Is withholding tax on credit interest in Switzerland 35%? Time deposit. Earn up to 1.75% interest now. (credit-suisse.com)

“Withholding tax of 35% on the credit interest; for accounts with annual closing statements, taxable credit interest up to CHF 200 is exempt from withholding tax.”

Yes, since, like, forever. It’s the one that is been reimbursed when you declare it in the tax declaration.

Thanks. What is the pre-requisite to get tax reimbursement?

To declare it in your tax statement.

![]()

So obvious question is what is the point to collect the tax when it is super easy to get it reimbursed?

Not everybody would be incentivised to declare it otherwise and the taxes would be lost. Also, foreign investors may not necessarily recover it.

Historically there was this thing called banking secrecy ![]()

So by having a withholding tax rate close to or higher than the marginal rate, people are more likely to declare it (and if they don’t declare it, it’s still ~neutral for tax revenue).

I hope the reimbursed amount comes back rapidly.

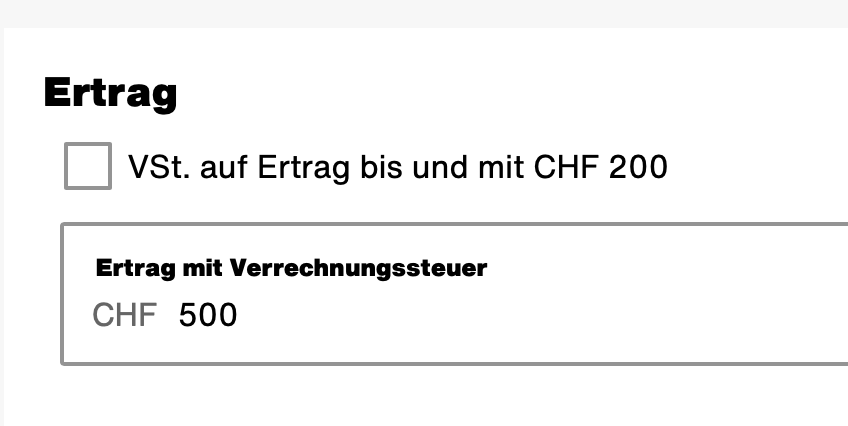

So how does one get it back? Let’s say I got 500 chf in interests and paid 35% of it already. What should I enter in the declaration? Does this look right? Thing is I can’t then enter anywhere the 157 chf I already paid…

Ok, so the software calculates the right amount in the total view, just not shown on the specific page.