you mean once a year during the 5 years before your retirement.

Mustachians: correct me if i am wrong but lets assume you have 5 accounts with a similar split of shares inside. If you withdraw once every year during 5 years, you save on tax.

But is the tax saving more interesting than mustachian b, who kept only one account at 5% per year (assumption- no market crash ![]() ). during the last 5 years?

). during the last 5 years?

What about married couples before retirement, can each of them take the money on their pillar every year without additions in tax?

Comments regarding property and pledging with pillar 3a 100% equity:

@nugget: sure but how do we concile it with the fact that the bank may only consider only 50% of the value as mentioned by @Mr.RTF ? Would that mean that we consider upfront that two blocked

accounts (me and my partner) have to contain less equity ? Moreover, those accounts would receive the full amortization during 15 years making the 100% equity account a bit useless. If two pillar 3a value at 50% each are worth less than amount required for amortization, do you have to compensate with cash?

Edit: I am starting to wonder that if you plan to buy and want to keep you pillar 3a 100% equity working, then it is better to pay the amortization every year to the bank. Maybe not smart at the moment. Any opinion welcome.

no

You can’t. The law is clear: once every 5 years. Not once every year for 5 years. Even after retirement AFAIK and the bank will force you to liquidate everything once you reach the highest age by which you’re allowed to keep 3a, so that means actually max 2-3 retirement withdrawals in practice: 5 years before pension age (earliest allowed by law), at pension age and 5 years after (age limit) but only so long as you still have a job (ha ha, good luck getting hired after 50+)

Varies by bank, I did once a pledge and mine (ZKB) considered 90%. Do not recommend though, makes no sense given the current interest rates and what they charge. Unless maybe you think you won’t be in switzerland in 5 years and would run into tax troubles in your new country because of a locked account here that you can’t close for a while

i actually realize that I made a confusion between “pledging” for the downpayment and putting the money on the 3a 100% equity pillar for indirect amortization which is what I meant. We are not sure we are clear on what happens if there is a market crash. I have actually raised a few questions on the thread given above by @cray.

AFAIK starting 5 years before pension age (m 60, f 59) you can withdraw as often as you’d like BUT no partial withdrawals, hence the idea of having multiple accounts.

Source, last section: Vorsorge Säule 3a -➤ Ordentlicher Bezug und Auszahlung

And: Vorsorge Säule 3a -➤ Wie viele Konten oder Policen darf ich eröffnen?

Money quote “Aus gesetzlicher Sicht gibt es damit keine Einschränkung in der maximalen Anzahl an Vorsorgebeziehungen.”

The bank will simply ask you to cough up money asap to keep loan-to-value below 80% at all times. No money - no house, off it goes to the highest bidder…

Your source is bad.

The definite source is here:

https://www.admin.ch/opc/de/classified-compilation/19850278/index.html#a3

“Eine solche Ausrichtung kann alle fünf Jahre geltend gemacht werden.”

No such thing there as withdraw as often as you like from certain age

I still read it that way though.

- Die Altersleistung kann ferner vorher ausgerichtet werden für:

- a. Erwerb und Erstellung von Wohneigentum zum Eigenbedarf;

- b. Beteiligungen am Wohneigentum zum Eigenbedarf;

- c. Rückzahlung von Hypothekardarlehen.5

- Eine solche Ausrichtung kann alle fünf Jahre geltend gemacht werden.6

It is not 100% clear whether 4 refers to 3 or the article itself.

Hmm, ok maybe you’re right, indeed there’s some room for interpretation, need to check case practice

Here is another article from someone with the same interpretation:

https://www.cash.ch/news/politik/gelder-aus-der-saule-3a-beziehen-so-funktionierts-519404

“Es lohnt sich deshalb, mehrere 3a-Konten zu führen und diese gestaffelt zu beziehen. Weil eine Auszahlung erst fünf Jahre vor Pensionierung möglich ist (siehe oben), machen mehr als fünf Konten in den meisten Fällen aber keinen Sinn.”

Here is my poor translation:

It is beneficial to have multiple 3a accounts, to allow for a staggered withdrawal. Conversely, there is rarely a benefit in having more than five accounts because you can only start withdrawing 5 years prior to ordinary retirment age.

→ This implies that you can make >=5 withdrawals in those 5 years leading up to your retirement age of either 64 or 65.

Ok, anyway only relevant if you’re going to stay in Switzerland all the way until retirement, which I’m not sure is even a majority on this forum

If you leave early, there’s little benefit to keeping multiple accounts or at least not as much as it’s hyped to be. Should you withdraw the money just before you leave, everything will get taxed together by CH in same year. If you withdraw after, high chances you’ll get hit by taxation in your new country. And if you relocate to a country that doesn’t tax, no point in not withdrawing everything in one go anyway then.

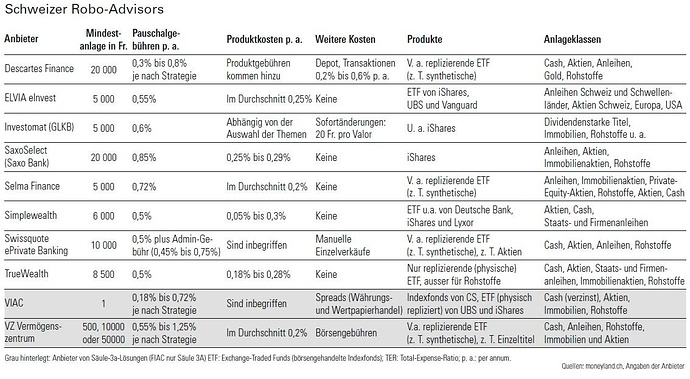

@ChickenFat pasted this beautiful comparison from the NZZ article. We where so honest (compared to the rest) to mention spreads as part of the fees (additional fees, not included). Well we reduce them trough our pooling and netting. But so far they were never as low as zero.

Blockquote

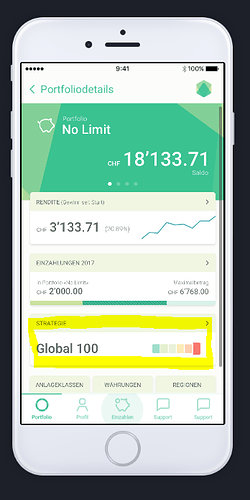

To set your own strategy you need to do the following for the existing portfolio:

Click on the strategy, then select “adjust strategy” followed by “adjust investment focus” and switch to “individual strategy” after that you are good to go.

I do appreciate this. Although the VIAC product still is not the holy grail, I really appreciate all the simplicity, straigt-forwardness and transparency that i hardly find elswere in swiss finance. Keep up the good work!

Thanks , I was looking inside “modify strategy” instead of “modify target strategy”

So after everyone got to look at the available options, I am now interested in which kind of portfolios you guys made, or are thinking of doing?

I went for 5 portfolios (to maximise tax advantages later down the road), which are all quite similar, but not the same. For instance one portfolio has 6% swiss real estate. I want to monitor how each portfolio does individually, instead of using the same portfolio 5x. I might change this later down the road though.

Breaking down everything, I land at something like this:

34.5% SPI Extra (swiss mid & small cap)

1,5% SMI

34% World exCH

14% Small Cap World exCH

12% EM

1% swiss real estate

3% cash

The indicies used are the MSCI ones, where South Korea is classified as EM. For this reason I am thinking of increasing my EM exposure here.

What do you guys think?

I have currently something very similar (1 or 2%) max.

Before the next rebalancing I am however thinking to make some modifications.

I see that no onw speaks About global 80 which is nicely diversified and contains REIT and Gold. I usually do not read About People considering REIT. Is there any specific reason to it?

The last time I checked the pre-made global portfolios contained a “complicated” mix of EU, US, Pacific ex Japan, Japan etc. IMO unnecessary so i went with the world fund / EM / SC.

I’m not too sure about REITs, I think I will be eliminating them from my portfolio in favor of stocks. The only reason I added them here is because I wanted to use them a bit for the required swiss allocation. I won’t however consider international REITs.

As for gold, further up it was mentioned that it was pretty expensive at VIAC, I’m guessing TER?, so if you want gold you should buy it outside of pillar 3a.

Yes true, I saw this earlier but since I was confused I contacted VIAC. They confirmed that the fund TER is included in the total TER. Hence I do not really understand the “expensive” part. Is it because this specific fund does not distribute dividend?

Also I am interested to get more opinions against REIT. Is it because you are not convinced to hold it long term vs: stock ETFs?