Hello everyone!

I opened an account on IBKR in June 2024 and started investing mostly in the S&P 500.

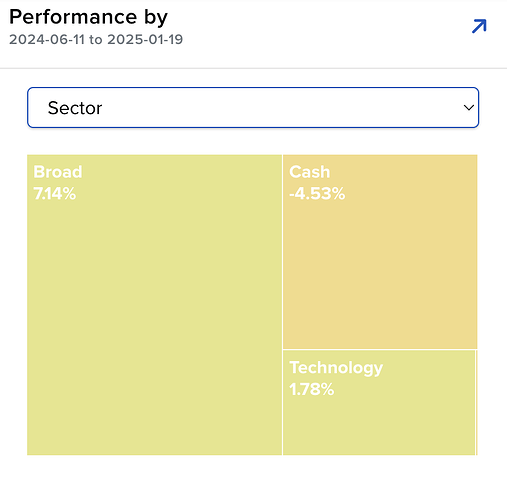

As you can see from the screenshots, I have about half of my funds invested and the rest in cash balances.

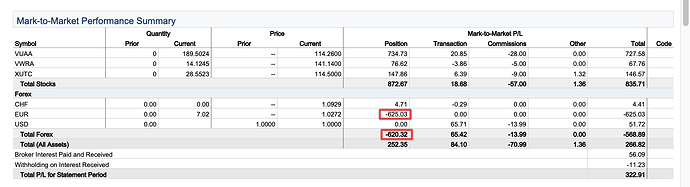

I initially deposited EUR, then converted it to USD to buy ETFs denominated in USD.

I understand that my performance might be lower since I only started investing in June 2024.

However, the performance is ridiculously low (0.92% TWRR) compared to the S&P 500’s performance over the same period.

After analyzing the activity statements, I think I’ve identified the problems.

The forex performance for EUR is showing as -625.03, which is huge.

I don’t understand why this has such a negative impact on my performance?

I simply converted EUR to USD when the EUR was relatively strong, so I don’t see why the impact is so negative.

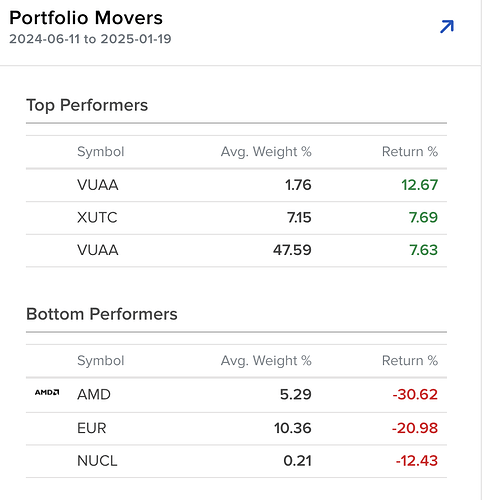

Additionally, I invested a very small amount in AMD, but it seems to have a disproportionately large impact on my overall performance, almost as much as my 80% allocation to S&P 500. Why is that?

My base currency is USD.

Can someone explain why this is happening?