Throw Goofy a bone and surely he’ll chew on it. ![]() *

*

I’m starting to chew on this bone and am slicing (breaking?) it across these three kinds of risks:

- fundamental risk: what can impair cash flow, put the payout in jeopardy, and potentially result in total losses (Buffett’s definition of risk)

- valuation risk: so overpaying for a quality company that even if it grows as expected you might suffer years or decades of weak or even negative returns (one of Chuck Carnevale’s key risk definitions)

- volatility risk: becoming a forced seller out of financial/emotional reasons even of quality companies bought at reasonable or attractive valuations

(quoted unhumbly from your mostly friendly neighborhood goofy dog, yours truly here)

Fundamental risk:

A little hard to tell given it is a microcap. It’s been in business since 1978 with a couple of murky episodes in the first couple of decades, but seems steady and growing for about the past two decades or so.

Their primary products are healthcare for women and their babies, they are geographically somewhat diversified (60% US, rest among other English speaking countries).

Conclusion after the whole exhausting 5 minutes of relentless scouring their Bloomberg description: doesn’t look like a whale oil or a snake oil company, not exactly $ES or $JNJ, either, but probably … or at least maybe, fine?

Valuation risk:

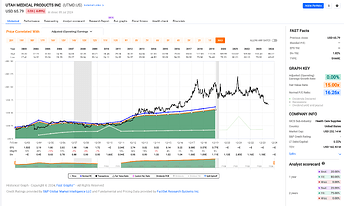

FASTgraphs is partially letting me down on this one as apparently FactSet doesn’t have any recent earnings data …

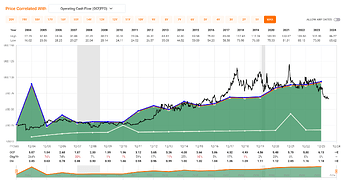

… but at least there’s some more recent Operating Cash Flow (OCF) data:

Looking already promising as price seems already below the anticipated (and probably fair) 15 x 2024 OCF (extrapolated by Goofy’s pea sized brain from the existing line on the graph).

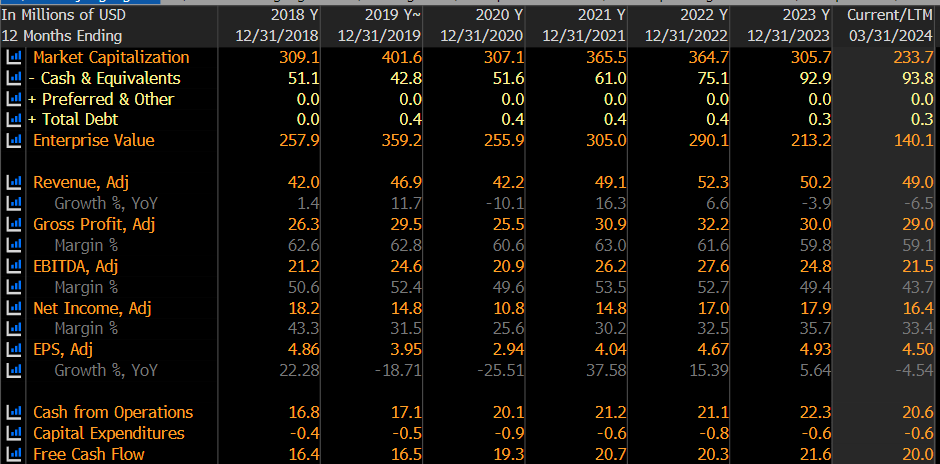

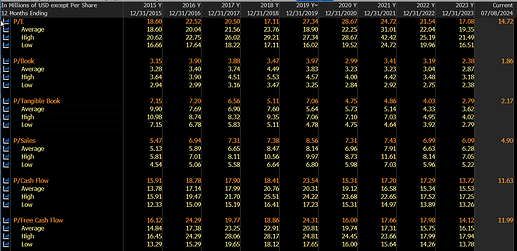

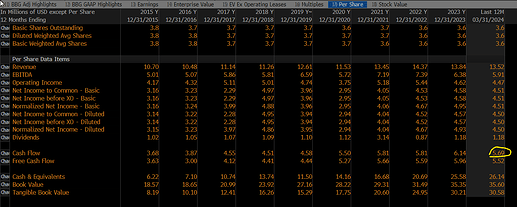

Luckily there’s other data providers, just not in the nice graphical visualization as I prefer it. Based on the earnings metrics data from your link as well as mighty Bloomberg tell us that the company continued growing since 2019 (with a bump or two):

while the PE and other multiples sank (as desired), especially recently:

The only thing that I would want to dig deeper on is that their trailing twelve months cash flow seems to be at (only) $5.69 (per share) versus their 2023 number of $6.13 (or $6.14 according to Bloomberg). Maybe some seasonality with a stronger second half of the year?

Volatility risk: well, my more sophisticated friends on this channel call this the sequence of returns risk, but I like the blunt term volatility risk better as it’s IMO closer to the reality of life where you need to unexpectedly withdraw a gazillion k of your (volatile) investments because of unexpected life event X regardless of the valuation of your investment(s) at the time instead of just withdrawing your planned 3.967614% (rounded) of your holdings in that year.

Anyhow … volatility risk is probably mostly out of your control even with decades of backtesting, as your specific case of needing cash in year Y isn’t included in the historic set of data for backtesting safe withdrawal rates.

Maybe, constructively speaking, the less volatile your specific investment (say, again, $JNJ) the less exposed you are to this, even when the surprise withdrawal is triggered exongenously.

UTMD isn’t in the $JNJ category here – no surprise, given it’s a microcap and somewhat more volatile fundamentals – but you also don’t have to put 50% of your investable income into it.

Diversification is your rescue boat here.

Goofy liked this bone, but is holding off buying into it for now.

Woof!

* In ernest, I like these potential throws and truly enjoy taking a stab at them with my tools at hand!