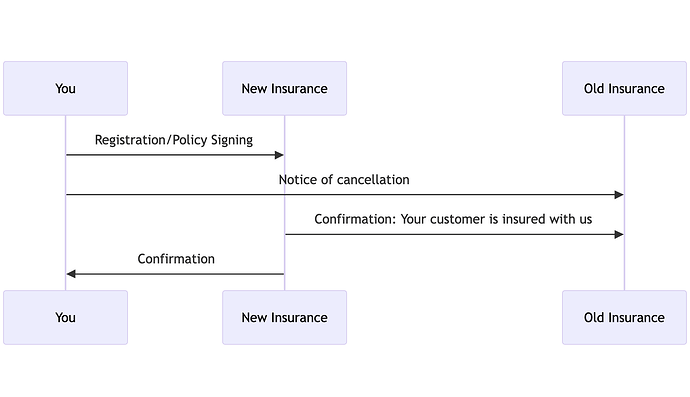

Normally, the new insurer sends this directly to the old insurer, provided you specified the old insurer when you took out the policy. That’s how it has always worked for me:

I can confirm. Your insurer from 2024 will be notified by the new insurer (2025). Maybe you signed up recently and that’s why they haven’t been informed yet?

Important to mention, you also need to pay all premiums or other open invoices with your current insurer before the end of the calender year. Otherwise Art 64a allows your current insurer in 2024 to continue with your contract in 2025.

Thank you. I signed at least 1 month ago.

Also I have paid all the premium and invoices for 2024, so I should be good to go.

I just wanted to add a note: Comparis sold their soul. If you do a normal search they won’t show insurances that doesn’t pay them a bribe. You should set to advanced search and even after that you won’t see the same info. They are just hidden.

So let’s use only priminfo

Provision-based „comparison“, sure. ![]()

So I was about to sign up for Assura’s qualimed solution (cheapest) but then decided to look at Helsana, which is only a tiny bit more expensive but has better reviews and less restrictions. But when I try to sign up I need to pick a doctor from a very limited list.

Does anybody know how important/binding this doctor’s selection is? Like, can I change it later to e.g., the paediatrician which my kids use and which is unfortunately not on the list? I did call Helsana but they are closed and I believe I have to pick an insurance today…

Edit: now I get it, the choice is (for some reason) limited to the doctors with highest discount, i.e., the ones that collaborate with Helsana. If I pick the GP options (where one needs to first go to the GP), then all other doctors appear and the premium increases…

That’s correct. I had the same situation at one health insurance. For example with their Flex model which allows to choose between calling e.g. Medgate / Med24 or going to the GP did not have my GP listed. The GP model which requires me to contact my GP first had the GP listed.

I find it frustrating how many differences there are between insurance companies and then even within the same company you really need to check all the details.

TBH I thought basic insurances should offer the same treatment for everyone so I was surprised to learn that some doctors are cheaper/more expensive.

Anyway, hello Assura my old friend…

Starting 1 January 2025, insured persons can switch their insurance model (e.g., family doctor, HMO, or Telmed) within the same health insurance provider at any time during the year

https://www.admin.ch/gov/fr/accueil/documentation/communiques.msg-id-103217.html

Change during the year to insurance with a limited choice of providers

Insured persons will now benefit from greater flexibility. In accordance with current legislation, insured persons who can freely choose their providers (free choice of doctor) and their deductible have the option of changing their insurance to a model with a limited choice of providers (alternative model) only at the end of the year. From 1 January 2025, insured persons will be able to change their insurance model (e.g. family doctor, HMO or Telmed) within their own health insurance fund during the year. This change is particularly suitable for insured persons whose financial means have changed and who are looking to reduce the burden of their premiums. However, joining another insurer during the year is still not possible, nor is switching from one alternative model to another with the same insurer.

I changed my previous insurance away from one of the cheap provider known for less than stellar support as i couldn’t deal with endless phone line waits to solve simple administrative issues that should not even require a call.

I am usually very frugal but growing older I decided that my time and mental well-being was worth the price increase - especially in the eventuality that one is not well when they need to deal with that.

Just wonder if somebody had a similar experience before.

I changed my health insurance for next year but haven’t received my new card yet nor invoice or an active account at the new insurance provider.

They told me that there is a risk they cannot finish in time due to a surprisingly high number of new applications and I might need to pay Jan and Feb with my former insurance provider.

This was surprising to me as I did not even know this is possible. At the end I basically need to pay more for 2 months since my old insurance provided increased their prices.

Just wonder if anybody had a experience like that before?

I cancelled the old one in time in Nov and signed up for the new one mid Dec. I guess maybe slightly late but I did not expect that this would take so long for them given that it’s done online.

Seems unusual to me, but have never signed up to the new one after end of Nov.

Happened before that the card came late, but having to pay at the old place for 2 months seems odd to me.

Why not just call them and ask it directly?

Should have clarified, the new insurer mentioned this over the phone which also seemed odd to me. Hence I wanted to see if that is something I was just not aware of or is wrong information.

KVG or additional insurance?

This seems very untypical for KVG.

This is regarding KVG

I know some instances of this; people who signed up with their new insurer between Christmas and New Years Eve and the insurer could not complete the paperwork by the year end. And yes, they had to stay with their previous insurer for January.