Didn’t find a way to get the credit card. Do you have a regular Margin or a Portfolio-Margin (afaik only available at 100k+) account?

I have just a regular margin account.

In the FAQ it seems clear that the credit card is for US only

You can only get the card if you’re an US resident. See Browse Our FAQs | Interactive Brokers U.K. Limited

The full set of eligibility requirements are as follows:

- Country of legal residence: United States

- Country of current residence: United States

- IB Entity: IBLLC-US

- TIN is a US Social Security Number

- Has verified mobile number

- Individual, Trust or Joint account excluding IRA’s

- Additional restrictions for FA Clients

This is interesting! I was thinking about this to buy a car. What are the risks here. If I continue to buy ETFs not using margin, is the only risk then currency risk?

Oh no there are tons of risk. You could lose everything. It’s all about moderation.

You are loaning money against your total assets (etf usually). If the market crashes, and your asset go too much below the margin threshold, IBKR will sell the etf basically at the bottom to close your margin position.

So yes you could buy a 20 k car, but do that only if you have 250k or something in asset. So that even a 90% will not close your position.

That’s what I’m doing right now- I don’t even take out margin, but keep it as a possible source of 10k for emergency (and I have 200k in assets on ib).

Be careful. Is a flexible instrument but just stay well below the threshold

Thanks for the info Grog!

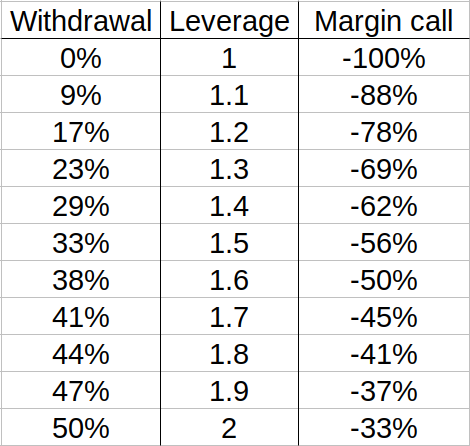

Here is what leverage a certain withdrawal corresponds to and when you will get a a margin call at 25% maintenance margin. With portfolio margin at IB, the drawdown can be a bit bigger.

Formulas, l is leverage, d is drawdown:

l = - 4/(3d - 1)

d = -(4 - l)/3l

IBKR can increase margin requirements in extreme times. I’ve read that they closed positions in 2008/2009 way sooner than some people expected.

Yes, IB can call the loan anytime. They may also arbitrarily change the rate. They don’t have an interest in doing that because they want to keep their clients but still… the GameStop saga has shown us that brokers won’t hesitate to take extreme measures.

It’s a good idea to see margin as a line of credit: it’s basically a low interest revolving loan. You may tap into it when there is a good opportunity but with the intent to pay it back eventually.

What I’m exploring is, in case of retirement in a country which taxes capital gains, how to use margin to lower taxation. In the standard withdrawal case, you would get about 2% in dividends and sell about 2% of stocks to get your sacred 4%. In this standard case, you would be taxed on both sources of income (dividends and sale of stocks). But what if, instead of selling 2% of your shares, you would use margin? Well… it doesn’t get taxed. The risk is minimal since your margin utilization growth by 2% a year ; that means: it takes 5 years to get to 10% and that’s assuming no growth of your nest egg.

Of course, you do get taxed when you end up selling but who says you can’t reside one year in Switzerland every 10-20 years and sell your stocks while you reside there? Or you never sell and your heirs will get a little less when the tax man raids your portfolio at your death.

More generally: margin can be a good tool to increase the success rate of the 4% rule. Instead of selling your stocks on the cheap after a market collapse, stay invested and wait for the recovery by consuming your margin little by little. But it takes balls to borrow during a crash and as I’ve mentioned above, your broker could screw you by calling the loan. So definitely not for the faint hearted (and I’m counting myself part of the faint hearted). I still think it’s worth exploring…

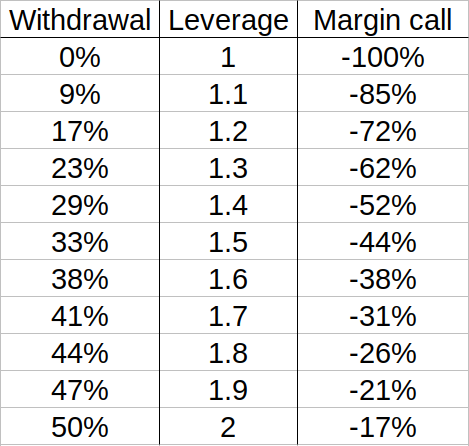

True, here is the same table if margin requirements increase to 40%:

If you have a decent saving rate and are able to contribute 1-2% of your initial portfolio value per month and assume that a 50% crash doesn’t happen faster than in 3 month, you can also add 3-6% cash to your portfolio.

This might sound like not much, but it increases your risk capacity a bit.

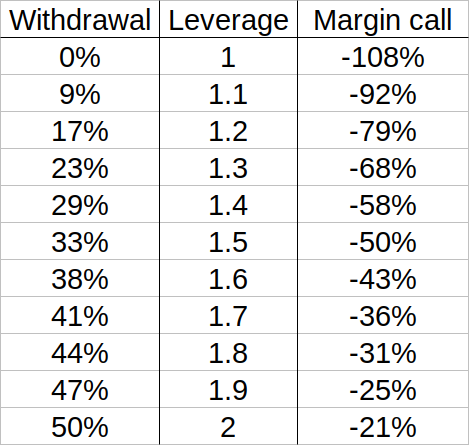

If you are able to add 5% of your portfolio value during the crash, you increase the possible crash required for a margin call at 1.5 leverage from -44% to -50%:

As the clever people on youtube have told me, this is similar to how billionaires bankroll their life. They use assets which are stable in value as collateral to an equity line of credit (ELOC). When they buy real estate or a yacht, they will take an ELOC on it. The banks are happy to give the loan because the risk is usually low and they get the interest payments.

I don’t know about the payment schedules but in the era of low interests this seems like a clever idea to get some high life cash for Dom and Lambos. Instead of having the same amount of cash sitting in your accoubt debt free (and being eaten by inflation), you get liquidity with a low interest loan while your equity keeps going up in value. This is the ideal scenario of course.

yes there is definitely an use case in which you use it to withdraw instead of selling during retirment, dpending on market conditions etc.

I think is worth thinking about as well for people approaching 60-65, and that are still working: they could tap into the margin loan to fill their 2nd pillar (tax deductible), where the money icnrease almost the same as the margin loan interest (1% vs 1.5%) and you get the money back in a couple of years, so risky, but by 60 you probably have some ETF on the side (if you are mustachian) so it will not be tooo risky.

Only works if you‘re still working, what about us that retire early?

Great analysis. Watch out, the margin requirements in IB are quite permissive compared to other brokers and assuming 40% margin requirement might be optimistic. For example Swissquote only give 50% margin on many stocks and no borrowing at all on others.

Thanks for the info, any input on which ones would allow for it and which ones wouldn’t?

You can contact Swissquote to go through your holdings and their borrowing capacity. Often my UK assets seemed not to be in their risk database and they were able to apply to their internal team to change it. Overall I can borrow 30% of my assets at SQ which is much more conservative than at IB

Well on this site there is a broad audience ![]()

In reality, one of the big disadvantage of the 2nd pillar is that cannot be used for rebalancing. You could expose yourself to risk by using margin loan as a negative fixed income position to reduce your total and use it to rebalance. Eg

You have Investment plan of 90% stocks 10% fixed income ( all in 2nd pillar, or you are investing 100% stocks in your taxable accounts).

With numbers: 450k stocks, 50k 2nd pillar. Stocks drop to 400k, so you have 87% stocks/13% 2nd pillar.

You decide to rebalance and take out a margin loan of 10k to purchase stocks.

New situation: 410k stocks, 40k fixed income (50k-10k=40k). Allocation back in balance (somewhat).

It’s a bit risky, but it can give a structure on your rebalancing

Agreed. What when stocks go up again? You can‘t take money from 2nd pillar. I wouldn‘t do any rebalancing with 2nd/3rd pillar (money in) as you can‘t take it out. Hold it in cash or buy bonds (when they actually give you any return)

if stocks goes up, you seel it to keep the 90%/10% split. This will cover the loan and leave you with some cash outside the 2nd pillar.

I actually think that, depending on your age and situation (buying an home soon-ish? leaving CH? etc), it does makes for a lot of sense to put the remaining cash lying around in your 2nd pillar. The tax deduction means up to 30% immediate ROI through discounted taxes. This is quite difficult to beat with bonds or cash in today’s low interest environment.

and yes you can’t take it out, but I just described a way in which you use an accounting trick basically and margin loan to shift allocation from stocks to fixed income. I would argue that you have a better overall ROI if you use margin loan to shift & rebalance and eveny pay into your 2nd pillar than leaving cash around.

Particularly because once you retire, your 2nd pillar can go to VIAC and you can start investing on it.

I might soon take out a sizable junk of money as a margin loan, since it’s the first time I’m doing this my question would be, how does one control or pay-back the margin loan? I haven’t found any obvious controls in the WebUI to use cash for paying back a margin loan, is there some secret menu or trick required?