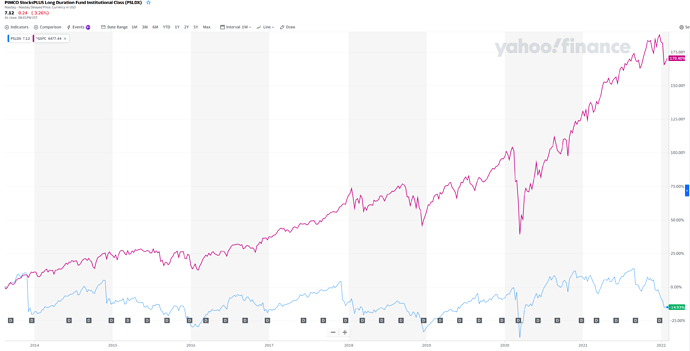

it sounded all good, until I compared the SP500 with the mentioned PIMCO StockPlus stuff that actually implements this strategy. I’m concluding that it either didn’t work out, or I’m just plain stupid and can’t see the forest from the trees. Please help me. ![]()

Just be mindful of your investment strategy and stick to that. In my case I keep going with my boring VT as main strategy roughly every month (I sometimes try to market time the buy, currently with a pending order at 95$) and beside that I have some satellite parts in Crypto, different stocks (quite some Biotech as this is my field of expertise) and do some mini-futures with the EMA and RSI charts. Specially the mini futures are more for fun and that way I would also recommend to handle a 3x ETF. Never ever I would go with a big amount of cash into such a construct. While understanding the physical ETF’s, I have no idea what’s behind a leveraged ETF, if you do not understand it do not use it

Well, there‘s synthetically replicating ETFs as well. Leveraged ETFs aren’t much different - and the beauty of them is that even their price development is strikingly simple.

I think I saw once an article that if the market would be stable a 3xETF would lose it’s value (both long and short), but I don’t remember what the reason for that is, cost of the synthetic assets???

Volatility decay.

Market goes down 20% and up 25%, so we are back to where we were before (0.8 x 1.25 = 1.00). With an 3x ETF you’re back to 70% of the initial value (0.4 x 1.75 = 0.70).

That’s interesting thanks for the explanation

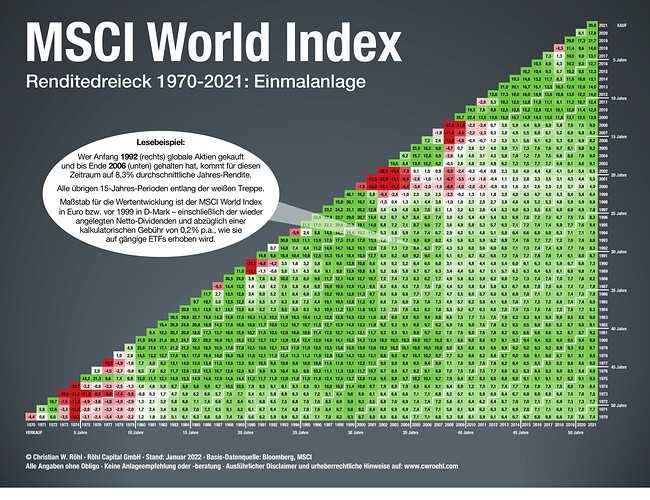

I just found an interesting visualization for boring but rewarding mustachian-style investing: the performance triangle (Rendite-Dreieck)

If you had purchased MSCI World Index on Jan 1, 1992 (right hand scale) and sold 15 years later on Dec 31, 2006 (bottom scale), you would have had an annual EUR performance of 8.3%. the author Christian Röhl also shows a calculation for a savings plan: https://www.dividendenadel.de/msci-world-renditedreieck/

Of course, we would like to know the performance based on CHF. I only found a representation of investing in the Swiss Performance Index SPI. If you had purchased SPI on Jan 1, 1992 (bottom scale) and sold 15 years later on Dec 31, 2006 (right hand scale), you would have had an annual CHF performance of 13.4% https://static.group.pictet/sites/default/files/2019-02/20181231-Das-Pictet-Renditedreieck.pdf

Let me know if you can find a CHF version for the MSCI World and MSCI Emerging Market.

it’s still reassuring to see that most of the triangle is very green, though.

Also reassuring is that the longer the investment period, the more it gets towards a stable 6-8% range. Already at 25y the minimum is 5.5%.

Would be nice to see inflation adjusted numbers, although it is not a big issue with CHF. I mean Pictet data.

With recent events I can’t really align myself anymore with investing in countries like Russia and China. Since my portfolio only consists of one MSCI World ETF and one MSCI EM IMI ETF im heavily considering either stopping to invest in EM or switch to an ACWI/VT ETF with atleast lower EM exposure than now.

What do you guys think? What is your point in investing in EM besides just buying the whole market where EM is already included?

What’s your allocation MSCI World vs MSCI EM IMI? ACWI is, if I’m not mistaken, around 88:12.

And Russia was 2% of MSCI EM anyway. So you’d only need to think about China.

Personally I’m not adjusting anything. I continue with my strategy of slightly overweighing EM as I expect those regions to have a large potential in the future.

NZZ recently wrote (not paywalled) that with a globalized economy there’s not much diversification in buying EM, as they’re so closely interlinked with the “developed” world.

Strictly speaking you’re not harming anybody.

No money flows to the companies when you’re buying their stock on an exchange market. With the exception of IPOs and capital increases.

Again strictly speaking, it’s impossible for everyone to sell their stock. Who are they selling to?

But yes, if mostly everyone suddenly wants to sell the stock, the price collapses, trading stops once there are no more buyers, and capital markets are not a viable financing option…

It’s around 75/25 now. The part in China is definitely more worrying for me because I don’t want to live in a world where a totalitarian regime is the biggest power in the world.

The power is IMHO never on the side of the government but on the side of the people. If ALL of the people would rebel including military and police what is the government going to do about it. The ones in power only have the power as long as there are enough people following their regime and obeying their orders so yes they are IMHO kind of responsible.

Not directly but you are definitely limiting their ability to get new money if your stock crashes because if all your stock is listed on an exchange you now have a live ticker of your company value for everyone to see which is then relevant for lenders.

My grief with EM is that many of their markets aren’t really mature and I don’t feel that, as a foreign investor (and even more so as a retail foreign investor with no political/economic leverage to speak of), my co-ownership of EM domiciled companies is guaranteed. My example would be China, where, as foreigners, we wouldn’t actually be buying stocks in the companies we want to invest but rather in shell companies listed on other exchanges.

I have the same concern for bonds: if things go south, I expect China to default on bonds held by foreign investors before defaulting on domestically held ones.

Exactly my thought. My solution is however a total market strategy: MSCI EM IMI or at least MSCI EM in a global capitalization weighted portfolio. Even if China goes to zero, it would mean a 7% hit, less than Apple + Amazon + Microsoft ![]()

I stay the course:

- Developed World 58.63%

- EM 20.65%

- CH 20.72%

Portfolio would be considerably higher had I put all in Vanguard All-World since the beginning…

65% US

14% CH

11% EM

10% Rest

So I decided to sell all my positions and bought VWCE. The TER difference between VT and VWCE doesn’t hinder me personally. My EM position is about half now. This helped me achieve some goals at the same time:

- Lower EM exposure

- Portfolio simplicity with only one ETF

- No rebalancing between World and EM

- Accumulating fund to set and forget