I like the thought of JEPx in retirement. I saw that in 2024 it had a dividend of 6.8% and additional performance of 10% through unrealized gains. Has it been backtested, i.e. are 6.8% return sustainable?

Isn’t that an active fund? Why are we expecting it to beat a world ETF long-term?

I’d take 980 BTC and keep my 7yrs old Navara.

https://www.bloomberg.com/opinion/articles/2023-07-19/a-stock-fund-that-can-t-go-down

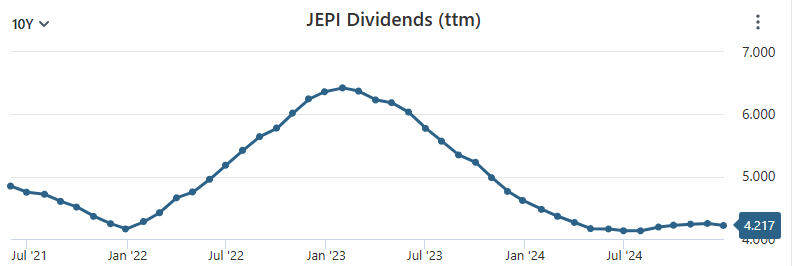

JEPx is not the same, of course, but I suspect there’s a similar illusion that this works universally, when it relies, in fact, on temporary effects. Like, the S&P500 only generates about 2-3% dividends, so the additional 4-5% dividends of JEPx come from premiums collected through the options. And THOSE are not guaranteed at all. Like if there is little volatility in the stocks, would the options premiums remain high?

It’s an old parlor trick, maybe in new makeup.

@Dr.PI off topic for the monkey brain thread: Monkey-brain ETFs: Dividend ETFs

When I write JEPx I mean JEPI/JEPQ (their newly launched UCITS versions), or JEPG.

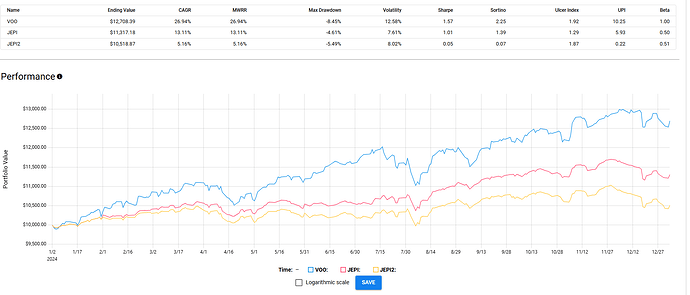

If you consume the dividends its performance essentially goes between nothing and very little, but that’s by design. Example for last year (JEPI2 is without dividend reinvestment ie consumption). I’m confident something like SCHD (when are we going to get an equivalent in Europe, Charlie Schwab?) is “better” as it captures all the upside potential and selects for dividend growers, but you need more capital to make sense and doesn’t pay monthly.

We aren’t expecting it to beat any diversified long-only ETF, it’s there for income ![]()

Yes, they do, in fact they rise during volatile times:

Cognizant we have little depth of time with these products, I am personally convinced about them, just don’t have them, yet.

1.19% as of today.

To be honest , I see two scenarios if I have 100 Million all of the sudden

-

Nothing will change on practical level except maybe less concern about unemployment and buying a nice house.

-

I would start taking it for granted soon and then suddenly comparison will be with billionaires

My normal and simple conclusion is that the value of money is derived by the way it is spent and with whom it is spent. And less from how much is spent. Lot of people on this forum are amongst top 1% of the world in terms of income. So compared to rest we should already be like centimillionaires. Did that make us less worried ?

I can share that when I was in school, I used to think if I had 1000,000 INR, I am set for life. Our assumptions of how much we need change with how much we have.

Yeah. When I was a kid, I thought with 1 million you’d be set for life. Although probably it was true if invested. Back then you had 11% interest rates and 110k a year is worth 305k in today’s money.

Of course you can and you will increase your expectations as your wealth is growing, but there are some objective milestones that you can define:

- you have enough wealth to stay unemployed for one year

- the same for few years

- you have enough wealth to generate income sufficient for a good life in a developed country with working society

- previous + your heirs will have a very generous inheritance

- you have built a generational wealth.

I would rather stop between 3 and 4, not sure that inheriting lots of money is a good thing, actually. Some empirical evidence shows that it is rather not good.

It’s made me a lot more worried than I was before when I had 3k in the bank and would expect bullshit Greek state pension of 400 euros/month. I’ve written before than saying something like this among…normal people…would be considered obscene, but it’s the case.

Agreed.

Or maybe your human capital is much smaller now?

Not sure what you mean, I understand human capital as productivity, skills etc, which have grown a ton since when I started working.

Same here. I guess 3 is what most of us consider FI.

Yes, but you get older, the year you have left to work decrease, your body degrades, your health suffers, older people might be less likely to be recruited for jobs.

I’m doing well in my role, but if I were to lose my job in a few years after I hit 50, I’m not sure I’d find something else at a comparable level.

I rather interpret it as “all potential (future) earnings one can make”.

(maybe discounted to today if you want to play, sort of like evaluating companies ![]() )

)

This would be highest at the start of a growing and promising career, it “degrades” as we age, but we can prop it up by upgrading our skills and market value.

It’s what others wrote. Yes, you might be more efficient at what you are doing, but you are both worn out and has less time to work in the future.

I often play Euromillions, so this is a question I ask myself a few times a week ![]() . First, I would like to help my parents and siblings, but I wouldn’t want them to know I won such a large amount. I’m still figuring out how to manage this, but I would find a way to buy some apartments in a nice neighborhood, close to the beach and the city center, in much better condition and location than where they currently live. I would give one to each of them. My parents could then rent out their own place and have this extra income (around 2k EUR per month), and my siblings, who currently rent for 1k-1,5k EUR per month, would save this amount.

. First, I would like to help my parents and siblings, but I wouldn’t want them to know I won such a large amount. I’m still figuring out how to manage this, but I would find a way to buy some apartments in a nice neighborhood, close to the beach and the city center, in much better condition and location than where they currently live. I would give one to each of them. My parents could then rent out their own place and have this extra income (around 2k EUR per month), and my siblings, who currently rent for 1k-1,5k EUR per month, would save this amount.

I would continue living in Switzerland, but I would leave my job immediately. I would buy a better house in my village and hire a chef and cleaning staff. They would take care of all household tasks, including gardening and grocery shopping.

With small kids still in school, I would need to find some hobbies. I used to play golf as a teenager, won some competitions, and reached a handicap of 15, but I stopped during university. I would spend my mornings playing golf, taking private golf lessons, swimming, and planning amazing luxury holidays during school breaks. In the afternoons, I would spend time with the kids.

So, I would allocate the money as follows:

• 2-3m CHF to buy 4 houses for my parents and siblings in my hometown

• 4-5m CHF to buy/build a house in Switzerland in my village

• 1m CHF in Bitcoin

• The remaining amount in a 70/30 portfolio managed by me

I would then aim for an annual budget of 600k CHF + 100k CHF for holidays + taxes(??) covered by dividends and withdrawals.

On the topic of lottery winnings:

My partner told me about a distant friend of hers who, when she got married a few years back, asked guests for Win for Life lottery tickets instead of wedding gifts. They won not once, but twice, so that’s a nice tax-free 8k/month for 20 years.

This lead me to looking up the exact terms: next to the monthly payments (4k × 12 months × 20 years = 960k), there’s also the option for a lump-sum payout: a paltry 500k.

Assuming investing winnings in stocks with a return of 7%, after 20 years you’d end up with:

- DCA’ing the monthly payments: ca. 2 million

- lump-summing the lump-sum: ca. 1.9 million

The usual advice is to always go for the lump-sum payout. In this case, why would you though, assuming you don’t need a large sum now for e.g. buying a house?

What the freak chance is that?! It’s quite common for people do add a lottery ticket among wedding/birth/baptism gifts in Greece, don’t know anyone who won anything though.

similar arguments to annuity versus lump sum pension.