Any reason for why they wouldn’t? It seems to me that they aren’t making additional money (for themselves) with any of this, or am I missing something here?

Their answer was that choosing the underlying currency is better for netting and that they also have ETFs with foreign currencies.

I thought about the following case but I’m not really convinced that it would happen so often.

Fund A: CS Global Dividend Plus traded in USD and underlying currency USD

Fund B: CSIF World ex CH traded in USD and underlying currency USD

If you sell 100 of fund A and buy 100 of fund B, there is no currency conversion. The FX cost is 0.

Fund A: CS Global Dividend Plus traded in CHF and underlying currency USD

Fund B: CSIF World ex CH traded in CHF and underlying currency USD

If you sell 100 of fund A and buy 100 of fund B, there are two currency conversions internal in the funds.

Sell: USD to CHF, Buy; CHF to USD.

It’s better for netting more fees from the investors, that’s for sure.

The currency fees is what WIR-bank wants for allowing VIAC to use their cash-account customers. These allow VIAC to stay, as a Vorsorgeeinrichtung, within the legal limits while offering 97% shares. I don’t like it but guess that VIAC does not really have a choice.

On the other hand, I don’t trust credit suisse either with doing the currency exchange. While the SEC forbids self-dealing, European ETF are allowed to do it. I read a prospect once that said: we use the trading desk of our sponsoring bank. We are under no obligation to check the market for best offer…

Credit suiss charges only about 0.1% spread between issue and redemption prices so that bounds the fx spread they can sneak it.

I am moving my CHF share of assets to VIAC and USD to IB. One thing is that FX at IB is cheaper. The other is that SMI pays 3.3% dividend, SPI Extra 2.2 and VTI around between 1.8 and 2.0.

I prefer to have no taxes where the dividends are high

Thank you, I disregarded this for some reason.

However, having said this, 0.1% is the spread for SMI. It’s much higher e.g. for the MSCI Europe index fund.

The standard indexes from MSCI itself is furthermore based on the worst possible withholding tax situation. So there is much to scalp off before the tracking difference mounts.

Excellent move, ChickenFat.

Yeah I’m also putting the high dividend stuff into 3a. IBKR purely for VTI and VIOV.

Speaking of this, some of these ETFs have equivalents tradeable on SIX in CHF with negligible FX spread.

For example for S&P 500 there’s Vanguard’s VUSA - https://www.six-group.com/exchanges/funds/security_info_de.html?id=IE00B3XXRP09CHF4. Bid/ask spread looks bad right now but you should check it during the trading day - it’s very reasonable actually, certainly way below 0.75% that wir bank charges - you can thank HFT companies for this!

But they went for an expensive USD-denominated ishares fund and rip off the investors on currency conversion instead.

They can’t just use any ETF, they have to take a Credit Suisse index fund.

They’re already using “iShares Core S&P500 ETF” for the S&P 500. Looks about as good as Vanguard’s ETF to me - if they can use the former they should be able to use the latter too.

You are right, my mistake!

VUSA is denominated in USD aswell?

It has VUSD ticker denominated in USD and VUSA denominated in CHF.

https://www.de.vanguard/web/cf/professionell/de/produktart/detailansicht/etf/9503/EQUITY/overview

I think VUSD and VUSA stands for distributed and acculumating?

They are both distributing - these are actually the same shares, just traded on different stock exchange under different tickers and currencies:

VUSA is traded on SIX in CHF:

https://www.six-group.com/exchanges/funds/security_info_de.html?id=IE00B3XXRP09CHF4

https://finance.yahoo.com/quote/VUSA.SW

VUSD is traded on LSE in USD:

https://finance.yahoo.com/quote/VUSD.L

Why don’t you suggest it to VIAC?

I suspect ripping off investors on currency exchange is part of their business model, and they are having problems admitting this. They gave me same bullshit answer about netting as to wapiti above. Thus they will not be interested in hearing about any savings possibilities like buying S&P500 in CHF on SIX or from credit suisse index solutions and subscribing directly in CHF. They likely already know and don’t care:

Why trade it in CHF to save your investors some money, when you can instead trade in it USD and charge those same captive investors arbitrary fx spreads pulled out of thin air?

I suppose they could be at a gunpoint from wir bank here to do this (they’re just a noname startup and the bank probably needed a good reason to give them their 3a business?) but still the overall intransparency reflects very bad on them either way.

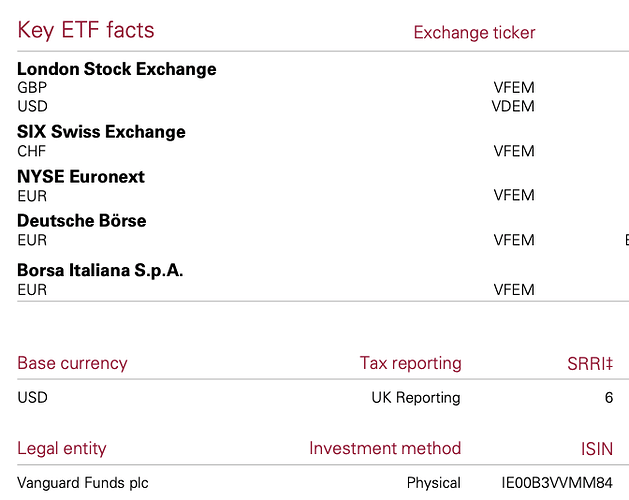

Wrong… Did you even have a look at a Vanguard fund factsheet just once? VUSD and VUSA are tickers for the same security, the same ISIN. The reason VUSD exists is that on London Stock Exchange VUSA is reserved for the GBP one. In a similar fashion, you have VWRL/VWRD, VFEM/VDEM.

Yes, a lot of ETFs are available with low spread in CHF.

They didn’t use the CS funds for the USA in the past due to the withholding tax, but this doesn’t make sense anymore with the new double tax agreement. I’m sure they could have at least 90% of the money invested directly in CHF. Only some “exotic” ETFs are not available in CHF like iShares Listed Private Equity.