Will finally ask someone @VIAC_Daniel?

Here’s a thought about long term implications: assuming you want to keep VIAC for 5 years (because you can withdraw money towards mortgage every 5y or maybe there’ll be a better alternative on the market in 5y), 1.2% transaction cost that I suffered x 60% USD-denominated funds portion x 2 (buy and sell) / 5 years could mean effectively a +0.29% extra cost per year, a not insignificant figure compared to their 0.5% fee.

VZ’s 3a solution with 0.68% fee/year suddenly looks not so bad and most of VZ’s funds are traded in CHF. If only they allowed to go to 100% stocks.

That’s why I’m just assuming a 1% lower yield for VIAC. At least for now.

But I’m rather optimistic about the future. Compare the 3rd pillar solutions from 10 years ago to today. I think it will just keep getting better.

Here’s a thought about 3a and long-term. Your 5 years is certainly not long-term for money in 3a for the majority of people, so your example and calculation of some extra cost per year for 5 years is nonsense to most.

The basis of your calculation (spreads, mostly fx spread) is true, but is it really hidden as you have titled this thread, I don’t know? They say which funds you can buy and explain the fx spread.

I came from a previous 3a fund at Credit Suisse which charged 1.4% (on the whole 3a amount!) for 45% stock allocation. It was the best value I could find about 12 years ago. Thank you VIAC!!

Move your 3a to VZ if you prefer, it’s a free market. You forgot to mention that in addition to 0.68% fee there is also about 0.2% ETF fees to add at VZ. But a founded analysis and reporting thereof seems not to be your strength.

I’m not talking about the time you want to be exposed to market risk (which should be much longer than 5 years, yes), but merely about the time you want to hold the particular shares you bought at VIAC - for which 5 years is a fairly long time.

Who knows how the 3a market is going to be like then. Perhaps and hopefully a much better vendor than VIAC will pop up by then and you’ll want to switch, which will force you to sell. Perhaps you’ll want to rotate money inside VIAC into different funds which will force you to sell. The moment you sell you realize the extra costs I’m talking about.

f*** you too

Careful with the tone, you two.

Sorry @pandas , I was grumpy about something this morning and let my mood influence my post. I should not have written the last sentence, nor the word “nonsense”.

Can we all agree that VIAC might not be ideal but still the best what we can get today?

Hello everybody ![]()

As requested in the forum, we would like to make a short statement at this point.

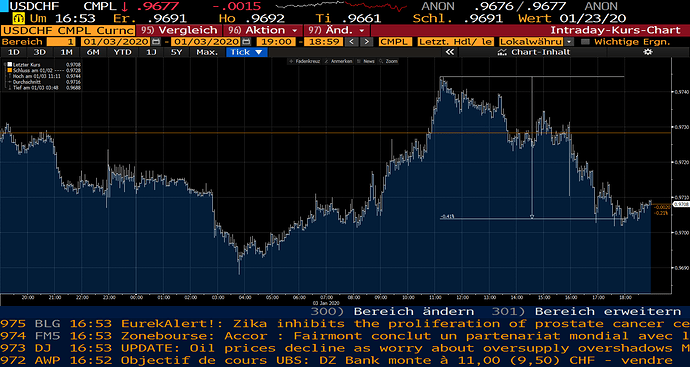

To cut a long story short: Rebalancing does not involve market timing or similar. We have no influence on when to buy, but always try to do it exactly the same way. Depending on market developments - such as in early January, for example - this can have a suboptimal effect in retrospective, as foreign currencies were bought close to their daily highs.

How exactly is rebalancing implemented?

The rebalancing was started on 3.1.20 after the opening of the stock exchange - here we always wait for the first price feed of the day. All ETFs were bought directly after the calculation, which takes place in the morning and before noon. The orders for the index funds are also placed directly after the calculation. How-ever, these are only traded once a day at the closing price of the respective day (NAV trades). We must also distinguish between the t+2 and t+3 funds. The t+2 funds are subscribed at the closing price of the rebalancing day (e.g. 03.01.2020). The t+3 funds (essentially all funds with exposure to Asia) are subscribed at the closing price of the following day, even if we placed the orders on the rebalancing day. This is because the stock exchange is already closed at the time of the cut-off in Asia. In the case of the World ex CH fund we have therefore subscribed at the closing price of 6.1.20. The fact that prices can change until the time of subscription is a disadvantage or inaccuracy factor with the trading of index funds - but we have no influence on this, on average this should be balanced out.

We would like to add the following comments on the external trading costs:

-

WIR Bank currently charges a markup of 0.75% on the net traded volume for foreign currency. Through pooling and netting VIAC tries to minimize the markup (see Pooling and netting – VIAC). It is correct that the effect is not yet as great with strong growth and a relatively small asset base. Nevertheless, it has often been possible to reduce the individual currency markups to around 0.5%. In the best case even to 0.35%. Whereby we are always talking about the general spreads. Through our personal pooling and netting mechanism, which is carried out before the general netting, this spread can be even significantly lower! I for once reached a markup of 0.01% on the USD / CHF trade.

In the long run and with a larger customer base we hope for even stronger effects. It is also important to note that the bank’s premium was higher at the beginning (1.5% was discussed before our launch, but we were able to reduce it to 1% through negotiations at the start). After the successful start, we were able to lower it again to 0.75% in mid-2019. The interests of the start-up and the foundation/bank may not always be aligned. However, we are very interested in keeping costs as low as possible. It is also worth comparing the FX spread with that of a comparable provider (mentioned above), which is estimated at 1.5% (not officially confirmed). -

CS funds have issue and redemption fees (similar to ETF spreads) - but these are usually relatively low and cover, for example, taxes or similar. (e.g. stamp duty in the UK). The premium on the World ex CH fund mentioned above is 0.08% for CS - see the factsheet at https://amfunds.credit-suisse.com/ch/de/institutional/fund/detail/CH0032400670 (login as a qualified investor is mandatory).

It is important to note that in theory the result should be “no spread paied” over time. The reason is that the foundation is expected to always buy (since only one year of age retires compared to the total customer base). Hence through netting and pooling, you would end up paying the spread when you buy the fund, but get it back once you sell it. This is of course conditional on the existing customers continuing to deposit and we always charge the purchase price including the spread - also to the customer who sells.

We are very much interested in minimizing external trading costs, which we cannot directly influence per se, but which we can optimize due to the legal set-up of the foundation and the intelligence of our system. We are also able to optimize the stamp duty, as there is no change of ownershipt through the netting process.

With reference to the rebalancing of 3.1.20, the costs for foreign currency and markups were therefore only partly responsible for the perceived poor execution. Another decisive factor was the additional lag in case of the t+3 funds, as the additional delay led to a higher purchase price. On the other hand the fact that we buy the currency volumes directly after the calculation of the trades was also decisive. The prices were relatively volatile on this day and our timing was unfortunately unfavourable. Again, we deliberately don’t have a concrete timing and trade to the best of our knowledge and belief directly after the calculation of the trades (then we know the volume). On average, this will also have no positive or negative influence in the long term, but in individual cases it can of course turn out unpleasant or very pleasing - depending on your point of view.

Possible questions are perhaps best asked to us by chat, so you have the fastest answer.

Thank you for the interesting and detailed answer @VIAC_Daniel

Thanks for the explanation.I agree if the market is volatile you can sometimes make a bad or a good trade compared to the daily average.

However, you haven’t explained why you have chosen the CSIF in foreign currencies and not in CHF. This choice seems to be more a deal with WIR than an advantage for the customers.

Which CSIF are you explicitly talking about? See link below with all available instruments from VIAC.

All of them except CSIF SMI, CSIF SPI Extra and the hedged.

Credit Suisse offers all funds in multiple currencies USD, CHF and EUR. If VIAC buys the fund in CHF instead of the foreign currency, the exchange fees would be 0% on the VIAC side and very low on the Credit Suisse side.

For example: Instead of buying the CSIF World ex CH fund in USD, they would buy the fund in CHF.

Do you have a number what the CS side cost would be?

It costs next to nothing to the bank itself, all cost (like 0.75% for wir) is pure profit for the bank.

As to what they charge to you, well, the spread between share issue and redemption prices for these CS funds is only about 0.1% - I posted the link to the data right in the first post. So, cost from mid-market value should be about 0.05% for everything, FX included.

Subscribing to these funds in any other currency than CHF does not make any sense and the argument that it “saves” money by increasing netting potential is complete bs.

Many ETFs that you trade in USD have equivalents that can bought on SIX in CHF instead. Like Vanguard’s S&P 500. See the ETFs choices that VZ made - https://www.vermoegenszentrum.ch/dam/jcr:4fa6be08-1b8c-40f0-8a52-20b2d4b5101a/Selektionsprozess%20und%20Titelliste.pdf - and note how many are traded in CHF. FX spread during SIX trading hours is negligible (<0.0x%) thanks to HFTs (btw welcome citadel securities to zurich!!!). Buying these ETFs in CHF and subscribing to CS mutual funds in CHF should be much more effective strategy for eliminating ridiculous FX fees from WIR than trying to balance cash flows.

It costs 0.002% at Interactive Brokers even for retail investors

VIAC is a startup company and probably still in the phase where they need to grow to cover the costs and future ideas. They broke the paradigm to do that innovation. We will see how VZ and other banks/service are capable to react to this service. They are really surprisingly transparent, as comment above shows. They answered to all my questions with a fresh honesty. Comparison to IBKR is really not valid, because the business model is a different one. Just to be clear, I do not know them in person, but really appreciate how they communicate and act. This is really refreshing.

P.S. and anytime I am in contact with them via chat, I drop my wish list of Vanguard assets to be available soon on their platform hopefully.

- Vanguard S&P 500 / VUSA / CHF / IE00B3XXRP09

- Vanguard FTSE All-World UCITS / VWRL / CHF / IE00B3RBWM25

- Vanguard FTSE Developed World / VEVE / CHF / IE00BKX55T58

Yeah, one of these business models is ripping people off by charging arbitrary spreads pulled out of thin air.

It doesn’t cost anything even remotely close to 0.75% to change currency to any well connected financial institution. You must be completely clueless (or held at a gunpoint at the threat of cancellation of your business relationship with no other vendor to turn to, for example) to accept it.

IB is just an example of a retail broker that lets you enjoy similar level of fees/spreads that professional big players pay. A reference point, if you will.

CS, as mentioned above, changes currency and covers all other costs (stamp duty…) for just 0.05% in spread or so. Much better than 0.75% too.

I do like your criticism. You cover with open eyes the blind spots. But that´s the beauty living in a free society. If you don’t like it, don’t buy it. Or even better - if you know how to make it better, crowdfund your own business and build up a better and cheaper solution as an entrepreneur. If you can manage that, all the Mustachian here will be your loyal future clients.

The comparison doesn’t make sense. Viac has 14k accounts and IBKR millions.

Is it correct that swissquote takes 0.95% for CHF/USD forex if a trade is under 50kCHF ???

Or am I comletely wrong?

(Page 15)

https://library.swissquote.com/shared-images/brochure-trading-pricing-bank-de