- Small positions ( under 10%) are a usually as recipe for constant itch and tinkering. If you can stick with them, it’s great.

- VT is fantastic choice any given day.

- If you want to do factors then look for fund shops that specialise in implementing factors of your interest. You can the even increase your VT and the remaining funds with strong factor exposure.

- You might consider to combine the value and quality ( profitability) with products from DFA ( vector ETFs) or Avantis value ETFs (they are really value + profitability).

thanks for this feedback.

my choice of funds is

55% VT

15% UC99.L

7.5% QCEU.MI

5% QQQM

17.5% AVGV

I sometimes feel that I am complicating my portfolio and adding some additional costs as some of these funds have 0.25% TER

so always the itch to go back to 100% VT or equivalent.

also, adding factors in the portfolio is not only to get superior returns long term (>15 years) but also to hedge against drawdowns or periods of no growth by reducing the weight of the big tech US companies.

any thoughts on this?

In my view it’s tough to build a portfolio which have high US exposure but less US Big tech because this can mainly be achieved by buying US small caps or mid caps or value stocks in higher proportion. I am not sure if that’s so prudent. Reality is that US big tech is big because they are also better businesses

A simpler way to achieve lower big Tech exposure might be to simply reduce US exposure and use regional ETFs

For example

US ETF + Ex-US ETF

Or

US ETF + Dev World ex US ETF + EM

If you’re influenced, here is “his” portfolio (you can use Avantis or Dimensional for value)

I wouldn‘t copy that version. I‘d simplay pair AVGV to VT and call it a day.

Maybe add a home bias, if you are convinced of the benefits.

The simpler and compact, the better probably.

- AVGV is fund of funds contains Avantis Value funds (which are really value+profitability rather than value alone). It is 2/3 large cap, 1/3 small cap, and ~60:30:10 US:DM exUS: EM. So it is an all cap, all world, maximum tilted (towards value and profitability) from Avantis. VT + AVGV should be enough if you don’t want to overweight small cap but want to tilt to value and profitability factors. (EDIT: @Tony1337 beat me to it)

- If AVGV looks too much value and not enough profitability for your taste, then consider DFA Vector ETFs for US and DM ex US: DXUV and DXIV (no fund for EM yet). DX*V are most tilted all cap solution from DFA - tilted towards value, profitability AND size. They are 60:40 large:small and in essence slightly more profitable and slightly less value than Avantis counterparts.

- Another option is pair VT with SCV+Profitability. This will need multiple US domiciled ETFs from Avantis/DFA or in UCITS ( AVWS, or upcoming DFA UCITS ETFs)

How do I unflag a post flagged by mistake ?

Continue doing what I have been doing.

Monthly DCAing into SPPW ETF and in my satellite positions if opportunity arises (eg TSLA recently)

4 posts were merged into an existing topic: Tesla thread [2024]

Hmm, so sticking to the plan, I’ve been investing in everything but the US these past three months (with the possible exception of the small cap index).

I recalculated with current valuations, but still, the next few months need to be ex-US exclusively to get me back to target allocation.

Well, trying to forget about it.

Thoughts?

Hard to tell and no experience, the “standard” advice is asking yourself if you’d be buying these positions today, and if yes then keep them, if not then ask yourself why not and decide if to sell.

I’d personally get rid of Tesla while you’re still in profit and plug the gains in a broad index fund. I’d personally never sell MSFT, even considered buying it myself last year. I only didn’t do it because I want to avoid the stock-picking slippery slope.

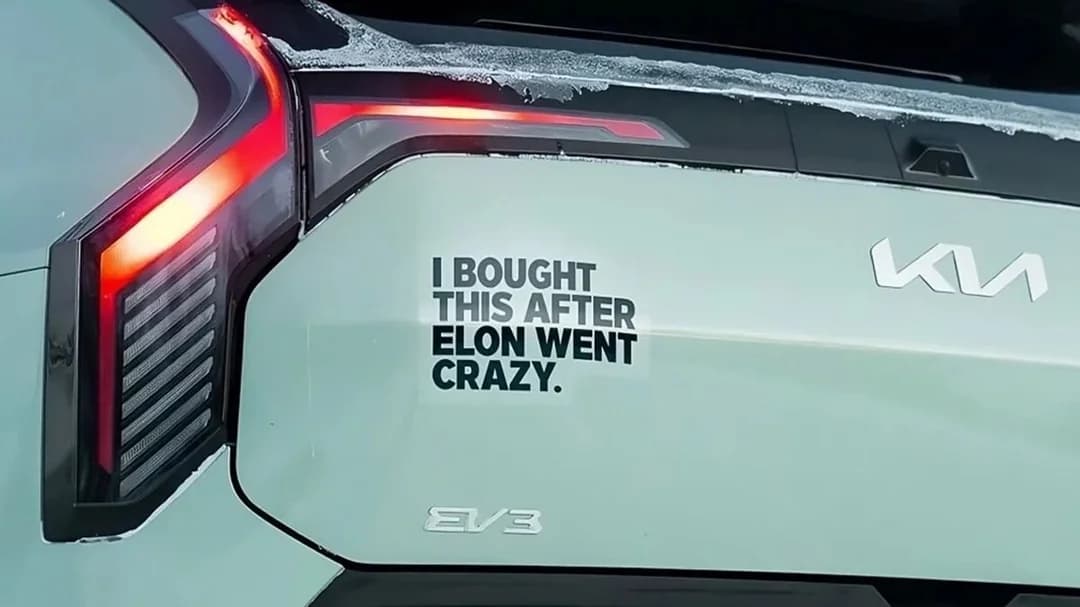

Oh I’ve seen tons of these lately!

Seems now US commerce secretary was suggesting to people to buy TSLA stock as it’s so „ cheap „

Looks like trouble when you need government to ask people to support your company or buy your stock.

Here is a video of that.

Just think for a second if one of our government officials would say to please buy Nestlé stock or something.

And the Nestlé CEO would be working for the government in that very moment.

Just think about the shitstorm that would happen.

And this is just a sidenotr, that nobody cares for right now in the US. That‘s the level of insanity we are at.

Steve Bannon’s “Flood the zone” strategy at work. Everyone not in the inner circle is constantly distracted by a thousand whack-a-moles of depravity and outrage that they can neither regroup nor react.

“Ignore the noise” John (Jack) C. Bogle ![]()

they

Until now, nothing substantial really happened except for going after the people who cannot defend themselves (small countries with tariffs threat , Ukraine with removing defence threat, federal employees etc)

I am yet to see the benefit of Flood the zone in anything that actually helps . For example

- inflation reduction

- GDP growth

- Debt reduction

- Job creation

The negatives that have already happened are

- Stock market tanked

- Tesla reputation ruined

- US reputation ruined