Apologies! Yes as @yakari already correctly pointed out, I meant “CSIF (CH) Equity Switz Small & Midcap ZB”. Which is not SPI Extra! I confused it with the SPI Extra available at VIAC.

I found this as I am looking to understand the funds name and I am a newbie:

All CSIF (CH) in Switzerland are licensed for distribution in Switzerland. All CSIF (Lux) and CSIF (IE) are licensed for distribution in the following countries: AT/CH/DE/ES/FR/UK/IT/LU/NL/SE/SG/LI/IE. The suffix “TR” after an index name stands for “total return” (gross dividends reinvested); “NR” stands for “net return” (net dividends reinvested). Q share classes are reserved to Qualified Investors, whereas the F and B share class can be subscribed by both qualified and private investors. Denominations containing the letter A indicate distributing share classes, the letter B indicates accumulating share classes. H indicates for hedged share classes. Source: Credit Suisse, as of 30.09.2020.

Anybody knows what is the “Z”?

For example share classe ZB, I assume means something related to “Z” (what?) and then “B” = accumulating.

Isn’t B for Blue? So no securities lending.

Can you explain how you comme to this figures / conclusion?

I started by looking at Vangard VT which says Switzerland 2,6% allocation. So I guess that how you represent it by 3% SMI? You mean this?

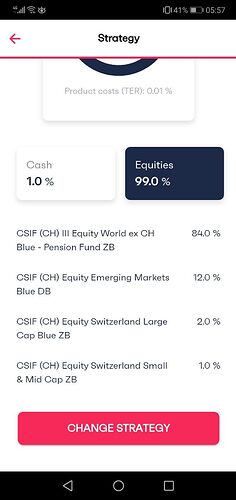

3% CSIF (CH) Equity Switzerland Large Cap Blue ZB

How do you find out you need to purchase then 10% EM and 86% World exCH to complete the “rest”?

In the list of Finpension’s available funds, you mean this allocation?

10% CSIF (CH) Equity Emerging Markets Blue DB

86% CSIF (CH) III Equity World ex CH Blue - Pension Fund ZB

Does blue mean blue chips? So you don’t really have a real VT here, but a kind of blue chips world?

I hope it’s not too newbie questions, pretty steep learning curve. I need to start from somewhere. Thanks.

Hi guys, I’m close to move my ~68k CHF (and my wife’s 25k CHF) from PostFinance to Finpension.

I went on the Play store (android) and… I’m a bit surprised to see that it has only 100+ downloads and no reviews

Is the situation on App Store (iOS) better?

I have transferred my fund there today. The app on IOS is good (not perfect). I already used their Valuepension service and I’m happy.

Looking forward to your blog post about that move ![]()

I haven’t found how much does it cost to transfer your 3a away from them. Any source?

If you buy an house it cost 250chf.

0 CHF afaik.

Transfers should be free, but the act of selling (+ repurchasing at destination) assets will probably incur fees.

@MrRip Google doesn’t show the “real” download count.

See here for reference: https://www.quora.com/Google-Play-publishes-the-amount-of-downloads-an-app-has-in-incremental-brackets-i-e-100-500-10-000-000-50-000-000-Where-can-I-find-a-full-list-of-the-range-of-brackets

I don’t think Apple shows number of downloads. There are 2 reviews, 5 out of 5.

There are charts on the app store. Finpension is not included. Viac, for example is no. 79 in the finance ranking. Frankly is no. 23. Finpension is rather new…

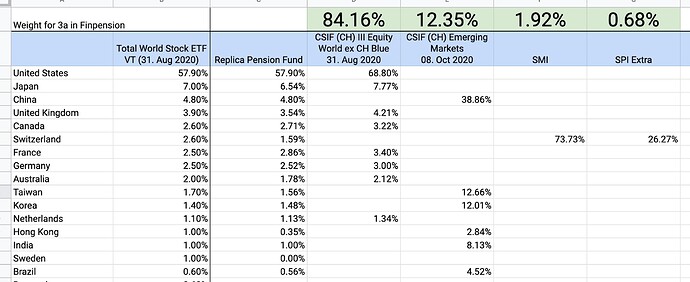

Below my quick and quite non-scientific approach of trying to replicate the mentioned numbers. Feel free to have a look at the spreadsheet to see behind the individual numbers/calculations (here). The raw data is mainly derived from the factsheets available from the funds. Note that there is rounding required when applying the numbers in 3a finpension. As I am super heavily home-biased, I went for the allocation shown in the second screenshot. Please adjust the strategy to your own liking, reflecting what you feel is the right allocation for your personal investment strategy.

I have a couple of technical questions about FinPension. I don’t know who can answer, maybe @finpension?

- How can I split my money into 5 Pillar 3A accounts without having to do it manually (by opening more “portfolios” from the UI)? The real question is: is there a way for me to only withdraw a portion of my assets on each calendar year in case of buying a property, early retirement, expatriation, et cetera?

- As a workaround to the previous problem, is there a way to open a new portfolio in the future and transfer money/assets among portfolios?

- “Portfolios” is the same as “accounts” from a withdrawing perspective?

- I’m in the process of transferring ~68k CHF, from two different Pillar 3A account, both on my name (40.7k + 27.4k). Should I transfer both to the “main portfolio”?

Thanks

- Portfolio = 3a account. You just open up 5 portfolios/accounts. You can withdraw a specific amount for buying a property, no need to withdraw the whole account. After you turn 60, you can only withdraw the whole account.

- You can merge two 3a accounts, but never split it up. Usually merging doesn’t make sense because you want to save taxes.

- Yes.

- You transfer each individually to two different portfolios.

Careful, splitting 3a is not possible retrospectively.

A portfolio is usually a securities account in combination with one or more cash accounts, in this case a 3a account. If you currently have 2, you cannot suddenly make 5 out of this without opening and starting a new one by paying in. Putting 2 accounts on 1 portfolio will merge them, with no way to split again…

- So the intelligent way to start with Finpension is to repeat 5 times the procedure of self assessing your risk tolerance? this seems unnecessary stupid. Viac opens 5 portfolios for you automatically, am I right?

- ok

- ok

- so there’s no way I can split that 40.7k CHF in the future, right? Shame on me that I bought Pension100 at 77 CHF per share in March and sold at 100 per share in August

- (Extra!) I was able to open an account without even being asked for an ID or a document… is that normal?

Basically depends on your age. Amount of year remaining until 64/65 times CHF 6826 (lets say 7000 for average, as keeps changing) plus your current accounts. Now divide by 5 or 4 (since you can start taking out as of age 60, 1 account per year until 65 normally). But don’t forget your 2nd pillar at age 65, that’s why 4 is safer.

Again that is all very average though, e.g. a house changes it all.

Also, accounts below 20k hardly have any tax impact anyway.

Yes, by distributing your funds/investments over multiple account - which can not be done retroactively.

Not as far as I remember. Though they don’t force you to do the risk assessment gain.

I just signed up with Finpensions, and the risk assessment is just a few clicks and a slide with the finger in-app. Honestly not trying to be snarky or anything, but could take less time than you trying to worry about it on the forum ![]()

PS: In your case, the per-account risk assessment actually makes sense, because you want to do staggered or early withdrawals.

Certainly on the lenient end of identification for a securities investment account. They’ll probably verify your incoming bank transfer.

Actually there is. Withdrawing it for buying a house or amortize a mortgage.

I actually did exactly that with a client. He was 55 and had 160k in one 3a account and 80k in the other. We withdraw 80k from the 1st to reduce his mortgage. Now he has 2 accounts with 80k each and a 3rd which he will use for the next 10 years.

So while he messed up with not splitting it up sooner, we saved it that way.

For a house (WEF), a partial withdrawal is possible.