Hi there, I would like to buy back capital on my 2nd pillar. I would probably get a better return on capital by investing in the S&P500 but the fiscal advantage of adding to the 2nd pillar is really just too overpowered. Especially since I do not plan to retire in Switzerland. Looking to add between 20-30k to my 2nd pillar on top of my salary and employer contribution? Is there something I am missing? I feel like it makes sense for most people.

make a model in excel and calculate. your gain is a one-time boost of approx. your marginal tax rate. And Mind the Kapitalbezugsteuer, people often forget it. A rough estimate is 5%.

If you look at the compounding of your 2nd pillar stash, look at for example the pension fund of the swiss federal employees. Mind the difference between what the fund achieves with your money (return) and what you are entitled of (compounding):

| Year | MSCI World | Publica return | Publica compounding | opportunity cost until today |

|---|---|---|---|---|

| 2018 | -8.2 | -3.26 | 1 | -9.1 |

| 2017 | 23.07 | 6.75 | 1.25 | 10.5 |

| 2016 | 8.15 | 5.06 | 1.25 | 18.0 |

| 2015 | -0.32 | -1.93 | 1.75 | 15.6 |

| 2014 | 5.5 | 5.87 | 1.75 | 19.9 |

| 2013 | 27.37 | 3.47 | 1.5 | 50.4 |

| 2012 | 16.54 | 7.94 | 1.5 | 72.7 |

| 2011 | -5.02 | 1.71 | 2 | 60.8 |

| 2010 | 12.34 | 5.16 | 2 | 77.1 |

| 2009 | 30.79 | 10.16 | 2 | 127.1 |

| 2008 | -40.33 | -6.86 | 2* | 32.9 |

| 2007 | 9.57 | 1.28 | 3* | 41.3 |

| 2006 | 20.65 | 4.49 | 3* | 65.6 |

| 2005 | 10.02 | 9.85 | 3* | 76.8 |

*assumption by me

so calculate beforehand the maximum time your money can last with the pension fund befor opportunity costs exceed your marginal tax rate. from today’s persepective, money put into the pension fund 6 years back would have compounded 50% less that with MSCI world. Kapitalbezugssteuer comes on top of that.

With the Sperrfrist von drei Jahren nach dem Einkauf für Bezüge (grace period of 3 years for cashing out after pillar 2 Einzahlung) you ended up with a tight time window of 4-6 years from back then to leave switzerland in order to make gains ond this.

Additionally there was a narrow opportunity window in 2008.

Nice calculation nugget! Did you consider the wealth tax exemption as well? It may be little but in most canton is around 0.2% per year.

Having said that, I don’t contribute anything to my 2nd pillar. Since this is ‘uber obligatorisch’, most of the insurance will give you 0.1% interest.

Hey Grog,

nice comment!

no, wealth tax is not in this calculation, but yeah, you can make an upper bound. Taking the numbers from here we end up with mean and max wealt tax of all cantons of 0.3/0.7 (1’000’000 CHF) and 0.4/0.7 (3’000’000 CHF) percent p.a.

your point with uber-obligatorisch is very important here, as it is even far worse than below ¨ber-obligatorium. hands off!!

thanks for your calculation, @nugget. What do you call Kapitalbezugsteuer? I am in Geneva, with a high-ish income so my marginal tax rate is pretty high.

Kapitalbezugsteuer is a lump sum tax on the withdrawal of funds from a 2nd/3rd pillar. Not sure what its specific term is in French or English but if you were to withdraw say CHF200k at retirement you would owe CHF10k-CHF20k in tax depending on the canton. Postfinance have a calculator here.

I wouldn’t consider 2nd pillar buybacks until you are 55+. The cost of locked up cash in 2p (no compounding) is too high when you’re young, even with the lower taxable income for that year.

When you are 55+ and there is less time for compounding you can buyback to the cap over several years pushing your taxable income to close to 0. As @nugget mentioned, make sure you have it fully topped up 3 years before you withdraw else you will have to pay the income tax on it anyway.

Some quick calculations I did with a few concrete numbers. Slightly different approach.

Say CHF 10000 is to be paid into the 2nd pillar. 30% marginal tax rate.

So 10k with 2% compound interest and 5% tax deduction at the end, or alternatively 7k invested. We need 3k to pay income tax. So right at the start the invested capital would have to increase by more than 35% to reach 9.5k.

Using above mentioned time span of 6 years the invested capital would have to increase by more than 7% yearly to reach 95% of the accumulated pension capital. Not to mention the differences in risk exposure between the two options.

Let me share my pension fund game plan. I have relocated to a European country, which will allow me to withdraw the “überobligatorisch” amount of the pension fund. Here’s a step-by-step manual

-

Make annual voluntary contributions to top up the pension fund (2nd pillar) of your company and save income tax by deducting the amount from your income on your tax statement. Like nugget mentions,

-

Quit company, move pension fund to “Freizügigkeitsstiftung” in Canton of Schwyz (stay in cash or invest in securities). Cash on “Freizügigkeitskonto” is not subject to automatic exchange of information nor negative interest rates (edited: both give peace of mind; not all countries understand the Swiss pension system and might accuse a person to not have declared all wealth)

-

Go abroad and wait for 3 years after the last voluntary contribution (for it to fully vest)

-

Withdraw the “überobligatorisch” amount (or all, if you have moved outside of Europe), which in my case is 80% of my pension fund. Pay 5% tax at source (canton SZ having the lowest tax rate in Switzerland) and a couple of 100 Francs for the service of the “Freizügigkeitsstiftung”

-

Depending on where you live you may reclaim the tax at source if your domicile does not tax such withdrawals (e.g. Israel) or it may be mentioned in your domicile’s double tax treaty with Switzerland that no further tax is owned. edited: Then remain in / move to a country that has no wealth tax to avoid being taxed.

-

Invest the money (which is now part of your savings) in a strategy of your liking.

-

If ever returning to work in Switzerland, you will have to transfer “obligatorisch” amount from the “Freizügigkeitsstiftung” into your pension fund and you can again make annual voluntary contributions to top it up (edited: this works also in e.g. UK). Save again on income tax, potentially not paying much of it until retirement age if you play this game in your mid 50s.

…plus income tax, depending on your country of (tax) residency.

Sure, you could go to a country that does not tax such vested benefits withdrawals. The question is: which country would that be? And what are the costs of spending 3 years there. Let alone whether you‘d actually enjoy your time there.

I do not really understand why is it important to be protected by non exchange of information.

Please, do not trust any protection of information provided by a swiss bank. Recent history has shown that this protection fails unexpectedly for many reasons (political pressure, theft of data, strategy of the bank,…)

I’m late to the party, just discovered this topic. That’s a great chart! But could you tell me why you are entitled to the discretionary interest that the pension fund sets and not their actual return? The fund I’m in has various plans like 20/30/50% stocks, but what, all of them give me the same return?

Also, can you help me to interpret the chart? For example, how to interpret the 127.1 opportunity cost in 2009? I see it like this, correct me if I’m wrong:

If I invested 10’000 in 2009 in MSCI World, my total return up till now (2019) would have been 127.1 percentage points higher, than if I invested with the Publica 2. pillar. That is, the difference between the two options would have been 12’710.

What do you mean? Can we recap?

- So AFAIR the annual salary between ca. 25’000 and 85’000 is insured.

- So if you earn more than that, then ca. 60’000 is insured.

- The insurance amount is set as a percentage, depending on your age.

- For age 25-34 7% has to be paid, 35-44 it’s 10%.

- The contribution is split between employer and employee.

- The employer has to pay at least as much as the employee, but can pay more, even all.

- Every year, the PK applies an interest to your capital (technischer Zins), not lower than Mindestzins set by BVG.

- When you retire, you may withdraw every year a portion of your capital set by the Umwandlungsatz (e.g. 6.8%).

- Each pension fund has a “health status” called Deckungsgrad, that is how much of the future payments are covered by the capital in the pension fund (e.g. 115%).

Now, in my case my employer pays the full amount and I pay nothing, because it’s tax efficient that way (either way I’m the one who pays). So for 2018 I saw that the pension fund contribution was 19’000. That seems like a lot, much more than 7%. Plus, each year I have a chance to declare an extra sum that I would like to contribute. It can be 1’000, it can be 20’000. Is this what you call as “überobligatorisch”? Unfortunately, I could not find any info on the interest paid on this extra sum. Where did you get this 0.1%?

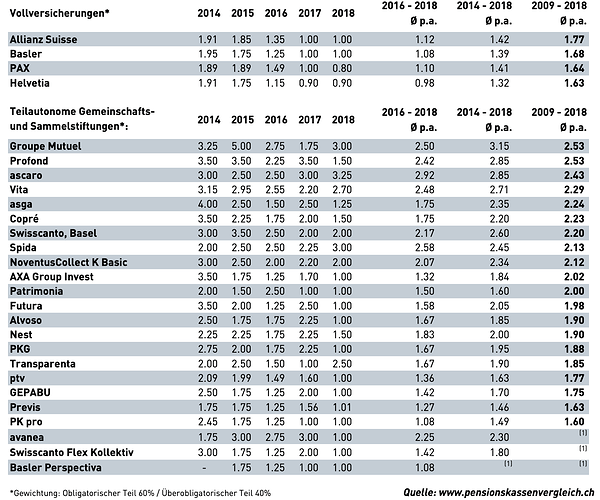

My pension fund does not brag about its technical interest on its website, I had to look to other places. I found this table.

OK, Let’s make an example where numbers are almost true.

I am affiliated in a pension fund that made on average these last years 3% according to their report. My savings are only credited by 1% interest and the difference disapears in the reserve. The reserve is used in special situation:

If the coverage of my assets by the pension fund is lower than 99% we can take some money from the reserve in order to cover the gap.

If we decide that for each CHF 100 of your asset, you get, once retired, not 5.5 CHF yearly rent but only 5 CHF yearly rent, we can compensate the drop of the rent by an increase of the asset made by taking part of the reserve.

All this is supposed to make the pension fund system more resilient but at the end it makes it less transparent.

"Überobligatorisch " means anything that is above the maximum requirement of the pension fund law. Up to 85320 yearly salary you are under the maximum requirement (Obligatorisch). Once above this number it may happen that it is not covered by cotisation to the pension fund, or it is possible that your savings has a lower interest like 0%.

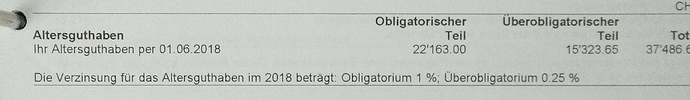

From my insurance annual report. For 2018 the uber obligatorisch had an interest of 0.25% in 2019 is 0.1%

If you earn more than 85k, every money you put in 2nd pillar voluntarily it reduce income tax but it has a 0.1-0.2% interest rate.

Thanks for the reply, @San_Francisco. I’ve researched a bit and so far found only Israel that would not tax lump-sum payments from pension funds. Singapore, Indonesia and Thailand are also mentioned in this article in German, but it needs to be verified. Plus one would need to find clever government officials who are willing to dive into the topic. It get’s quite complicated to understand all the moving pieces like age requirements, tax treatment, synonyms for vested benefits/lump-sum payments/etc. in all the countries. There is an good OECD document, but it is quite outdated (2008).

Of course you wouldn’t have to take up residency in a country you don’t like. And the 3-year period is only relevant if you’ve made voluntary contributions.

Hi @bamboo, I’ve updated the post to explain what was on my mind regarding AEI.

Ok so if I get it right, they are forced by the state to offer a minimum annual return. Their actual return is usually much higher, but since some years it can be even negative, they mostly stick to the minimum. If there are many consequent good years, they could raise the rate, to make the future pensioners happy or increase the Umwandlungssatz, to make the current pensioners happy?

To me it’s all a bit weird. They want to make sure that you never lose money from your pension account, but that costs a lot of return over the years.

What I still don’t get is how can they offer multiple plan with different stock allocations, if it goes into the same pot eventually?

Thanks, I will check my letter from the pension fund to see what they write. In my company there are guys over 50, getting close to retirement, so they are all very eager to pay more than necessary and save that 40% marginal tax rate. And I didn’t know what to do until now. So I think I will always contribute the minimum, especially that I don’t plan to leave Switzerland soon.

What remains is the 3a pillar question. I still didn’t invest with VIAC, although on paper it would make sense…

The difficulty is that a pension fund should be managed with a time horizon of 25 years but the employer wants a time horizon of 12 months because if the coverage drops under 99% some more money has to be injected in the system. The consequence is that everybody lives with a voverage of 101% and only 3% yearly growth of the capital.

Everything is in the same pot, what is compulsory and what is above it. The poor interest you get on “Überobligatorisches” makes some more reserve to compensate for the stupidity of the system.

This is true communism, the rich pay for the incompetents. ![]()

the founder of IB is a Hungarian immigrant? interesting…

no. when you retire, you can either cash out the lump sum (at least up to now, there are plans to remove this option) or turn it into an annuity with a yield according to the size of your stash and the then-current umwandlungssatz. If the latter, the stash “vanishes” into pension fund property.

since historically those annuities were well above what the market would have allowed (6.8% instead of ~4%) the accumulated imbalance of today 7 billion CHF per year (still growing) between what current retirees injected and ultimately recieve, needs to be paid by those who still contribute to the system. This is you, and that’s where a big chunk of the gains from your stash go