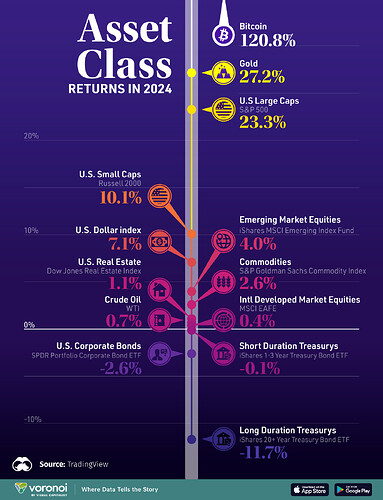

So, I think we can say that 2024 was more or less a direct continuation of 2023: Mag7 and AI outperforming, value and the rest of the world underperforming. Interestingly, Emerging markets performed better than Developed ex US for once.

People were rather sceptical about Bitcoin, which mooned. Hardly anyone mentioned gold, but Ok, this is a boring old non-productive asset.

I was bullish on both but as a matter of policy don’t invest in BTC (I did break my rule last year as the opportunity looked too good, but I reversed it quickly - unfortunately before the 100% gains arrived).

Gold (and filling pension) was my big move for 2024. Gold did good. Miners less so. Still invested in miners, but it is uncertain whether they will come through or not.

Lovely infographics.

As for my pension buckets:

- I stayed with 50% Quality which is heavily Mag7 and it went well

- I have diversified into 30% Gold which looks to have been a solid bet

- I have a 5% BTC allocation that is massively profitable (but got perma-rebalanced as it skyrocketed), so it won’t move the needle much

- My Value allocation didn’t move much

On the more active side:

- SSON and Fundsmith still both underperform

- just hit the SP500 benchmark by year-end in 2024 (which is positive I guess

)

) - some questionable stock picks still hurt (PYPL you hear?)