What do you think “near future” is?

It was voluntarily vague.

If I were to take a stand, I’d say it covers now to June 2022.

I have good confidence that, in Switzerland, rates won’t rise in the second half of 2022 either.

That’s about as far as I’m willing to go.

Even so, a rise in rates may have a rapid effect on current market prices. To begin with, there is less demand. Then you have more supply from people who need to renew their mortgage and are uncomfortable with new, higher rates. Plus, you have more supply from people who are highly leveraged and think prices might go lower in the future.

Subsequently, lower market prices may affect valuations for ongoing mortgages, as explained elsewhere in this thread.

I recently talked to a guy who has a SARON mortgage.

I asked him what he thought of the long-term development of interest rates.

A short transcript of our conversation:

Dude: “Interest rates? Why would I care about interest rates?”

Me: Well, you have a SARON mortgage…

Dude: “I pay a fixed amount every month, you know!”

Me: Yes, but that’s linked to the SARON rate…

Dude: “Of course, it’s a SARON mortgage, but I pay a small amount every month, my house is soooo cheap.”

Me: But that could change, depending on the SARON rate…

Turns out he has a SARON mortgage but doesn’t know what it is.

I think some people want to realize their dream of owning real estate and don’t care much about anything else. There’s going to be a massacre if interest rates start to go up, as Cortana said above.

It’s a shame that nobody responded to my request to explain how banks handle credit. I guess I will have to talk to some guys at the bank  . I know that in Switzerland and Germany there is this Pfandbriefbank, to which the commercial banks pawn off the collateral (the right to sell your house if you don’t pay your interest), and receive money from it. Pfandbriefbank creates bonds which are secured by this collateral. But I’m not sure if all credit has to be financed by some bond, or do the banks really just create loans without a need for a source.

. I know that in Switzerland and Germany there is this Pfandbriefbank, to which the commercial banks pawn off the collateral (the right to sell your house if you don’t pay your interest), and receive money from it. Pfandbriefbank creates bonds which are secured by this collateral. But I’m not sure if all credit has to be financed by some bond, or do the banks really just create loans without a need for a source.

Only a small portion of mortgages are used as collateral for the two Pfandbriefbanke in Switzerland. Most of the mortgages are financed with the savings of customers. You can check the balance sheet of any bank.

Edit : And btw, the Pfandbriefbanke can’t sell the houses, the bank has to give another house as collateral to the Pfandbriefbank when it believes/knows the borrower can’t pay

Bigger banks like CS, UBS and ZKB refinance their mortgages on the market with swap deals.

But I don’t know enough about it to post any more details.

Maybe in the past but big banks are moving full steam to full securitization, far beyond old Pfandbriefbanks. In the last deal I was very recently involved with ZKB, the money actually came from SIX SIS, they were the holders of mortgage deed, so you wouldn’t find it on ZKB’s balance sheet.

Hi everybody!

I’m one of those that bought a house recently and after reading this topic I’m trying to understand and plan what would be the best to be on the safe side.

This is a summary of my situation:

- Still to decide the type of mortgage: 0.6% SARON vs 0.8% fixed for 8 years

- We still have some cash after buying it: 70k approx.

- Our saving rate is around 50%

- The house is close to the city center and there are plans for the following years (2021-2029). They want to renovate the main street and to build a few buildings with offices, shops, appartments and even a park in the area. So I don’t expect the value of the house going down (at least not a lot).

Would you be worried about anything? Which actions would you take now to be on the safe side in the future?

If there is a significant gain for adjacent buidlings, they may bill you part of the costs. It’ll also be an opportunity for you to rebuild old utility pipes, which would spare you trouble in the future if you have to do those works on your own without the city participating (and not wanting to authorize it because they wouldn’t want to do works in the main street anymore). I’d send an e-mail to the Gemeinde and ask if you should plan to set aside an amount for that and, if yes, for roughly what amount (by e-mail so that you have something in writing).

Edit: I may have misunderstood your statement. None of this applies if your building is not on the main street but rather simply close to the city center.

Congrats on your purchase! The above advice from Cortana is the most relevant in my opinion. Since your savings rate is 50% it sounds like you are following this path already.

Are you still able to get 0.80% for 8 years? Refinancing rates increased by 0.25-0.30% in the last 4 weeks. So it would be equivalent to a 0.50-0.55% offer for 8 years 4 weeks ago.

Good point, it’s a building next to us and the street behind us. I’ll write that email just in case.

That’s true, I had in mind to keep saving for the future (which in this case is not buy a house anymore, just hold it). But that mindset help to have it clear.

I would need to double check with the banks, but those were the 2 options in our last discussion

I think that the best way to be on the safe side when owning real estate is to be able to pay back a significant part of the mortgage should anything happen. I find Cortana’s advice very relevant: do as if you were charged 5% interest but invest 4% that you’re not paying in interest in a moderately safe strategy (one that matches the duration of the mortgage). If at maturity rates are very high, you can use that money to reduce your debt. And if free money is still available, well, you can keep the money invested.

It would be strange if the things you mention were not already priced in (except if they were made public only after you bought)

Most of the news are from the 30.08.2021, and we agreed on the price at the beginning of August.

Maybe there was something unofficial before or I’m missing something but I don’t find it overpriced. We’ll see in the future…

Yes, it changed. Now the options are:

0.6% SARON

0.75% 5 years

1.15% 10 years

Meanwhile in Czech. Rep.: Czech National Bank raises key interest rates by 1.25pp, biggest hike in 24 years | Radio Prague International still not 3% increase but with this:

Almost a perfect storm scenario, these one million people will have to get a new provider but with current rates for electricity and gas + now hike of the interested rate will put many people there into an existential crisis(most people have mortgages even the poor ones).

Poland:

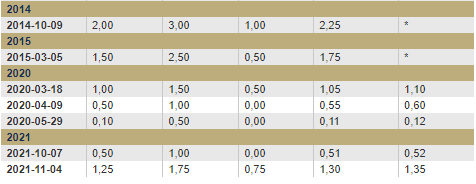

In Poland, inflation is already at 7% (even though before they said there is no need to worry and we should rather be afraid of deflation). So they raised the interest rate from 0.10% to 1.25%. I wonder if 1.25% would already cause havoc in the Swiss real estate market?

I believe it would have a signifianct impact. However I can’t figure out if or how we will ever get there.

I would love to see an economic analysis of the endgame for current SNB intervention on FX and interest rates and impact on inflation.