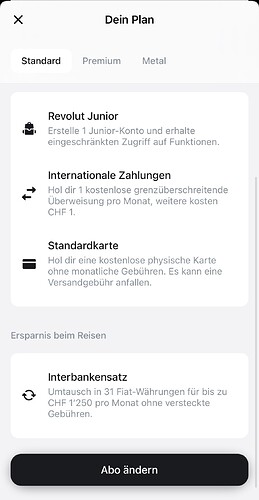

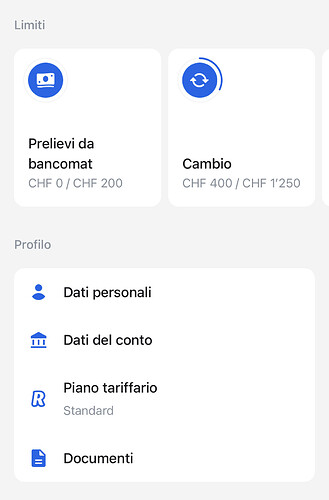

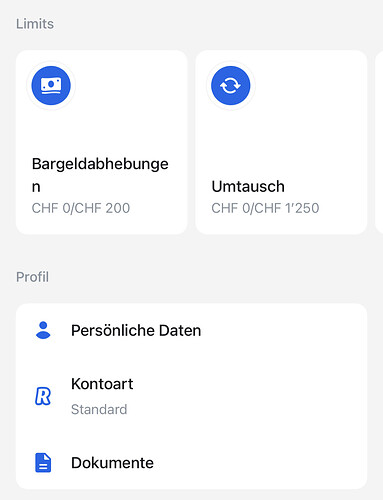

I always had the standard plan and it says “ATM withdrawals €0 / €200” next to “Currency exchange €0 / €1,000”. All is good here ![]()

Their webpage also confirms this ![]()

https://www.revolut.com/our-pricing-plans

do they not have a proper overview site that compares the plans directly?

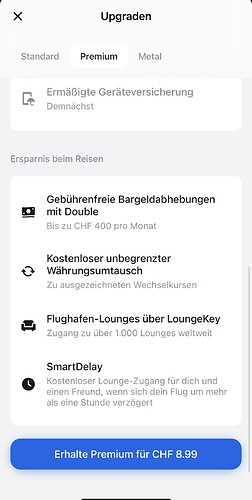

In my app I no longer have the 200 ATM withdrawals for Standard. But I see 400 for Premium. Plus is not available here in Switzerland.

I am with the free account and I still have the monthly 200 CHF free withdrawals

maybe scroll down? ![]()

I have to say that this “new” user interface is far from user friendly…

Revolut made a fee change:

As a reminder, there is currently a CHF 200 limit on free monthly ATM withdrawals on our Standard plan. After this, you begin paying a 2% fee. We are changing this, by adding a limit on the total number of ATM withdrawals as well, and by setting a minimum fee once your free allowance runs out.

Going forward:

- Your CHF 200 free monthly limit will remain the same, and once you hit it you will still begin paying a fee.

- We are also introducing a limit of five ATM withdrawals as well. Once you hit this, you will also begin paying a fee.

- Both of these limits apply independently. You will start paying a fee as soon as you hit one, even if you don’t hit the other.

Does anyone understand what the second point means? Is it 5 monthly withdrawals or 5 withdrawals, period?

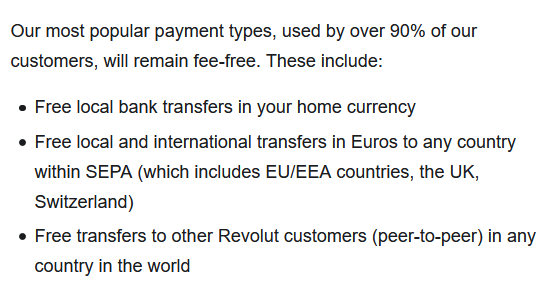

And does someone understand this new cross-border payment fee system?

International Payments_Pricing Sheet.pdf (revolut.com)

Why does it matter to Revolut whether you send money in the local currency or not?

In context and in line with the CHF 200 limit, and according to common usage, it will be a monthly limit.

Local currency can usually be sent as a(n inexpensive) domestic bank transfer.

Foreign currency usually can’t - but needs to be sent as a more expensive SWIFT transfer.

Yes, but that sentence is really really badly written. I know it’s not a legal document, but still…

Sounds like I might start thinking about another card. If I understand it correctly, every time you send euro to someone, you have to pay. It doesn’t matter if you have an eur account.

edit: correction. You don’t pay.

So SWIFT occurs a fixed cost to Revolut but the domestic bank transfer is a percentage of the payment? It’s cheaper to transfer USD 10’000 to a non-US country.

So what is the most convenient, yet inexpensive way to handle multiple currencies? I’m a bit bummed by Revolut. I used to have a PLN IBAN, so people could send me PLN directly. Now it’s gone. 200 CHF withdrawal per month - I can live with that.

The 1250 conversion limit is the worst. When I went for holiday to country X, I used to convert 2000 CHF to their local currency, then withdraw the equivalent of 200 from ATM on arrival. Then the weekend surcharge would not affect me. At the end, if there was anything left, I would convert it back.

I also use Revolut for small monthly fees in foreign currencies, like Patreon, Youtube etc. You can easily see who you authorized.

I get why they had to make the conditions worse. Corona…

In the meantime, I’m trying to make my life a bit easier and carefree. I don’t want to have to memorize Revolut’s new complex rules, not to be badly surprised. But I still don’t want to give a fat bank 3% for every forex transaction. Suggestions?

If you know 1 month in advance where you’ll travel to, you could pre-converse the currency? Even if you don’t end up going you could converse it back in some later month…

I also find it frustrating that it has become increasingly intransparent. I’d prefer to pay a couple CHF more in a year if in return I didn’t have to worry about getting screwed.

Sure, if you don’t forget, you can do it. But convenience and flexibility is not ideal. I’d like to have a solution that is convenient and is priced fairly. Revolut ticks many boxes but it’s a bummer that they didn’t make any progress in having dedicated IBANs for respective currencies. So if someone should send me PLN, they have to use SWIFT, and SWIFT is one of very few services, where you don’t know how much it’s gonna cost, but probably a lot.

Transferwise. (Hardly anything is free with them, but it‘s fairly priced)

For card payments, you could use Neon at Mastercard rates.

Wait wait… I didn’t think about it… if you use Revolut to pay any purchase in usd (amazon.com, ebay, patreon) are you going to pay 0.3%?

It basically kills Revolut as a credit card then.