I think it’s lower based on other feedbacks.

Finpension use CHF funds in 3a.

Mine is:

VIAC strategy to replicate an all world ETF:

• 86% - CSIF World ex CH - Pension Fund Plus

• 10% - CSIF Emerging Markets

• 2% - CSIF SMI

• 1% - CSIF SPI Extra

The news announced and discussed on the other thread

Swisscanto emerging market should have lower fees than CSIF.

Thinking about the minimalistic approach:

90% CSIF World ex CH - PF Plus

9% SPI

1% Cash

Still overweighting Switzerland four times (Swiss contribution to an All World Etf is around 2.5%)

Any considerations for this minimalistiv approach from you?

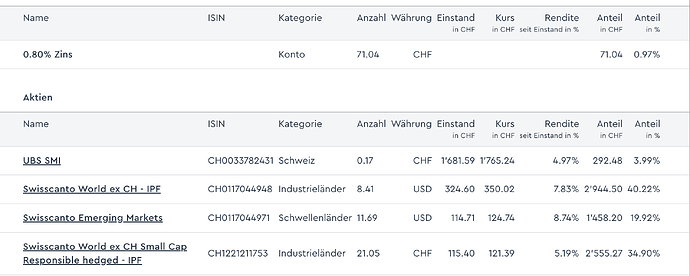

This is my test strategy of replication of the all world ETF to beat Global 100 . Started at 21.11.2023 and im now +18%

For the reasons mentioned in Comparing 3a fund performance: ETFs vs. CSIF, Swisscanto, UBS - #51 by covfefe, I’m gonna go for 99% CSIF World ex CH instead.

thanks for this. seems like you even more minimalistic…! you write, that with one fund, there will be less fees. as far as i got it, fees are fixed anyway in viac (around 0.4%), regardless of the rebalancing. offtopic: i was asking myself, if the hedging in chf (awailable for seweral funds) comes with higher fees or not, because the fees writen in the ‘viac-fund-selection-menu’ are the same and im wondering, if/why you can get this hedge for free…

The cost of hedging is built-in the fund itself and is not even reflected in the sticker TER. So no, it is not for free.

Are you guys switching your 3a Strategy in cash instead of stocks ?

In general it’s a bad idea to react to market event (it’s a sign you really overestimated your risk appetite, normally there’s no reason to change allocations).

No, 3a is too inflexible to shift around to new allocations. If you want to sell something I would do it outside of 3a. I personally will be shifting more to CH-Stocks in 3a, perhaps exclusively so, howeber this drop messed with the timeline

No… buying more today using my 2025 deposit which I was waiting to deploy.

Yesterday I allocated it to equity (unfortunately VIAC/Finpension only rebalances on tuesdays instead of daily)

I’m not close to retirement (and if I was my allocation would look different anyway)

I’ll keep

5% IBIT

10% Gold

5% Commodities

rest cash

I am keeping same strategy…

5% IBIT

15% GOLD

79% Stocks (World ex CH , CH, world High dividend)

99% stocks (Dev ex US), as usual.

(US and EM etc. are outside of 3a)

I have gold, commodities, real estate and stocks.

Current allocation:

CH0429081620 CSIF World ex CH – PF Plus - CHF (fee 0%; Subscript. Fees : 0,05%; Redempt. Fees : 0,02% ) : Allocation = 78%

CH0214967314 CSIF World ex CH Small Cap – PF - CHF (fee 0%; Subscript. Fees : 0,10%; Redempt. Fees : 0,06% ) : Allocation = 10%

CH0117044971 SwissCanto Emerging Markets - USD (fee 0%; Subscript. Fees : 0,17%; Redempt. Fees : 0,23% ) : Allocation = 9%

CH0215804714 SwissCanto SMI - CHF (fee 0%; Subscript. Fees : 0,01%; Redempt. Fees : 0,01% ) : Allocation = 2%

Crurent allocation:

- Cash - 1%

- SPI ESG - 29%

- World ex CH - 70%

I’m thinking to going back to the VIAC Global 100 strategy. I will see by the end of next year.

Did anyone do a thorough analysis on individual funds, instead of a stand-alone strategy? Meaning within larger portfolio, what to move to 3a or VB first?

I do remember some discussions, but could only find some posts in the tax optimization thread. Is there some specific discussion I missed in my search, not only limited to VIAC but in general?

There’s a nice comparison from Dr. PI, and I tried some ranking, based on fees and taxes, with assumptions on dividends etc. but not detailed enough to be conclusive.