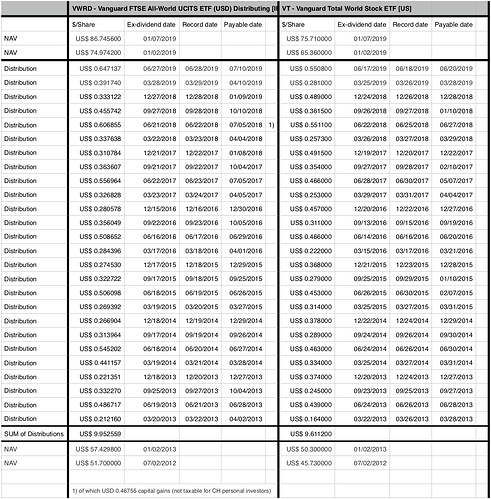

Having questioned before the fixation on TER, I have just quickly cobbled together a spreadsheet for the distributing ETFs (VWRD / VWRL domiciled in Ireland and VT domiciled in the US), beginning in 2013 - the first full year that VWRD / VWRL has been available:

I fail to see how VT or Vanguard’s US ETFs are supposedly that much superior to the Irish ones.

In this example (though not discounting dividend cashflows or accounting for compound interest on them, since I’m lazy and interest rates are now low anyway), the difference would haven roughly amounted to 1% over a period of 6 years.