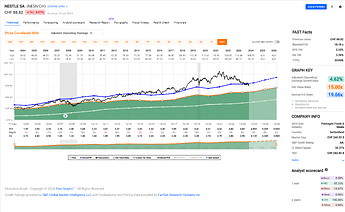

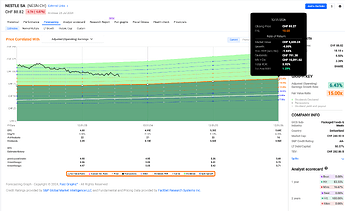

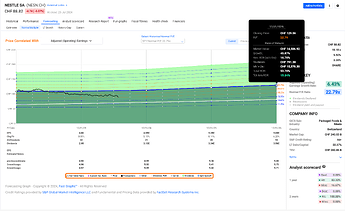

I personally would quite strongly disagree: for a long term investor* the graphs provide literally all the information you need.

The premise of my thesis is that price eventually tracks earnings and the P/E multiple tracks earnings growth.

I.e. earnings in principle justify price and earnings growth justify a certain multiple of earnings per share (EPS), the higher the earnings growth, the higher the multiple.

Neither of these hydrogen companies have any earnings or earnings growth to show for as evidenced by the graphs and hence they are not investments (for me).

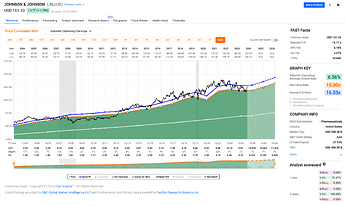

Compare this to boring company like Johnson & Johnson

or even boring but somewhat cyclical companies like Best Buy

These are both textbook examples of price relatively quickly catching up with proper valuation (aka earnings/earnings growth).

I’ll admit that sometimes it takes years or even a decade for the price to catch up with what the fundamentals suggest, but eventually the rubberband between price and earnings will do its thing.

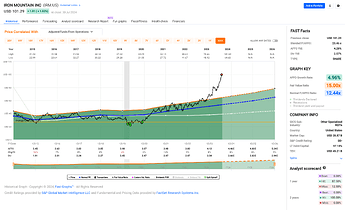

Here’s one that’s worked in my favor: Iron Mountain

I accumulated my position when the price was way below fair value in 2020 and had to wait 3 years until price exceeded fair value.** In the past half year or so, the company got way overvalued – probably because of the AI hype – and I sold off some of it (about the amount of what I initially paid for my position).

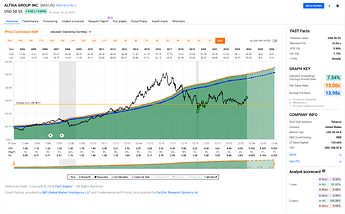

Here’s one that’s not really worked out so far: Altria

Built up most of my position in 2020, stock price is still roughly at where I bought it. The dividend yield is nice, though, and I am still convinced the price will return to fair value eventually (and I just added to my position today  ).

).

Even megacaps like mighty Tesla – not invested, needless to say – feel the gravitational pull of proper valuation eventually. I’ve tried shorting Tesla via buying long dated Puts

but this has been painful – well, about $200 went up in smoke – and taught me in practice what I already knew in theory: to remain humble and true to the saying that the market can stay irrational much longer than I can stay solvent.

Based on the current price trajectory, it looks like this will take another 2 to 3 years until price reaches fair valuation for Tesla.

But it wouldn’t surprise me if the price dropped more suddenly on unexcpected news or if the company remained way overvalued for another 5 years.

Be well and invest well!

* As a speculator, you of course don’t need to worry about any fundamentals like earnings or earnings growth. This isn’t meant in a dismissive way.

When I started out picking stock I would pick the ones I felt I knew something about and that I thought would have a bright future without even knowing about fundamentals, let alone looking at them.

And it’s of course totally fine to speculate.

** While waiting, I was getting compensated with a close to 10% annual dividend on my initial investment, which made it easier to invest in the first place.