False, Neon does not send you paper statements at all.

Hey guys, I am currently using the Cembra Cumulus credit card, which will soon expire. I am looking at the following options:

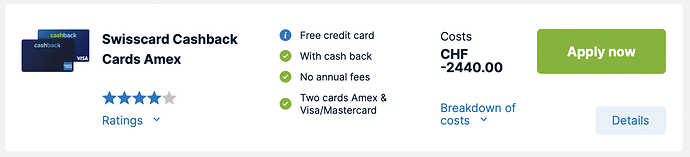

- Swisscard Amex

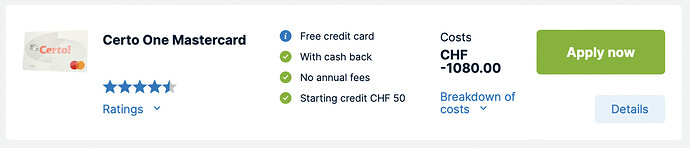

- Certo One

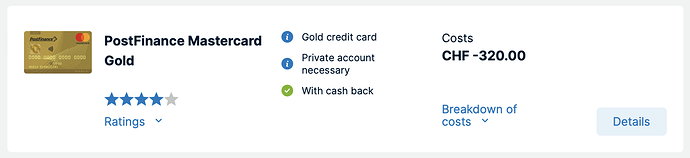

- PostFinance Gold

For 2000 CHF spending per month, after 10 years you get:

The Swisscard seems like a clear winner. 2’440 CHF cashback over 10 years. The Certo One is a successor offer of Cembra to my current card. Finally The PostFinance has the advantage that I already have a bank account with them, so it would simplify it a bit if the card was from the same provider. But to lose 200 CHF per year of cashback just for this?

Please advise ![]()

I’m planning to go with a Cashback AmEx and a Certo One! as a backup for the shops who don’t support AmEx. You’d need a third payment method for payments outside of Switzerland incurring Forex fees/spreads.

The simpler but less efficient version is to use only one card and incur additional fees/gather less cashback when it’s not the optimal solution, in which case, I’d go with either a Visa or Mastercard.

So, customer binding works on you? If you consider paid credit cards, take a look at Cornercard Gold or platinum. I am considering taking them for insurances.

Your solution seems too much for me. I really want something convenient. I do have Revolut, and I could even ditch all other cards for it, but sadly a prepaid card doesn’t work in all cases. I would just go with the PostFinance VISA/MasterCard Gold (hopefully I could then see all my transactions directly in the PF app), but I when I look at this 2000 CHF loss over 10 years, it feels kinda “unfrugal”, tbh.

I am attracted to one-stop shop solutions. My current account at PF is quite competitive on price, the online trading too, so if the credit card was under the same roof, I wouldn’t mind.

It’s 200 CHF per year, if the convenience is worth it for you, then I would go for it. There is an “opportunity cost” to the time you take managing your finances, and psychological availability/efficiency/wellbeing matters too, I wouldn’t fret it if keeping all at PF is what works for you.

As an intermediate solution and if I wanted to use only one card, I’d go for the Certo! One. Free, Mastercard, some cashback.

the Amex Cashback is bundle with a Visa or a Mastercard.

Why do I get two cards?

As a Cashback user you benefit from the fact that you receive the Cashback Cards as a duo. You decide whether to combine your American Express Cashback Card with a Cashback World Mastercard® or a Cashback Visa. With these two cards, you benefit from very high worldwide coverage and always have a second card at hand should you have to block a Cashback Card – if you lose your card, for example.

edit: you’ll get the 1% cash back only with the Amex though

Cashback Programm

Your Cashback credit cards are free and you also get money back with every purchase.1 When paying by American Express Cashback Card you get 1% cashback. For payments with the World Mastercard or Visa Card it is 0.25%. Once a year you will receive the collected cashback amount credited to your card account.

Thanks, I know the details. But keeping two cards obviously doesn’t make it simpler. To maximize your cashback, you always have to carry both cards, or at least have them configured in your phone, because if that one time you want to pay and they don’t accept Amex, you’ll be bitter.

Does Swisscard have E-Bill? I have to admit that I was too lazy to ever send an LSV permission to Cembra. Filling out a paper form and sending it per post seems like going back to 1990. Thus, I think I had to pay the Mahngebühr of 30 CHF like 3 times already.

Cembra does have the app now, so that probably improves user experience, but I feel tempted to ditch it. I don’t want any regrets and don’t want to have to re-switch, I would prefer to commit for years.

Yes, Swisscard have ebill.

I have to say, like @Patron, I also would focus more on simplifying in an “all in one” solution where I can track my expenses in one place only.

The more I think, the more I find this “cashback” as pervert option. Best Cashback is not spending your money, or think a little bit more of what is a necessity and what is a desire.

But it seems that people are to lazy to think and find that it is good to have money back when spending money. I am sure all of us around here can easily save the same “cashback” money without spending on frivolous things.

Swisscard + Neon (for international) is my solution. I found it cumbersome to optimise beyond this because I also get CSVs into Wallet for categorisation and having more sources is just too much hassle.

Anyone of you know why I get billed in foreign currency using booking.com from Switzerland? Can I change that to avoid currency conversion fees / bad rates?

Well, yes, I am paying in CHF for booking. Check your account settings and in which currency the prices are shown to you?

Thanks, I do need to check my account settings. PF charges me a foreign transaction fee and bad conversion rates on top of that, worst case scenario ![]()

Edit: Strangely enough my settings were CHF, still got a bill in foreign currency though… Guess I’ll have to check next time before booking anything! I still had a foreign address though, maybe that was the reason.

BTW: Can we safely use Cashback for booking.com? Is there some turnaround like using paypal?

So, you see, they are trying to accommodate you, and you are complaining! ![]()

Haha, yeah, but strangely enough they charged me from Amsterdam while I indicated a US address ![]()

This card stuff is already beginning to annoy me, so much time & nerves lost. However, incredibly thankful to @anon95353169 for clearly pointing out that I should not use my credit card for paying abroad ![]() Will use Neon from now on

Will use Neon from now on

As to Amex Swisscard: Does it work on booking.com, or is there some sneaky stuff to consider? Like: You do get your meagre 1% cashback, but are charged foreign transaction fees and dismal exchange rates?

I think booking.com has a foreign address, so itäs a foreign transaction, even if usually in chf, so there is a markup/fee anyway.

I see, thanks! So there’s a fee on that.

Regarding currency rates with Swisscard: Sometimes, booking.com indicates prices in CHF, but just as an estimation. The hotels will bill in local currency in the end, leading to really bad exchange rates charged by Swisscard. Neon/Revolut would be better in these cases, I guess? Anyone know how to avoid that?

For me normally Booking is billed in CHF without a markup. Same for AirBnb. I normally use the Cashback Amex.

According to this source (Neue Partner | American Express Selects | American Express Schweiz) they now support Digitec-Galaxus as well.