Hi @slive,

I am on the process of changing from Swissquote to DeGiro and I will share some of the info I got this month (August 2019, I’m a buy and hold investor):

1 - I’m with Swissquote since 2008. I have 1 IBAN for 3 Currencies (CHF, EUR, USD). If I only have deposits and no ETF or Stocks the maintenance costs is 0 CHF

1.1 - Last year I bought Stocks and since then I pay 16.16 CHF/Quarter (total 64.64 CHF /Year) maintenance for the Depot

1.2 - and paid in fact 34.80 CHF commission to buy my stocks in the SIX… this makes Swissquote as bad as UBS (charging 40CHF commission, 1.50 CHF SIX fee and 0.90CHF Stampelsteuer)

2 - then to escape 1.1 I first considered moving to CornerTrade. Their commission for my Stocks would be 18 CHF and maintenance was for free

2.2 - they changed the maintenance charges in July 2019 and now charge 35CHF/quarter (140CHF/year) if you don’t trade for 2 consecutive quarters…

So, I decided this is not worth the risk as I don’t know how regularly I will be able to invest. The initial idea with CornerTrade was to have a Swiss based broker. But their fee structure is no longer appealing to me.

3 - DeGiro seams to be the cheapest kid in town. It also has a list of free ETFs (no commission for buying) including the ones I am planning to invest in and charge no maintenance fee

3.1- however, you can only chose 1 base currency. My stocks are in CHF, the ETF is in USD but traded for free only in Amsterdam and in EUR.

3.1.1 - They convert everything from your base currency to the target currency of the product automatically and charge 0.1%. There is an option of turning off auto-currency-conversion, then they will keep your deposits and dividends received in EUR or other currencies in that currency. You can then reinvest without FX costs. You can also convert currencies manually, this costs 10 EUR +0.02%

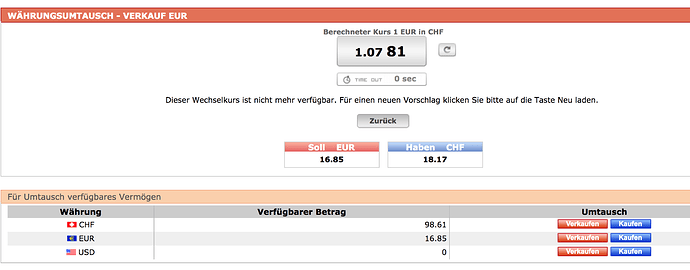

My issue now is: the deposit has to arrive at DeGiro in the target currency so I don’t pay the conversion fee. With Swissquote I had the 3 currencies in my account and could exchange it “free of charge” (the rate was suboptimum as I have made a comparison this week).

I also considered Revolut, as they announced this month that would be possible to trade for free just like Robinhood. However, it turned to be only for EU customers (or UK even) and only for US Stocks.

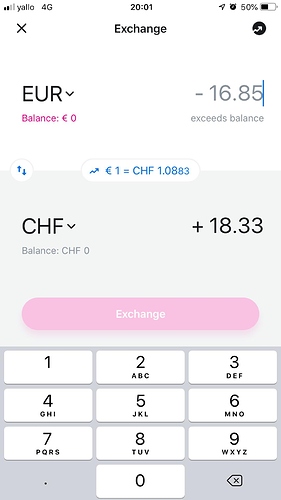

Anyhow, I registered with Revolut for cirrency conversion and did a comparisson:

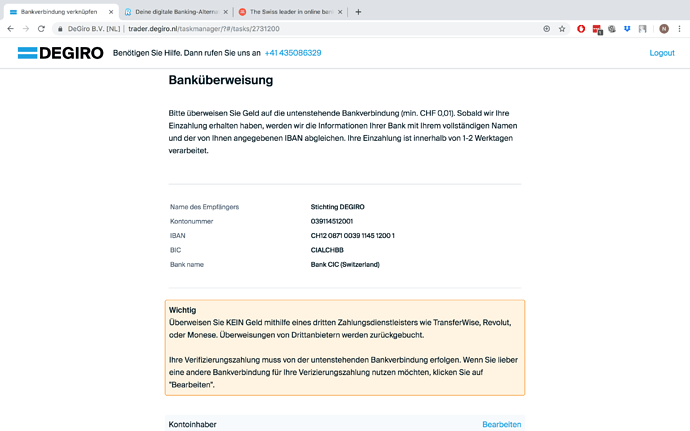

Then my plan was simple: use Revolut to convert from CHF to EUR, transfer it to DeGiro and invest in the ETF. But this seams not to be possible:

You need to have an IBAN. My wife used to convert currencies with IB! But this would also not solve the problem because with IB you also don’t have an IBAN.

Then you ask, but why dont you use IB? The answer is simple: there are cost comparisons showing IB is only better than DeGiro for portfolios larger than 100k

My solution now (still to be tested next week) is rather complex but if works I will have a good solution to avoid FX fees:

I have opened an EUR Privatkonto with Migrobank (free if you have more than 7500 CHF). I will now send CHF from my main account to Revolut, convert it, send it back to MigrosBank EUR account and from there transfer to DeGiro.

There is 2 ways of sending from MigrosBank to DeGiro 1- Sofort 2 - Bank transfer

Sofort costs 1.25 CHF

Bank Transfer: DeGiro’s account is an CH IBAN so this Inland transfer should be 0 CHF. However, I do not know what happens if I transfer EUR there… maybe their receiving bank will automatically convert it to EUR…

As mentioned in 1, Swissquote could be used to convert CHF to EUR but it would be difficult to bring it to DeGiro, 1 - Swissquote is not on “Sofort” 2- they charge 2 CHF/2 EUR to send inland and SEPA transfers

If sending EUR to DeGiro’s CH account does not work, then I will activate the auto conversion and pay the 0.1% as it will be much simpler…

hope those lines help

regards