Does anybody know what are the regulations applying to this? I would expect that you cannot go as far as 97% stocks as in their 3a but maybe I’m wrong.

Same regulations, so the offer should be identical.

I can’t find VIAC on FINMA, did any looked for it?

Maybe you have to look for Terzo fundation

I was of the opinion that “Property” would be just a bit less volatile in times like these.

Browsing through the re-balancing transactions at the beginning of April 2020, I saw an automatic purchase of “Real Estate World ex CH”. I had small percentage in this position, and it seemed to have bought more to hold this percentage (I didn’t manually adjust the percentage).

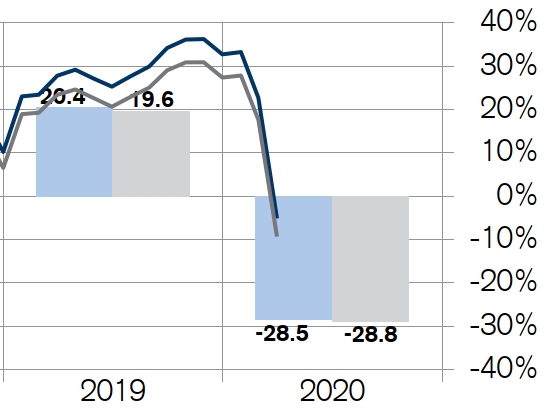

Look at how Corona has affected Real Estate World ex CH (-28% 1.1 to 31.3.20)

In the red compared to Jan 2015, that’s pretty bad.

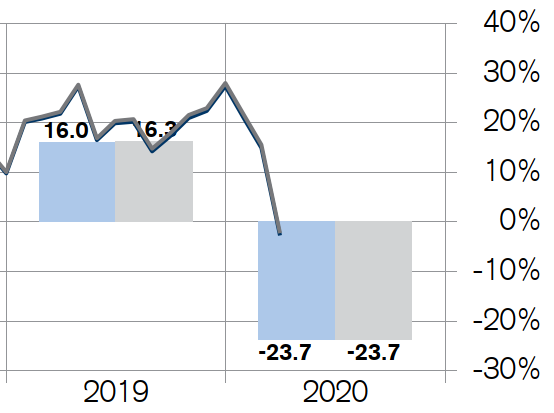

That’s worse than Equity US Blue - Pension Fund

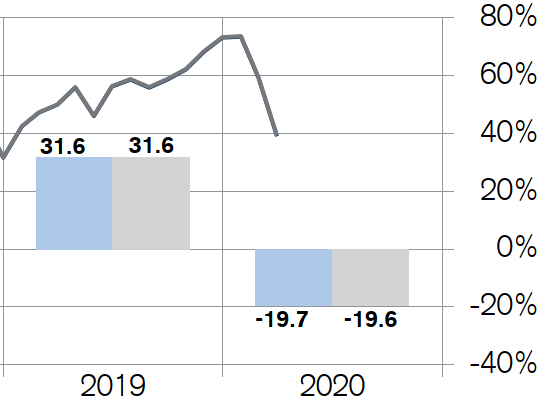

or worse than Equity EM Blue

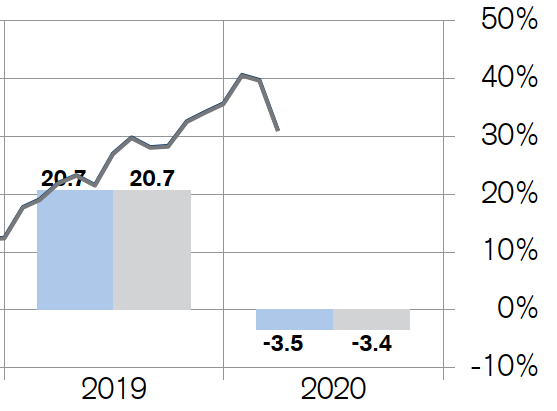

At least Swiss RE (Real Estate Switzerland Blue) held up much better

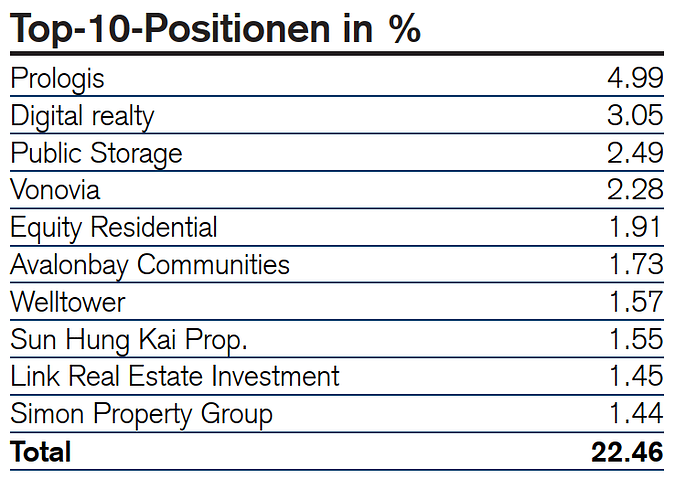

Looking a bit at the constituents of Real Estate World ex CH, there’s certainly some punished Mall Owners in there, but everything else seems quite steady. Strange. I never wanted to buy it really anyway, I “got it” when going for Global 60 or something at the beginning, but I’ve changed to my own Portfolio at Viac a while back. This is one I’ll be kicking out and staying away from IMO. What do you think?

You mean you checked the single companies and they did not lose on average as much as the fund?

I am not surprised that REIT have taken a hit, my US REIT is as of now the worst performer in my portfolio. I think they have a lot of commercial real estate, hopefully that means they’ll go up again when business pick up again.

I also wanted to buy some of it in VIAC to be able to keep all my VIAC assets in CHF (without overweighing the Swiss stock market), but then I thought: I own a house, it’s already a pretty big chunk of my NW, I am exposed enough to the Swiss RE market, so I didn’t.

Sorry, no, i expressed myself poorly, I only looked at the top 10 & Welltower (-50%) or Simon (-60%) bombed, the others all smallish drops. 10 companies out of more than 100 probably is a poor sample. And I looked again and even the better ones in the Top 10 are all actually at drops between 0 and -20%, so an “average” of -30% is “ok”, I guess.

Ok, I don’t follow US REIT’s, but then it makes sense that Real Estate World ex CH is a poor performer in this crisis.

So, I would say in the last crisis (2008-2009) that would have also been the case (without checking, but it was a property crisis as well).

They will recover, but commercial REIT’s in US (malls) will never be the same again, I reckon.

3a solutions (and many other mixed fund solutions) often throw in some Property for the “lower risk” solutions (Global 40, Global 60), but it’s a false feeling of security.

Your house in good ol’ CH is probably the best “anchor” for a portfolio in most crises.

Can I ask your opinion on the Postfinance 100 fund in comparison to VIAC Switzerland 100?

What I was able to determine myself:

- TER of 0.98% instead of 0.54%

- it looks like both are unhedged

- any hidden costs? anything else speaks for VIAC vs PF?

- VIAC Global 100 would be better, but I don’t mind to overweigh CH with such a small amount

I’ll share my experience with Postfinance 3a, not directly related to the Pension 100, but instead it’s “long-term” experience, a few years.

I have Postfinance Pension 75 since its inception in late 2016.

Postfinance Pension 100 started in late 2019.

I will change my 75 to Postfinance Pension 100 in the next months. (Have held back recently due to market uncertainty).

It’s about 25% of my 3a total, and I will keep it that way, I find the 1% TER ok, even if theoretically “double” Viac.

It’s a bit of broker diversification for my 3a & I have other stuff at Postfinance so not “another login, another password, another newsletter” etc.

I can’t handle to change to Frankly or something like that, else it’ll all get a bit too much.

No hidden costs that I found. Although I did notice at the beginning the TER of Pension 75 was 0.9% and it sneakily crept up to 1.0% by 2018. I thought it may go up n up, but I see it’s now down a bit to 0.97% (so it’s more a fluctuation over the years).

The foreign bonds and commodities are hedged in Pension 75, but I suppose there isn’t any of that in Pension 100, so no hedging for stocks only.

I’ve been getting to my end portfolio result stepwise at Viac & look in every now & then to see what rebalancing has been done. Let’s say Postfinance is more care-free for me in that regards, as it is what it is, and rebalancing and all that is “hidden”.

PS they speak about the ex-CH part being invested “Climate Aware”, which means companies producing 30% less CO2 (whatever that means) than the comparison index. With an expected same performance as the index. Mmh.

Foreign bonds should be hedged. It increases risk adjusted return.(Mainly by lowering risk)

By the end of Feb 20, I changed my 5 viac accountst cash only from global 100.

Now thinking about putting it back to global 100 (yes, doing this end of march 20 would have been better). Any thougths on doing so or better to wait for the Q2 figures?

Hi TrickMcDave,

What prompted your decision to go for global 100 rather than a lower exposure to the stock market (i.e. : what’s your investing horizon, what is your target capital in your 3A accounts on that horizon, have you assessed your risk tolerance)?

What prompted you to get out of the market and what were your thoughts about if, when and how to get back in?

Investing is a very personal endeavour, we can tell you what we would do ourselves but that may not fit your own parameters. I’d be only investing with a high stocks exposure if:

-

I don’t plan on using that money in the short term (real estate or self-employment project, leaving the eurozone or nearing retirement);

-

I don’t fret my funds going up and down (3A funds are typically invested for a long term horizon so short term moves, even -50% ones, bear few consequences as long as the market keeps going up in the long run);

OR

- I have a written strategy for getting out and in of the market, telling me at all times what I should be doing with my money and I know I have the ability to stick to it no matter what happens (and I’ll use this ability to actually stick to it no matter what happens).

Otherwise, I’d be invested with less exposure to stocks, either with the same strategy on all my accounts or on a diversified way through the 5 of them, and I’d stay invested at that allocation throughout my investing career.

What is your own take on whether or not to get back in right now?

Similar here - not investing new money and keeping cash position higher. But the statistic shows, that I am probably not correct on this ![]()

Hi there,

I’ve been thinking for a long time now to get a third pillar with VIAC. Now it’s time for me to do it, but I have a few questions, I hope you can help me ![]()

- Should I just go for Global 100 ? Is it that simple ? I don’t understand the [1] next to the strategy, but it shouldn’t be important I guess… Or is it ?

- What about the risks ? With Coronavirus the market went down quite a lot… (Well it already went up) Does it mean I should monitor the strategy and sometimes change it ?

- What happens if I change the strategy? Are there some fees that are applied when you go from Global 100 to Global 40 and back to Global 100 for example ?

- Do you put the 6827 all at once, or do you invest a bit every month ?

- Is it a good time to start now (I mean, with Coronavirus, doubts and everything). I saw in that topic that some of you prefer cash position right now…

I’m sorry if some questions are too basics, I’ve tried to read a lot from this topic but it is very big now ![]()

Thanks a lot!

Good for you to decide investing!

- Regarding the [1], you are on the wrong page. This is a note for the vested benefits account (second pillar), not third pillar. There is no [1] for the third pillar. And yes, unless you want to go fancy, start with Global 100. It’s already much better than the alternatives.

- No, you shoud stick to it. Continue investing into it and you will buy the ups and the down. But it depends on your time horizon. Are you investing for 5 years? 10 years? 30 years?

- There are no fees if you change. But it’s rebalanced only once a month. So you can only change once a month.

- Both strategies are valid, but mathematically it makes more sense to invest all at once. Now, most people are more comfortable with investing a bit over month. It also depends on your risk capacity (and on your budget)

- It’s always a good time, do not start trying to time the market

That’s just my two cents, some people will tell you to invest now, some people will tell you to wait. If you are worried, invest 6826 / 12 every month and you will not have to worry

That’s just my two cents, some people will tell you to invest now, some people will tell you to wait. If you are worried, invest 6826 / 12 every month and you will not have to worry

if you moved out of global 100, then you should not hold it. got global 80 or 60 instead, and then stick with it regardless of stock markets.

Just so that you have something to compare with: I got a 3rd pillar with VIAC last April. I invested the full amount distributed over 5 portfolios (so that I can go for staggered withdrawals to reduce taxes) all using the Global 100 strategy.

Thanks a lot for your quick answer @anon95353169 and thanks for your blog ![]()

Also thank you @nugget and @Baracus for the great advice.

I will create an account tomorrow. Do you have any referral code you want me to use ?

For staggered withdrawals, please check with your canton to find out how many 3a accounts you are allowed to have. From one canton to another, having several 3a accounts can be considered as tax evasion.

For example, the canton of Vaud only accepts the creation of a maximum of two 3rd pillar accounts, otherwise they consider that there is a desire for tax optimisation and therefore tax evasion ![]()

@florians : you can use my code if you want ![]() qCyeRRF

qCyeRRF

Very good to know indeed ![]()