Hello everyone. Im 28 years old male and currently earn around 95k before tax. I recently “took the hit” from swisslife 3a pillar and transferred around 6k from swisslife to finpension. I have also around 50k sitting in a savings account at postfinance. My car is worth around 25k. What would be the best way to proceed from now on? Keep my money in a safe savings account or invest it somehow (i have no idea how to invest, this is new to me)? Max out my 3a?

- Max out 3a (probably too good to pass at your income level),

- Determine if it’s worth, e.g. if and how much you could increase your income by I nvesting in yourself (i.e. your education)

- Consider your personal life plan (having children?) and desire to purchase a house / apartment to own

- Invest in low-cost quality index funds

Welcome, @SwissBoy !

TL;DR: max out your 3a, read an introductory book or two on how to invest. For you I have one super easy book recomendation and one still easy but super profound recommentation (see below).

In more detail:

What @oslasho and @San_Francisco have already said … though …

… since you mention that you have no idea about how to invest:

Evaluating your risk profile and investment approach might sound a bit like voodoo to you? Or if it doesn’t sound like voodoo - which might even be more concerning (my alarm bell of “over confidence” just went off) - you might only have a superficial understanding given you don’t seem to have much background on financial markets, asset classes, and how these things work over the short and the long term?

Therefore, I would insert bullet point 1.5 into @San_Francisco ’ s list:

educate yourself about how to invest, or more generally, how financial markets/returns etc work over time. Asking how to do this in a forum like this sounds like a good starting point, but with all due respect to my forum colleagues I would actually start with a couple of books.

I’m sure there’s a gazillion book recomendations in this forum for how to educate yourself on how to invest, but probably hard for you to filter through. I’ll offer two recommendations that I found helpful at your stage of “I haven’t much of a clue yet” (if I understood correctly):

- Really easy to read, illustrated, IMO super easy to digest even for novices:

“The Behavior Gap” by Carl Richards. Amazon link (no affiliation).

This book helped me with my “investing paralyis” (perhaps similar to your current situation) and led me in 2012 to converting with my own conviction a 7 figure amount of essentially cash into a 60/40 portfolio (you’ll learn about the 60/40 portfolio approach in the book).

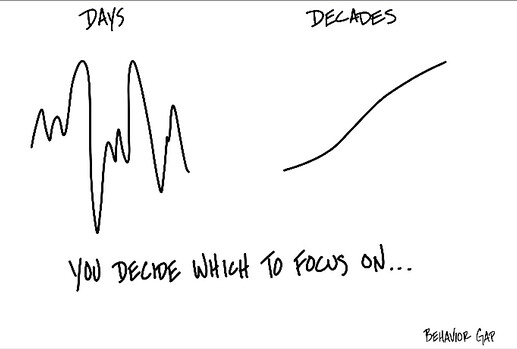

The book features witty sketches that capture the essence of the book’s messages on back-of-the-napkin drawings like this one, one of my favorites:

There’s also a website: Behavior Gap - Seemingly novice advice, but eternally true. This is both sophisticated as well as easy to access as a novice, IMO:

“The Little Book of Safe Money: How to Conquer Killer Markets, Con Artists, and Yourself” by Jason Zweig. Amazon Link (no affiliation).

If this reading list sounds intimidating and you are unsure what to do (right) now:

- No need to rush it to deploy your savings right now even if generally long term speaking, it’s better to be in the market than to stay on the sidelines. With your time horizon, you will have plenty of time to compound, even if your entry point isn’t the March 2020 low.

- I feel, however: it’s better to build your own conviction why you want to be invested and be in the market (instead of watching from the cash sidelines) than to invest based on advice from strangers like me and then for the lack of your own conviction pull out at the worst point (like that March 2020 entry/exit point mentioned above …)

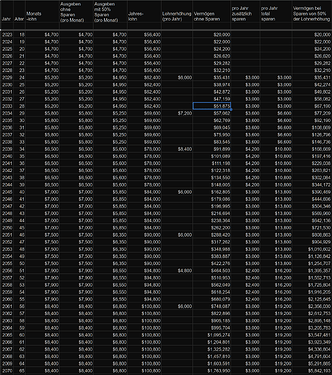

P.S.: Congrats on having saved up 50k at your age and making 95k before tax. According to my “Getting Rich Slow Plan” for my son you’re on a good trajectory …

This plan assumes a 10% growth rate which will be challenged by many, but assuming reinvesting your profits in your retirement accounts (especially the tax free ones), I feel this isn’t out of reach.

Call it aspirational if you like … ![]()

Good luck and good night!

Also a great book and an easy and quick read: The Simple Path to Wealth by JL Collins. I wish I’d read that book at your age.

Do you mind sharing some interesting proposals?

Among European ETFs:

- IE00BZ56SW52 WisdomTree Global Quality Dividend Growth UCITS ETF

- IE00BL25JL35 Xtrackers MSCI World Quality Factor UCITS ETF 1C (sector-neutral „factor“ ETF)

- IE00BX7RRJ27 UBS ETF (IE) Factor MSCI USA Quality UCITS ETF (USD) (distributing only)

- LU1681041890 Amundi MSCI Europe Quality Factor UCITS ETF

Many here would (among European ETFs) of course recommend the following…

- IE00BK5BQT80 Vanguard FTSE All-World UCITS ETF

…but that‘s not tracking a Quality index (more on that topic in on this thread).

Many thanks (the thread you mentioned is really valuable)!

What do you think about SPHQ for USA?

Why not buy a NASDAQ-100 fund instead?

If I would be you I would think of an ETF strategy that makes sense to you situation. I think it is important to consider investment goals, your risk tolerance, and your time horizon. You are a young investor, so I would focus on low-cost ETFs to maximize returns over time. Diversification is is a key strategy to spread risk across various asset classes.

Example portfolio asset allocations are:

- Aggressive portfolio allocation:** 70-90% stocks, 10-30% bonds

- Moderate portfolio allocation:** 50-70% stocks, 30-40% bonds, 0-10% cash

- Conservative portfolio allocation:** 20-40% stocks, 40-50% bonds, 10-40% cash