Hi guys

Has anyone in here also seen this website:

I have been trying to learn from this guys transactions over the last 1.5 years, but was not that successful using it (didnt beat the market after all).

He has been doing it for over 30 years, and always beat the market by a couple of %. Every transaction he made is also listed on his blog. I still see a lot of potential, especially in the current market environment.

What are your thoughts?

Too much effort in my opinion.

1 Like

Yes, I am at the same point now.

I d rather focus on increasing my salary, creating value, or generate additional income.

Also had a look at your blog, your portfolio looks interesting.

Why did you decide to go for AVUV and AVDV in addition to VT?

2 Likes

The issue with covered calls is that you can lose a lot of the upside.

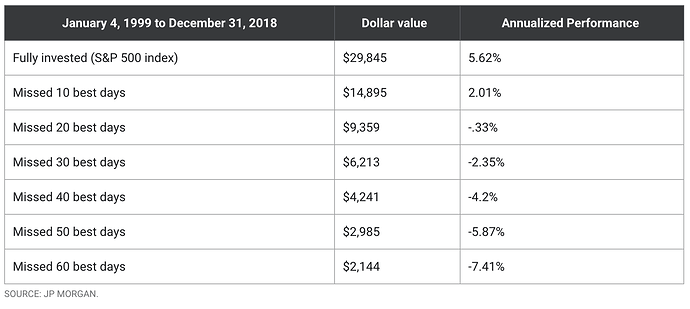

Consider this table:

It shows what the performance would have been if you had missed the 10 to 60 best single days in the stock market. Being assigned on a covered call is not exactly like missing the best days but it’s certainly similar.

For me, selling covered calls would be a good retirement strategies though because you don’t really care about losing on the upside as long as you are protected from the downside. So I would use the income from writing covered calls to buy puts in order to get some insurance on my money.

Yes that is exactly the point. In addition, when constantly writing Covered Calls, you have to make a lot of “good” investment decisions. And no one is perfect, so there is always some “bad” ones that can impact the performance even more when writing ITM Covered Calls.

“So I would use the income from writing covered calls to buy puts in order to get some insurance on my money.” → valid point, but this would cost me even more time making trades.

Well… you can buy puts only once a year if you want, with an expiration date set a year from now. It takes like 15 minutes  Plus, when you’re retired, you’re not exactly… busy.

Plus, when you’re retired, you’re not exactly… busy.

1 Like

Ok, but for example the guy above: He buys monthly CCs, so you would have to constantly re-invest premium into puts from the same stock you wrote Covered Calls, no?

Guess you are not writing calls at the moment then?

I am also far from retiring.

Yes, if you write monthly calls, you have to write calls every month. But it doesn’t mean that you have to write puts on a monthly basis. And you don’t have to write the puts for the same stocks because… you don’t have to do anything. But it would be smart to do so if you were worried about the downside.

Guess you are not writing calls at the moment then?

No, I’m not… As I said, I would consider doing it in retirement but just like you, I’m far from retiring

1 Like

To give my portfolio some more small cap exposure over what VT provides.