I might be blind, but I can’t find VWRL in Zurich’s etax, even if it’s there on ICTax.

Am I copypasting the valor number wrong?

isin is IE00B3RBWM25

I’ve pasted the ISIN from your post into the ISIN field, clicked on “Suchen” and that filled out everything it should, so it looks fine to me.

I wrote the text, switched of my pc and went to brush my teeth. After like 30 seconds I was “WTF! I know why!”.

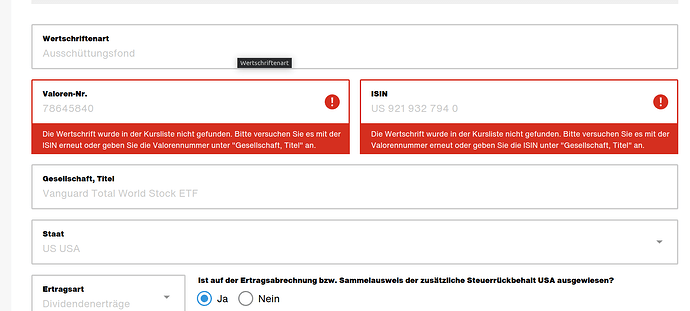

I tried to search it on the DA-1 Form ![]()

(VWRL is Irish)

Not sure how far you reached with that toothbrush!

ops. now I can’t find VIOG.

The story continues…

since I can’t find VIOG, I just filled it by myself. The problem is that the ISIN gives an error and once the error is there, I get the error on all DA-1 ISINs. Even VT is shown with the wrong ISIN

I should probably ask ICTax to add it or ZH, but ofc the contact form is mega-annoying.

On a side note: What does the sentence with yes/no means? Just that the information is present on the document attached?

That is about R-US, the additional 15% that only Swiss brokers have to withhold. If you hold the ETF at a Swiss broker (and the broker is a IRS QI), answer yes, if you hold the ETF at IBKR or another foreign broker, answer no. And that extra R-US deduction must be noted on the attached broker document.

How did you manage to understand that from the sentence:

Ist auf der Ertragsabrechnung bzw. Sammelausweis der zusätzliche Steuerrückbehalt USA ausgewiesen?

translated :

Is the additional tax retention USA shown on the income statement or collective statement?

I might have notice the difference once printed the PDF.

At the moment I’m stuck because of the bug.

“zusätzlicher Steuerrückbehalt USA” is the term they use everywhere for this.

The ZH DA-1 Wegleitung says

I don’t know what statements you’re referring to. Which broker? Swissquote has a line “Zusätzlicher Steuerrückbehalt 15%” right after the “Quellensteuer 15.00% (US)” line on their dividend documents for US securities. For IBKR it’s not applicable, as mentioned.

I just took the sentence from deepl.com It’s a translation from the german one. I did indeed see the issue once I printed the pdf.

I use IBKR so I had to change it to No.

About the bug, if I logout and login every seems ok but it seems I lost a couple of buy/sell orders.

VIOG still doesn’t exist, so I need to find out how to ask the addition or just leave it like I did (by hand without valor/isin since they break the tax software).

On a side note: The software (zhprivatetax) seems to be buggy elsewhere as well , or maybe it’s on purpose. The assets for 2023 are total ( “normal” + da-1), those of 2022 are without DA-1. The deduction summary shows all the deductions for 2023, but for 2022 just one.

If you say yes, you will get a refund of the additional 15% of US dividends that your Swiss broker withheld (only if visible on broker statement, of course). So it definitely makes a difference.

If you use a foreign broker such as IBKR, you need to say ‘no’, as there is no such additional withholding.