I was reviewing my portfolio the other day and I noticed an amusing fact that goes against modern portfolio theory, so I thought I’d share it.

Investors care for risk-adjusted returns - on this I think everybody agrees. Given two investments providing similar expected returns, investors will prefer the one with the less risk.

Where modern portfolio theory and practitioners disagree however, is in how you should measure risk. MPT states that risk should be measured as the volatility of the stock price. In particular, William Sharpe (one of the founders of the MPT, who later got a Nobel Prize for his work) introduced the Sharpe Ratio, defined as:

In other words, the numerator is your excess returns (how well the asset has performed), and the denominator is the risk you have taken, i.e how volatile the asset has been over the measuring period.

Now another tenant of modern finance is that markets are efficient: if a given asset has a high sharpe ratio superior to 1 (i.e a lot of excess returns for the risk that was taken), market participants should bid up the price of the asset so that prospective excess returns decline and the ratio converges back to 1.

In plain english, that means that investing opportunities with low risk and high returns should be very rare, and quickly arbitraged away because everybody would rush to them.

The other day, I was reviewing one of my biggest positions, Constellation Software (CSU). The goal here is not to present CSU’s business or investment merit (and this is definitely not investment advice).

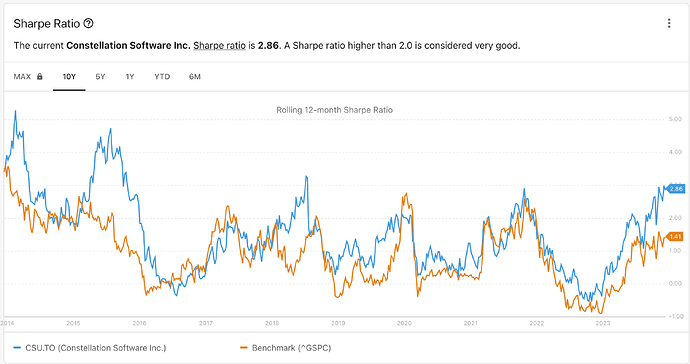

I was amused to notice that since its IPO in 2007, CSU has had very long periods where its Sharpe ratio was very elevated.

Current Sharpe ratio is 2.86, which means that according to MPT, for each unit of risk taken, CSU has returned almost three times the returns of the average stock investment.

If you look back over times, there have been really a very few times where the ratio has been below 1. Here is the chart compared to a good diversified index, the S&P500:

What the graph shows is that over the last ten years, CSU has had more returns and less risk than a whole index of 500 diversified businesses, at least according to MPT. One stock vs 500 businesses.

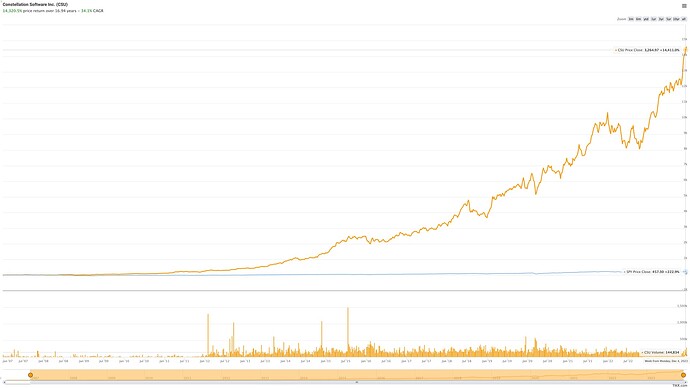

What does it look like from an investment point of view? Let’s compare it to the S&P500 again (i took the stock price of the SPY ETF, which should be a good proxy (but maybe is missing reinvested dividends).

Since 2007, CSU stock price went from 18.30 CAD to 3’300 CAD today. That’s a 34.3% CAGR.

Tthe blue line is the S&P500 (it returned 282% over the same period) and the orange line is CSU.

In terms of downside, the worst drawdown was -25.9% in 2018. And 2022 was the only year in 15 years of being publicly listed where the annual performance was negative (-2% for the calendar year).

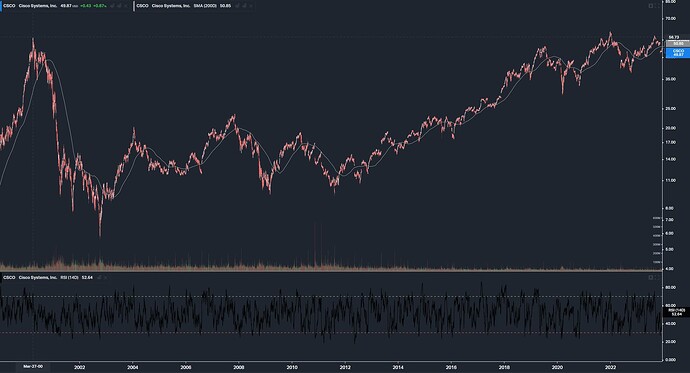

Again, the goal of this post is not to pitch CSU as an investment thesis. Just to point out the inconsistencies of Modern Portfolio Theory. Given 15 years, a stock like CSU should not exist. Its risk/reward profile should have been arbitraged away.

Either volatility is not the same thing as risk, or markets are not efficient, or another piece is missing from the puzzle.

That’s all for today.