Hello guys

I have a couple of foreing shares (including USA) and it is my first time completing the tax declaration in Switzerland. That means that I am a little confused with where to fill the data in the programm, so I decided to ask in the forum.

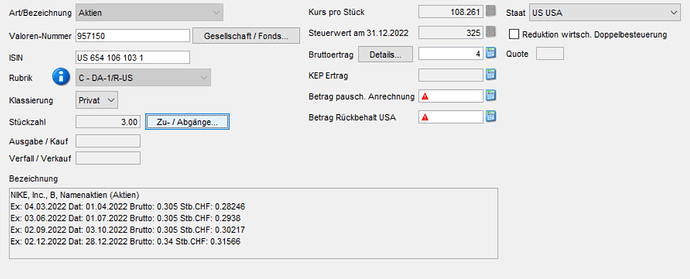

This is an example:

Product: NIKE INC. COMMON STOC

Symbol/ISIN: US6541061031

Country: US

Date: 01/07/2022

Gross income: 0.88 CHF

Withholding Tax: -0.13 CHF

Net income: 0.75 CHF

Can someone tell me what to enter in “Betrag. Pauschale Anrechnung” and “Betrag Rückbehalt USA”?

Should I enter the 0.13 CHF in both fields?

I also have an accumulation fond, whose dividends are not known to this date.

https://www.ictax.admin.ch/extern/en.html#/security/IE00BGV5VR99/20221231

Should I patiently wait until it is known?

Thank you very much for the help

1 Like

Doesn’t your tax software do this automatically, once you‘ve entered the stock?

„Betrag Rückbehalt USA“ is zero (leave empty), since you are obv. holding them at a foreign broker.

Taxable income for some accumulating funds can, in my experience, be published considerably later (think I‘ve seen more more than a year later) - by which my tax administration would have threatened to fine me for late/non-return of the paperwork.

I just make a note for that item and submit my tax return before having the figure.

1 Like

Hi, and many thanks for the quick answer.

I am using the software of the Canton of Zug.

When I enter the stock and its number, the field Bruttoertrag is automatically entered.

But both fields “Betrag. Pauschale Anrechnung” and “Betrag Rückbehalt USA” are not automatically completed:

I will enter the withholding tax from the dividends in “Betrag. Pauschale Anrechnung”. And 0 in “Betrag Rückbehalt USA” because Degiro is a foreign broker as you pointed out. Is that right?

And about making a note for an accumulating fund with unknown dividend, can you tell me how you could make a note in the software?

In my case, the field bemerkungen is not available to type anything, and I don’t see how or where I could do it.

A solution may be to enter the fund as “übrige Werte” where all the fields can be manually introduced. Is that how you were able to do it?

Sorry for the long answer and thank you again for your time. It is much apreciated

My tax software asks me whether I would like to copy the figure for „pauschale Anrechnung“. Not sure about „Rückbehalt USA“ (don’t think so), since this obviously depends on the broker.

Can‘t help about the comment, since I‘m not filing in Zug. My canton‘s tax software allows for comments.