Thanks for all of your inputs.

I understand that Real estate requires much more efforts than other investment supports.

The point I am struggling with is the structure of the mortgage in Switzerland : it seems quite different from other countries!

In France for instance, a smart RE investor would do the following : Let’s say a house costs 300’000 EUR.

(1)If your bank credentials are good, it is possible (tough difficult) to have the full financing from the bank (300k plus notary fees) : no payment upfront! Plus you agree to reimburse the whole amount over a fixed period of time, let’s say 20 years.

So each month you pay interest but also a big part of equity (the amortization of the mortgage).

(2) If the smart investor did his homework correctly, it is possible to find occasions where the rent from the tenant covers your mortgage payments plus charges : this is the ideal situation! The tenant is then building your equity and you have nothing to pay! At the end of the 20 years, you globally did not pay a dime, and have an equity of 300k euros.

The big advantage is that, because you don’t pay anything, you can use your money to invest in stocks for instance.

Even if you have to take care of the house, the return of investment you get is quite high (you put almost nothing on the table and get 300k after some time!).

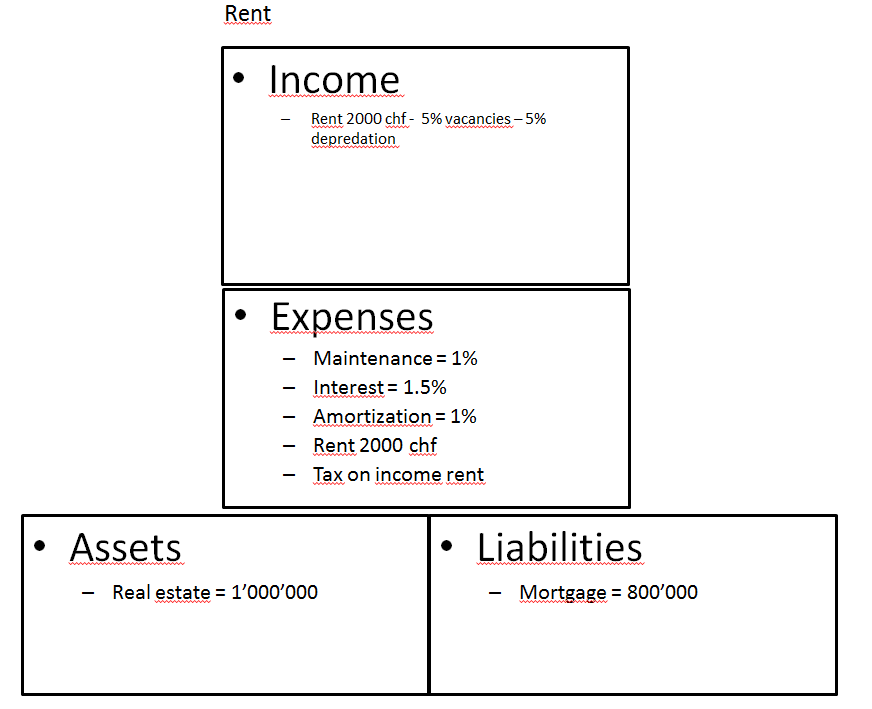

Here in Switzerland, things seem more complicated :

(1) As i said, a downpayment of 20% (or 25% with notary fees) is required.

(2) As far as I understand, the amortization of the mortgage is very low : between 1 and 2% per year! And the bank only asks that you pay reimburse 15% of the capital, over a 15 years period… This means that afterwards, there are stil between 60 and 65% of the value of the house that you owe to the bank => you will pay interests until your death. This is apparently to leverage tax regulations…

This is very not advantageous for the investor because the part of the rent paid by the tenant that goes into the equity becomes much much lower!

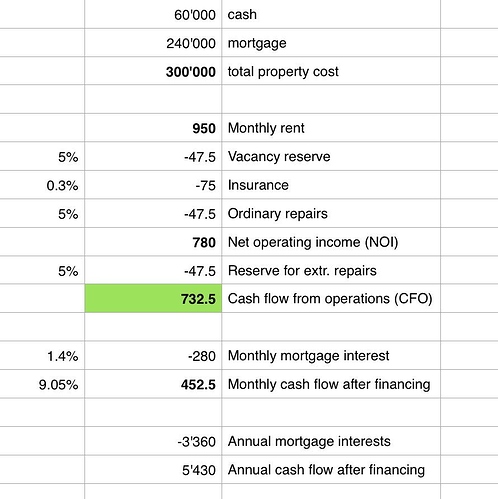

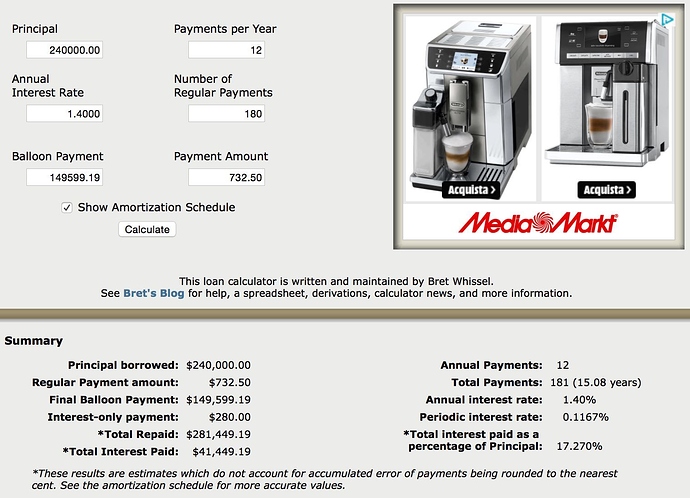

For instance, i went to a mortgage simulation website for a 250’000CHF apartment : downpayment 50’000 CHF. I borrow 200’000 CHF.

The bank let me choose between a 1% or a 2% amortization per year. Let’s say I choose 2% : this means that I will reimburse 4000 CHF per year, and build only 4000 CHF equity per year by paying my mortgage. For the 15 first years, because afterwards I will build nothing.

Even if i am in the perfect situation where the rent paid by the tenant covers the mortgage payments plus the charges,

For an initial capital of 50’000 CHF I build 4’000CHF equity per year : this is only a 8% return, and it is not a compounded return!

I find this mortgage rules crazy! Can someone confirm if I understood correctly?

Perhaps @_MP can confirm how the amortization of his mortgage works?

If this is really how mortgages work in Switzerland, then it is clearly not interesting to invest in RE here for rental purposes.