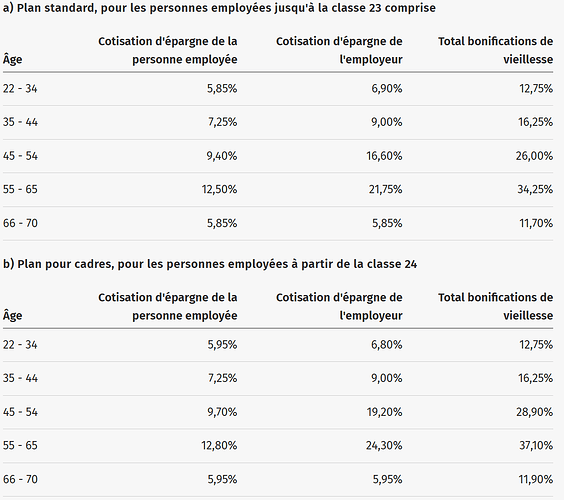

He refers to this table IMO. Generous indeed ![]() But as you said it does not say anything about the PF performance. As stated, the performance of Publica was not bad these past years. I wonder what was the compensation offered by the fund.

But as you said it does not say anything about the PF performance. As stated, the performance of Publica was not bad these past years. I wonder what was the compensation offered by the fund.

Isn’t performance of the fund irrelevant as long as it doesn’t hurt the Deckungsgrad?

I mean performance doesn’t tell whether the money goes into reserves or into the pockets of the CEO or into my account?

Eg https://www.news.admin.ch/fr/nsb?id=88610

They have different rules from private sector.

True, yet not unheard of in the private sector, either for both the level of employer contributions nor the big jumps in some age brackets.

Best case, it adds to employee satisfaction and retention. Worst case, you’ll have some co-workers that complain all the time, yet won’t leave because they can’t find similar conditions elsewhere ![]()

It gives me an indication if the professionals are really doing their work or just stick to their CHF bonds, their CHF stocks and their Swiss real estate (with resulting low single-digit returns). IMO, that would be a clear signal to request changes to the PF’s investment committee.

Impressive numbers from the employer above 45y.o. !

Do you know if the risk insurance is also paid by the employer? It should be 3-4% on top of this number.

Risk premium is payed solely by the employer, 1,5% as stated by Publica.

The payout ratio is somewhat lower than other pension funds:

Note that all these informations are for the Confederation pension plan.

Got a notice from our pension fund a few days ago:

The interest rate for next year will be 7.25%, and retirees are getting a 1.5% increase in their payouts ![]()

The funding ratio is 134.7% as of September 2025.

Taking the Swiss politics into account and my personal view on restricted/blocked assets: I have to consider maxing out my monthly contributions into the pension fund next year. I’m currently paying in the bare minimum. Maybe I have to rethink about that.

Can you say what this is? I need to change jobs ![]()

5% here, with a funding ratio of +120% as of Q3 25

Reading though the last posts: Anyone willing to volunteer and open up a thread / spreadsheet anyone can (anonymously) contribute the yearly numbers of their employer?

Sounds like @xerox5003 is a “Migros Kind” ![]()

That‘s absolutely right ![]()

@PhilMongoose it‘s the Migros Pension Fund.

You mean “for this year”, right?

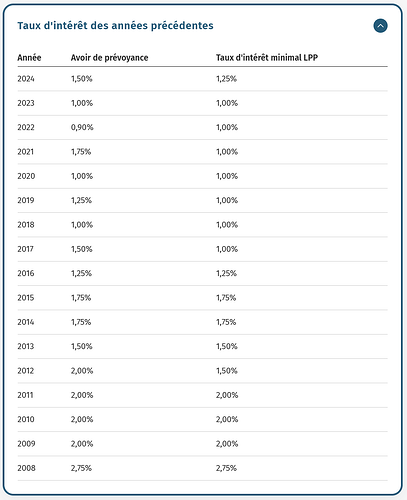

Typically they set the “next year forecast” to the (legal) min (1.25% or so).

Since they don’t know how they will perform / what can they payout.

Looking at mine -

Approx. 7% avg over the past 5 years.

Not too bad.

P.S. Swiss international company in the finance sector.

No no, that’s correct — those interest rates are for 2026. The MPK board of trustees sets the savings interest rate for retirement assets, as well as the other interest rates for the following year, every November.

It’s possible that your pension fund handles this differently, though.

Seems that people of Publica read this thread : for 2025 will it be 4% ![]()

Apparently mine was 1% for 2022, 2.5% for 2023 and 5% for 2024… not exactly fantastic for a successful company in oil and gas.

Ehm, if you consider these numbers “no risk gains” then the 2024 one is phenomenal in my opinion.

Sadly, the ETH Domain of Publica only gets 3.5% ![]()

That’s probably fair… I just suddenly got jealous when I read someone was getting 7% average over the last 5 years!

With my pillar 2 vested benefit accounts (aka not risk free) I only have a rearview mirror and cannot set next year’s return – it might even be significantly below 0 (as it has been before, see below).

After fees for 2025:

- YTD: +5.83% in my bigger account (Finpension fees: 0.49%)[$]

- Since March 1: +5.77% in my smaller account (VIAC fees: 0.4%)[$]

I just last weekend again adjusted my strategy in both accounts for less risk as I plan a staggered withdrawal in 4 and 5 years.

Excellent point!

Everyone wants to have better returns on their employer managed pillar 2 account, but nobody’s willing to take more risk.

For my one VB account – the bigger pot, of course – I had in 2022, the drawdown for that year was about 17%. The other pillar 2 account (then with my employer) instead added 1% (or 1.25%, whatever the mandatory minimal return was at the time set in 2021) during the same time.

Of course it all depends on your investment horizon, but it took me some handwringing to not adjust the strategy in my VB account during 2022. In hindsight, I should have adjusted it, namely increase the risk, but hindsight is 20/20 especially if you experience within a calendar year 7 figures becoming 6 figures or so. ![]()

$ Finpension and VIAC are both low(est?) fees VB providers, but as I wrote this, I felt like the fees actually still seem royally high.

- it is solely I who has the entire market risk

- the costs for managing the VB money in a multi-tenant application surely doesn’t cost 0.4% of the AUM … sure, there’s additional costs, but I would be happy to manage Other People’s Money for that kind of fee, even if I had to use off-the-shelf ETFs (which again come with their TERs …)

Professionally managing money is essentially a fee scam … much like most of the ETF industry.

Ich habe fertig.

(I am done with my rant)