from KPT? A thank you letter sounds nice. I got the silence treatment ![]()

I got the letter as someone who was already insured with them. They basically explain that they are dealing with a lot of new insurees, tell us we’re likely to be experiencing delays and thank us for our understanding.

It seems pretty chaotic but reacting by hiring too many people to deal with the additional administrative work of getting everyone set up quickly would also leave them with unplanned for overhead later during the year (my analysis, not theirs), so I hope they also manage their expenses to avoid a redo of EGK in Vaud in 2012 where such a mistake of having underevaluated to new inflows due to the low premium led to an intra-year adjustment of said premiums. We should know more by May-June (if the law hasn’t changed since, there’s a 5 months delay between the time they announce it to the regulator and when they can enact it - it might have changed, though, I haven’t checked).

I talked to a friend who works in the insurance industry, we talked about the way insurance premiums are calculated for basic insurance (KVG). Apparently insurances need to cover the expected expenses and submit a budget to the BAG for approval. Now, depending on how creative the accountants are with these budgets (depending on insured population, risk compensation factors, financial situation, reserves, etc.), there can be big differences in the premiums.

This year, KPT was one of those insurances who were quit aggressive with their budgeting and got their premiums approved. Now, what people do not necessarily consider, is that KPT is a mid size insurance company with probably only a couple dozens FTE’s on the KGV operations team (they rank #10 with 4.1% number of insured people by start of 2022).

Apparently, due to their low premiums, they were able to capture a huge chunk of the people who were switching due to increasing premiums, word on the street is >40% increase (i.e. >140k new insured people). Processing these forms takes quit a bit of time, so that’s why they are allegedly doing weekend shifts and even have ordered employees from other departments to help out (can’t verify this - just rumors).

That is also what my friend was concerned - he actually speculated that their reserves would not be sufficient and this could lead to intra year premium adjustments (luckily this gives the clients the right to cancel their contract and switch to a different insurer).

Edit: just looked up their reserves: solvency quotient was 150% per 1.1.22, according to BAG data, so they might be good.

That is some great insight! Thank you, and your friend.

I never even ever thought about what happens “behind the scenes” - we will have to wait and see.

Not frontrunners with digitalization, not made to scale automatically ![]()

Hi guys, anyone else still waiting? I am yet to receive the contract, insurance card/number, portal login, yet even an INVOICE ![]() … Gonna have to pay 3 months at once

… Gonna have to pay 3 months at once

They dont answer my emails, and I dont have time with work to stay on the phone waiting line for more than 20 minutes, even if, bloody annoying… Without answer… And they close at 16h on fridays, 17h rest of the week…

Does anyone know if I could revert back to my old insurance? It doesnt seem that they are holding their part of the contract… Well wait, they havent even signed it as far as I am aware.

Luckily I am healthy and rarely use my insurance. I hope no one in need of the insurance is in the same situation I am in…

That would not be an issue for the mandatory health insurance as you would automatically be insured with your previous insurer if something wouldn’t work out

Based on Google reviews, you are not the only one waiting.

Being with KPT for 3 years, I can say that everything got much much slower. It used to be quite smooth and now each interaction takes way more time.

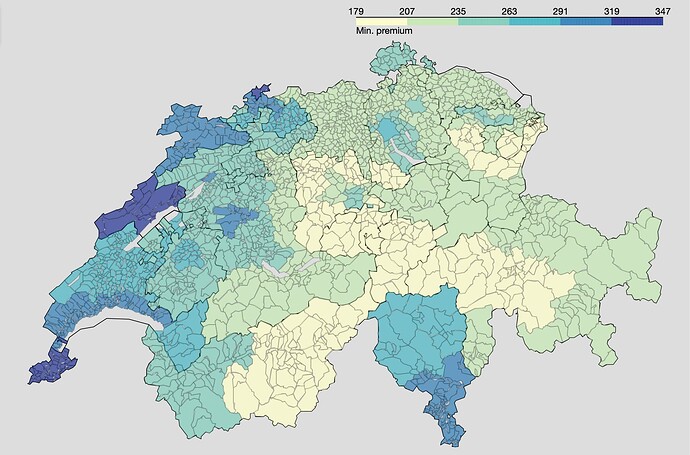

We will move in a few months to a region which spans multiple cantons and KVG-regions. It was hard for me to visualise which municipalities fall into a given KVG-region so I decided to take on the pet project to map it.

The interactive map is available here.

It shows the cheapest premium for an adult, with a deductible of 2500 and without accident coverage. It does not take into account the redistribution of the CO2 levy.

Quick update from my KPT case, it turns out they find 0 trace of my 25th of october online sign-up (despite me having received an automated email confirming my inscription)… So if you’re still waiting, it’s safe to assume you’re also not in the system.

I am now reverting back to my old insurer, going to try and negotiate to change model though…

Good to know ! I wonder if this is specific to KPT who did not expect a massive influx of new clients, or if it would have been similar with another insurance.

To remember: choose the 2nd or 3rd cheapest insurance in the future to avoid the costly administrative hassle in the end (in terms of time, effort, etc).

I continued to work on the map to offer kind of a tool to know what to do at a glance when the new premiums are published. It still displays the premiums for an adult, with a deductible of 2500 and without accident coverage. The map has now 3 layers:

- “Recommendation” which gives you an advice for the cheapest premium for the next year. The color code works as follows:

- Red: another insurer will offer the cheapest premium;

- Yellow: another model (within the same insurer) will be the new cheapest option;

- Green: the current cheapest insurer/model is the same for the next year.

-

“Change of cheapest premium (YoY)” which shows how the cheapest premiums changed across the KVG-regions.

-

“Cheapest premium” which shows the cheapest premiums (absolute) across the KVG-regions.

Hovering your pointer over the municipalities displays more information in each of those maps.

Feel free to share any suggestions you may have or any mistakes you spotted.

The interactive map is (still) available here.

Note: I previously claimed that the cheapest premiums had increased YoY quite uniformly across the country ranging from 5% to 5.4%. Turned out it was a computation mistake, apologies. The region which had the smallest increase is OW (0%) while SH2 got the maximum (13%) increase this year.

EDIT: you can now navigate between age groups (young/adult), accident coverage and excess.

I am thinking about switching insurance this year. Currently I pay 380 per month (Basel city l, basic insurance only with max deductible). I feel this is really high… However, when I am checking comparison websites, others are not so much lower - perhaps 360/350. They are from much less known companies such as Assura and have less flexible model. I wonder if anyone has any tips on switching insurance provider?

… as in “this year” or as per 2024?

If the later: As the 2024 premiums are not yet released, I’d just wait a few more days / weeks…

yea for 2024. I will need to wait. Thanks!

There is no magic bullet, choose the model and deductible you can live with (some models are not that restrictive in my opinion, such as going to your family doctor or calling the insurance first - which doesn’t restrain your options but give them an opportunity to advise you) and choose the provider with the right balance of price/administrative model/reputation you like (price is my main consideration).

In order to get meaningfuly lower premiums, you may have to move to Basel-Landschaft or another Kanton. Only you can know if the (big) hassle is worth it (other things to consider, in this case, are taxes, cost of housing (price of RE assets or rent) and subsidies (if you are elligible to any).

Check this for franchise options, sorry in french.

Use Google translate if needed.

Thank you for these interesting insights. It seems that this fact is known by a majority of people, as 77% of adults had a 300 or a 2500 CHF franchise in 2021 (see Statistique de l’assurance-maladie obligatoire (admin.ch)).

Such a nice map

If you ever get bored please consider adding more waterways! Somewhat funny when you try to get oriented by some Zentralschweiz lakes and… they’re missing ![]()