I think that the 5 year limit for buybacks applies only if you were allowed to contribute in the first place, which is not the case if you’re a foreigner arriving in Switzerland as a 25 year old for example

While I appreciate that there are many forms of ‘Mustachianism’, it seems an odd comparison for this forum. Are you planning to work the full 44 years @ 200k - 300k income on average?

If you look at it from a FIRE perspective, the current system might even, to a degree, have some advantages. If we assume a scenario where your contributions are based on:

- 50k average salary in your low twenties, if even that (studying).

- 75k - 100k average salary towards late twenties.

- finally beginning to make some real money in your thirties, say 100k - 175k by the end.

- a few years in your forties at 200k, achieving FIRE and retiring.

- the rest are minimal contributions until 65.

You just about get to the max. 1st pillar pension and benefit from those years you overpaid, compensating the later FIRE years. It probably makes more sense if you lived in CH from 20&up, instead of migrating later and already having a degree from abroad.

In my simulation, assuming that I go for a more frugal FIRE, I will be short of the maximum 1st pillar pension. Or more precisely ‘we’, since it will be averaged between us for the years we are married.

True, I did mean “limited way” in various limits (I was just too lazy to research & quote all the exceptions).

As one counter-example - I arrived in Switzerland at 25 and could’ve*1 paid the missing years (I think it would’ve been CHF 400 p.a., the minimalbeitrag since I had been a student with no income), but yes, it was because I was/am a Papierli-Schweizer.

*1 I didn’t, I was broke and didn’t think of AHV at 25.

I would recommend paying it to my younger self now though, I suppose.

Tbh my examples were more for the sake of explaining that OASI contributions have no upper limit than anything.

My real commentary/personal takeaway is that because Swiss social costs don’t have an upper limit (like in most other countries) they become a fairly significant additional tax drag after CHF88k income. I wasn’t aware of this before and it contributes to my recent belief that Switzerland is not so good for taxes after all (unless you are lump sum billionaire paying 112k taxes in valais ofc but thats a discussion for another thread ![]() .)

.)

In some cases the OASI implementation can be beneficial though you’re right.

When you say asset-based comp starts to dominate comp from employment what do you mean by this? Do you mean that the citizen at later stages in life has saved up and invested a lot, or that the richest are asset owners already, or that people are able to structure their comp at any time in an asset-based way?

For the LLC/Ltd point is it as easy to do as you make it seem? e.g. could I go to my employer tomorrow and tell them to start paying me into an LLC instead? I assume there are some struggles in terms of the employer agreeing, rights changing to that of a contractor, termination periods, payment of bonuses, etc.?

As a side note - to me it seems a bit perverse that governments structure tax drag in this way. If I work hard and get a great bonus the government will apply a huge marginal tax drag (Geneva) + uncapped OASI costs. However, if my portfolio/properties passively pay me money I have no OASI drag. And of course I can inherit billions for no tax drag at all.

Seems like the system heavily disincentives entrepreneurship while incentivising wealth hoarding. I suppose this is part of why the FIRE movement has grown so big as of late…

As a side note: does anyone know at what “salary” contributions made by non-working people is recorded at?

Like when you’re a student and pay the minimum; is that at minimum salary?

And when you’re RE and pay based on total wealth, what is the equivalent salary used for the later pension?

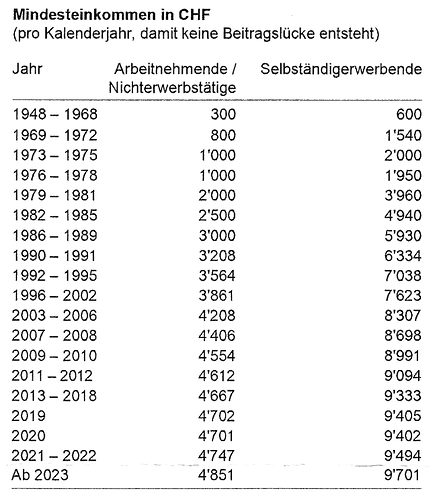

The income that would match the contribution if there was no minimum. E.g. this year the minimum contribution is CHF 514 and this is recorded as CHF 4’851. For self-employed people it’s double due to a progressive part in the contribution rates. See the following table for earlier years (from my IK-Auszug):

I expect it to be similar. E.g. if you’re contributing CHF 1’060 based on wealth, the income will be recorded as CHF 10’000 (based on a 10.6% rate). However, I’m not in that situation (yet), so I can’t confirm this.

What I don’t get about AHV: I was stupid enough not to contribute voluntarily to AHV while living abroad and will get sanctioned by a lower AHV pension. No way to repay what I missed, not even with a “penalty fee”. To me, this is rather arbitrary and somewhat annoying.

Anybody know of a possible solution (other than jokes / snarky comments at my expense ![]() )?

)?

You are not “sanctioned”, you’re not entilted to the maximum amount if you haven’t paid your premiums for the required time. Maybe you have claims towards the social security you paid while abroad, instead?

Build up or buy-in to pillar 2, take advantage of pillar 3a, and/or save or invest for yourself. And check claims towards the social security you paid while abroad

Thanks! I’ve worked for the UN, so I guess no national social security system claims. Of course, I got my UN pension contributions back (deducted from salary), but that’s nothing compared to the AHV payout I’ll loose (plan’s to live until 100 at least ![]() )

)

So, it’s more than 5 years ago?

Unfortunately, yes, a sin from my youthful days. But thanks, that payback window would have been a good option!

Regarding asset-based comp dominating income - the higher up the income scale you get, the more you’ll see exposure to asset-based income (rents, dividends). That’s because typically, the highest income earners tend to own a significant part of the business they’re working for (self-employed, family business, private practice, etc).

As for how easy it is… you can certainly try, chances are your employer will laugh you out of his office and you’ll want to do business with the competition. . . . ![]()

The system incentivizes entrepreneurship vs employment income, that’s for sure. You just shouldn’t live in a tax hell =)

So just to be completely sure

If I moved to Switzerland at age of 30 years, and already living here for more than a decade , there is no way to make up for the missing years. This means I need to be content with max 35 years of contribution. Right?

Note -: I am not a Swiss citizen.

Correct.

I’ve been wondering, can you continue contributing past 65 (eg to get to 44y of contributions) and get a higher payout? (Can be worth it if you only need to pay based in wealth and had high salaries before)

Checked a bit, probably doesn’t work unless you actually continue working (and with a high salary). You need to earn at least 40% of your average contributed salary.

Means I’ll have a big AVS gap (missing 7 out of 44 due to working abroad) even if I contributed way more.

Had I known I’d have tried contributing missing 5y when I moved to CH (too late now, and nobody tells you about that while it might be ~always worth it for high earners even if they don’t end up staying in CH long term).

Not sure if it works like that. I think you can only contribute for the last 5 years if you missed it out due to not working but still be a Swiss citizen.

correct as @Cortana said, however keep in mind that you should be able to claim from the country you were working in before.

Furthermore, if you plan to move out of CH before the pension in a third country which has no social security contract, you can ask for reimbursment of the paid contributions.

Not possible afaik, you can only contribute for years living in Switzerland, but not for years living abroad. I might be wrong though.

Yeah looks like you can only back pay if you were subject to mandatory AVS. So a swiss citizen living abroad in EU faces similar issue.

It’s a bit annoying when I contributed 7y in EU, above the AVS minimum contributions each year.