you.

The key points from the fund managers themselves:

- "Historically, index deletions have beaten the Russell 2000 Value Index in spectacular fashion and could add an abnormal upside to a portfolio when the current growth-dominated bubble starts to deflate.

- Deletions lag the market by more than half in the year leading up to their removal from an index, but they historically outperform the market for at least five years after the breakup.

- A deletions strategy relies on two growth drivers to fuel performance: long horizon mean reversion and a liquidity effect."

Oh, if you’re interested when the S&P 500 rebalances, I’ve already googled that for you:

03.15.2024

06.21.2024

09.20.2024

12.20.2024

(source)

I’ll stick to my fundamentals approach, but will maybe occasionally check whether newly kicked out companies match my fundamental criteria or are perhaps already on my eternal watchlist.

In June 2024, Robert Half (RHI), Illumina (ILMN) and Comerica (CMA) got booted from the S&P 500.

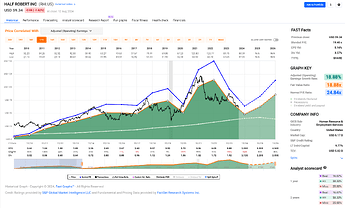

RHI actually looks interesting. It’s a little cyclical but is overall growing earnings at a nice cliff.

Still a little too pricey for me, though. I like to buy with a margin of safety and this one doesn’t have one (yet).

I went shopping the last days: MXL, LULU, ALGN.

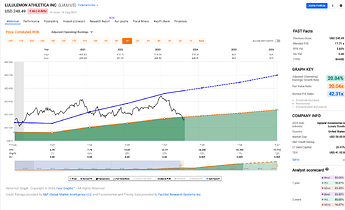

More growth/recovery tilted stocks as my portfolio is currently very defensive. Normally, I’d never buy LULU since I considered it more of a meme stock, but it did seem relatively oversold.

This time, I have been more lucky, with all stocks up around 7%, which makes a pleasant change from down 25%! ![]()

![]()

Still, LULU …

Man, we are not the same! ![]()

I guess you can gauge those oversold-in-the-market conditions … I just can’t – the wiring for this does not exist in my brain.*

My recent buys since the absolutely epic market crash – ![]() – almost two weeks ago: BTI, OXSQ (DRIP), BTI, GPN, BNS (DRIP), ARE, CMCSA, VICI, CSCO (up rather nicely today), INGR, CVS (SEP24 65 Put got assigned early … ouch!), BMY, OZK, and T and VZ today.

– almost two weeks ago: BTI, OXSQ (DRIP), BTI, GPN, BNS (DRIP), ARE, CMCSA, VICI, CSCO (up rather nicely today), INGR, CVS (SEP24 65 Put got assigned early … ouch!), BMY, OZK, and T and VZ today. ![]()

Took some profit on LMT (sold about as much as my original total purchase price), overcame my loss aversion with MMM and got rid of them (after they essentially broke even for me, including dividends), took profit with GD (nice company, but tiny in my portfolio and currently overvalued) and got rid of LAND (no dividend increases).

* Admittedly, you could say they look perhaps attractive even from a fundamentals perspective …

… but their growth has been slowing and they seem at best only fairly valued?

I surprised myself. I hadn’t even looked at LULU before since it was one of the stocks hyped by YouTube finfluencers, so I avoided it.

Then, I looked again, saw that it was profitable (unlike many YT stocks), oversold, had a forward PE of <17, PEG <1 and seems to be still growing (if not as fast as previously). I guess the main downside is that it is very exposed to any downside in consumer spending.

If retail investors pile in again and take it back to a 40x multiple, I can exist and double my money.

I’ve bought worse things in the speculative part of my portfolio!

Big gains on ASTS – $26K so far today, ~$60K gains in total. I already mentioned this stock pick in another thread. Waiting for the $500/stock to FIRE xDDDD

One question (sorry if I missed it in another conversation on the forum):

With that active buying/selling, did you get into the issue of being declared a professional trader? Or you hold those positions for > 6 months usually?

Yep, good question.

All of these buys/sells indeed have several years in between them.

I don’t violate the rule, but even if I were violating the rule, take into account that the Steuerkommissär looks at the overall picture before declaring you a professional trader. Thread: e.g. here.

Oh and thank you for nothing Mr. Buffett. Just after I sell my speculative position in ULTA, he goes and declares he bought into it and it shoots up 11%. Grr.

If you pick stocks and actively trade, do you track the performance incl all cost for trading?

Do you benchmark the performance against a broad market index?

Do you generate alpha?

I used to trade for more than 10 year. It beought me some kind of joy.

Considering all costs, i did not manage to outperform the msci world, but invested an significant amount of time. Only passive now and sleep much better with it.

I don’t, but I for sure would have under performed both nasdaq and sp500 given the huge magnificent 7 performance.

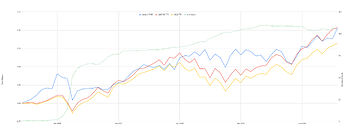

I track the performance of my stockpicking portfolio (including all costs) but really only more for fun, as the appeal of putting together my own custom portfolio lies within being able to generate enough (dividend) cash flow to live off versus having to gradually sell down my nest egg.

Anyway, I benchmark against the S&P 500. Just today I added the MSCI World since it seems popular in this forum.

Since inception in June 2019* up until the end of July 2024 this is what the corresponding charts look like:

I have no alpha and currently a beta of 0.95 compared to the S&P 500.

Just eyeballing it I have less volality than both the S&P 500 and the MSCI World, especially since starting to diversify from just a couple stocks to a couple dozen in March 2020.

* As with all performance comparisons, you can alter the picture easily by picking a different starting point.

Not bad ![]()

Especially if you track it you are already honest to yourself. And the performance is respectable.

For income generating i would probably be lazy and use something like that

Thats actually impressive ![]()

![]()

When Goofy-Index?

It’s very impressive isn’t it? The power of value investing and dividends. Oh wait dividends are irrelevant and bad, especially in CH!

Wouldn’t you say it’s more than respectable? So many professionals apparently fail to beat the S&P500, so a retail investor matching it with lower volatility, eg in times like 2022 and COVID’s drop is pretty impressive!

@Your_Full_Name’s portfolio is public, I recall reading that a position is considered filled if it yields 2000CHF/year in dividends, so someone could make the index fairly easily ![]()

Absolutely more than respectable.

It’s exactly like you say. So many people including professionals fail to beat their benchmark.

I just wanted to point out that its important to track the performance and be true to yourself, so you dont underperform the index.

Goofy seems to be very diciplined. Highest appreciation for that.

Their investment approach* is just a lame** copycat of the Goofy index … ![]()

More seriously, I like most of their holdings and have a good overlap with them.

* From their Factsheet:

Investment approach

- Uses a bottom-up fundamental proprietary research process

designed to identify over- and undervalued stocks with attractive

risk/return characteristics to construct a diversified, low volatility

equity portfolio - Overlays a diversified global equity portfolio with index options with the

aim of generating income through option premiums and stock

dividends - Use of options overlay to allow for income generation that flexibly

adjusts with the market

Investor profile: Typical investors in the Sub-Fund are expected to be

investors who seek an income, with the prospects of long-term capital

growth through exposure to global equity markets, who are prepared to

accept the risks associated with an investment of this type, including the

volatility of such markets and the use of FDI.

** Their total return YTD is about 9% (SPY: 17%, MSCI World: ~13.6%).