Replying to your recent update of the Fat Years Chronicles thread.

My recent activities were (aka “talk your book”):

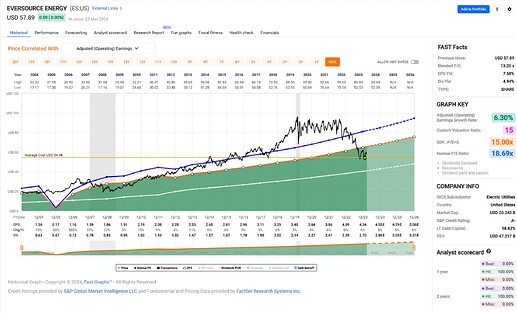

- $ES

- Bought an initial position of $ES in February. It’s not in a prolongued bear market (yet)* and it’s not the most exciting company in my portfolio (a utilty!). However, it has a small margin of safety, the company has a stellar track record growing their earnings and their dividend, nice current earnings yield of 7.5% and dividend yield of about 5%, great A- credit rating and a nice moat IMO. If anything, a little too much debt, but still acceptable. Payout ratio is rather high, but normal for utilities. Chart, courtesy of FastGraphs:

If you believe in macro (I don’t, but I still find it entertaining):- I believe $ES stock price is suffering from elevated interest rates. This will probably pass later this year or next year. I don’t care that much, they can also stay elevated for a couple more years, allowing me to further buy into the company until I have a full position.

roll … waaaaait for it … AI! If AI takes off as projected by $NVDA’s price, all these CPUs and data centers actually need electricity!

roll … waaaaait for it … AI! If AI takes off as projected by $NVDA’s price, all these CPUs and data centers actually need electricity!

<insert some impressive hand waving here, including waving around the newest NVDA AI training CPU>

This rising AI tide will clearly lift all boats, including boring utilities. $ES PE will be back at its February 2020 PE of 23x real soon now!

- Sold an $ES Oct24 50P in mid March. Didn’t pick the perfect day to sell a put on this company, but was kind of eager to put my first batch of cash at my IBKR account to work.

- Bought an initial position of $ES in February. It’s not in a prolongued bear market (yet)* and it’s not the most exciting company in my portfolio (a utilty!). However, it has a small margin of safety, the company has a stellar track record growing their earnings and their dividend, nice current earnings yield of 7.5% and dividend yield of about 5%, great A- credit rating and a nice moat IMO. If anything, a little too much debt, but still acceptable. Payout ratio is rather high, but normal for utilities. Chart, courtesy of FastGraphs:

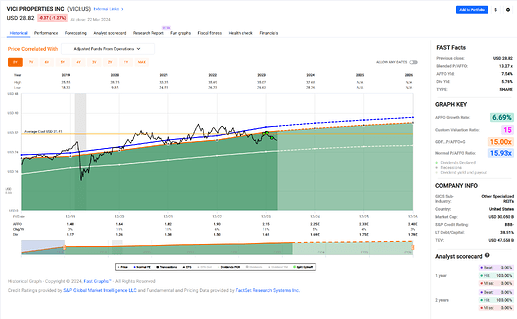

- $VICI

- purchased my last tranche to a full position. Similar arguments as above, better debt situation, slightly worse credit rating. I’d buy more, but I have a full position now.

- purchased my last tranche to a full position. Similar arguments as above, better debt situation, slightly worse credit rating. I’d buy more, but I have a full position now.

- $MO (and a bunch more from my existing portfolio): I have a full positions already, but I find them attractive at their current valuation.

* I’m sure though Mr. Market is listening to this and uses my purchase as one of his signals to decide whether to now send $ES into a protracted multi-year bear market. ![]()