Hmm, this was the only reason why I added my revolut card to Amazon (EUR)?

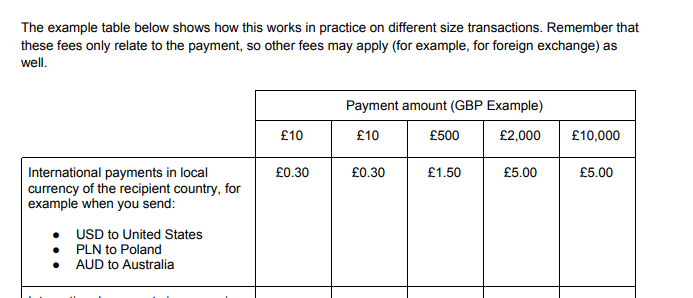

Where does this 0.3% come from? Sorry I’m not up to speed with ever more Byzantine costs and fees of Revolut.

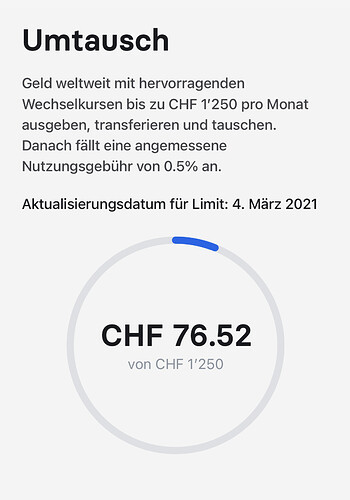

That’s only if you exceeded the monthly exchange amount, right? I use Revolut Metal for the cashback so I’m not bothered about the fee changes too much.

Exactly, the fee is just for wire transfers, card payments are not changed (as far as I understood it right of course).

You pay 15.99 to get 0.1% back? (15990 a month) assuming you spend in EU (1% outside EU)

Revolut Premium costs 72 GBP per year, Metal costs 120 GBP per year. That’s 48 GBP per year extra for a 0.1% cashback in Europe. But let’s assume you exclusively travel outside of Europe, so it’s 1%. 4800 GBP per year will make Metal a worthy option. Makes sense, I guess.

To me it would be sufficient if Revolut had a forex limit of 10’000 GBP per year and ATM withdrawals of 2’000 GBP per year (compared to the current 1’000 & 200 per month). And all options, including metal, don’t offer local IBANs for most currencies (you only get the IBAN of the country of your residence + EUR + GB ).

Browsing Revolut pricing page is annoying, a lot of small print and not every restriction is mentioned.

I got it from the pdf mentioned by @trotro

I’m just not sure if it counts just for transfers or else. The pdf says “payments” but below “send”, so I suppose even buying a phone cover on aliexpress counts.

It’s a freaking nightmare.

This is a confusing design decision. It seems like you can’t do international payments, but the real description of the feature is the small grey text. Also using different words. Payment or transfers? Should I get a bachelor in Finance to understand hwo it works?

Again… Title in black. feature in grey…

I am confused.

From the pricing page I get that I can use it to pay once for free only. Or once to send money to friends.

It has basically become a tiny bit better than my Postfinance Eur card. The only advantage is the exchange rate.

Edit: I suppose it’s not meant to be used as a credit card anymore

It never was a credit card, always as debit card or am I mistaken?

You are rigiht. I should have written “payment mode”.

You can’t use Revolut as payment mode anymore. Or at least the free one. If I understand it well…

Yeah, the whole update mail they sent and the pdf are soo confusing.

Either they are really incompetent or they are deliberately trying to obfuscate what they’re doing.

I’m guessing the second one considering this type of phrasing:

We are combining “cross-border” and “SWIFT” into one simple and transparent category we call “international payments”.

I‘m going by (what I suppose is) costs, not necessarily their fees.

But then, I‘m obviously not the only one that doesn’t quite get the pricing they‘ve been publishing lately.

iirc Metal in Switzerland is 160.- Fr. but yes I did spend about 5-10k CHF outside of Europe… before COVID… however I get the cashback in Bitcoin which appreciated quite a bit, so even the 0.1% in Europe became several hundred CHF.

By the way, as an alternative to Revolut, anybody used PostFinance Travel Card? At a first glance it looks like a terrible deal:

- when you top up, you pay 1.5% commision

- 7.50 CHF fee for withdrawals abroad

- 1.00 CHF fee per transaction

- exchange rate not specified in the offer

- free account at HotelCard

So if I spend 6000 CHF in a year, make 6 withdrawals, and 100 transactions, the total cost is:

90 CHF + 45 CHF + 100 CHF = 235 CHF

I don’t know who would go for it any why. I guess someone who does not know Revolut? Can anybody share their experience? One reason might be the HotelCard account. It costs 99 CHF per year and offers some decent discounts on selected hotels. Though I don’t see why this has to be a packaged deal…

Travel card is for boomers without revolut or neon and just to be considered legacy

Indeed.

It’s a pre-pay card solution for those who used to use Traveller Cheques. Swissbankers is the same company that used to offer the TC. The only advantage I imagine, is that since it’s specialised for travel-use, you can probably get replacement cards delivered more easily and quickly to some beach hut in Thailand or wherever than cards from other companies.

I have revolut premium and got it delivered pretty quickly to Colombia for free (ok it was to a big city). I was easily able to specify an address with someone elses name.

Ok, good to know. Since you have a great real-world example, how many days did it take?

Travelcard “promises” that “…outside Europe, replacement may take three to four working days when away from bigger cities.”

I don‘t remember when I ordered it, from confirmation of it being shipped to actual arrival (via DHL) took 4.5 day. Can one look this up in the app?