Ok that’s a bummer. Then idk how MMM went through with buying real estate like this. Btw I wonder how rich people do this. They have this line of credit thing, I guess banks are a bit more solid when it comes to the rules that you agree on.

Yes I saw that VWRL’s collateral value will become 0. Do you know why is that?

The IB TWS has a feature that estimates the portfolio margin you would receive. Since it is risk based it depends on the stocks you have. I just ran it on a paper trading account and got for VT an extremely low 10% and for TSLA I got 40% (TSLA is 40% on Reg T account as well, but at least the portfolio account removes the overnight 50% rule).

As pointed out by others, it would be pretty crazy to go that low and put the money into an illiquid asset. But on the other hand one should know the limits, if only to know how much safety buffer there is in case of a (inevitable) crash. Converting to a portfolio margin account would increase that safety buffer, but expect that IB will increase their margin requirements exactly when you would need that buffer: in a crash.

If you can stay clear of the 50% mark even during a decent crash maybe you have a case. Somewhere north of 80% in good times should survive the bad times as well. That still gives you $1 million out of your “insane $5 million portfolio”. If that is not enough maybe you can still find a way to pledge the house itself as collateral? It should still be possible to get a mortgage approved when you sit on such a portfolio.

No idea. Nobody shared that experience yet. But surely, any Swiss bank would need to have custody of this portfolio in order to give a mortgage?

I just wonder if you can get a mortgage without income, so that you can buy real estate without having to sell any of your stocks.

I think @Cortana mentioned once that they would transform wealth in income through a % -not 4% but 2% or similar.

I might be wrong though and it might change over time

Usually banks use a formula like: total liquid net worth / (85 or 80 - age) = yearly income from assets.

Wow, OK, this is very interesting! First time I hear this. So this formula assumes that these liquid assets are fixed in value over time, and that you will use them each year, until your death, to finance your expenses. That makes sense.

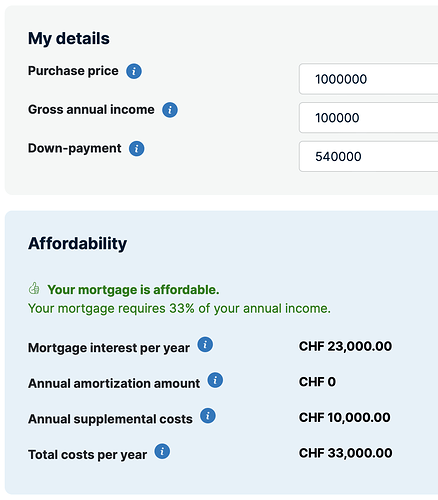

So let’s see. Let’s take CHF 4 million of portfolio value, then apply:

total liquid net worth / (80 - age) = CHF 4 million / (80 - 40) = CHF 100'000

This should be enough to support a mortgage loan of around CHF 500’000, right?

Another example. Let’s say I would like to buy a house worth CHF 2 million, with a downpayment of 34% to avoid any amortization payments. The calculator tells me I would need an annual income of CHF 265’000 to afford it. So I could then cover part of it through work income, and part with my stock portfolio.

@Cortana does this math check out for you? Would I need to transfer my stock from IBKR to the bank, if it were to count my liquid assets as income?

All correct. No need to transfer the assets to the mortgage bank, at least in my company.

I was thinking of using a margin loan soon for the first time and I have to say I still don’t understand the fine details.

Today I got a message from IB saying that for one of my (EU based) funds, marging requirements will change as of TOMORROW from an initial requirement of 50% to 100%, while the maintenance margin will increase to 100% much more slowly, in a week… This was a bit shocking and makes me rethink my plan. What if had borrowed against that fund and had only one week to pay back ALL of the loan?

One think I don’t understand is: if I have a bunch of ETFs on my portfolio, each with its own (up to to today rather similar) margin requirements, which ones will I be borrowing against if I take a “small” loan (up to 20% of the total portfolio)? I don’t see the possibility to choose, I can just withdraw something like 50% of the portfolio value…

Too many different related threads, sorry.

This is rather a technical issue. IB decided that the fund you own is not traded enough and is not liquid enough under the ticket (exchange/currency) you have bought it. You can of course sell your position, convert the currency and buy it as the most traded ticker version. I don’t know if it is possible to ask IB to convert your position from one ticker to another, as it is a technical issue after all.

Against all of them. As long as your net equity (stocks value minus debt) is higher than the margin requirements (typically 50% for regT margin), you are fine.

On the other hand, if your margin requirements are not fulfilled, IB seems to sell positions rather randomly.

And 20% is not small, I would limit to 10% if you don’t have experience and not sure how it works.

I think the lesson is that if you want to use margin, you should hold very liquid securities: stocks with high market cap or ETFs with high AUM. Some niche European version of an ETF will have a high risk of having its margin requirement jump to 100% at any point, due to low liquidity. Because I guess with low liquidity, they can’t tell the “fair” price that easily, or liquidate your position soon enough if you go under the required threshold.

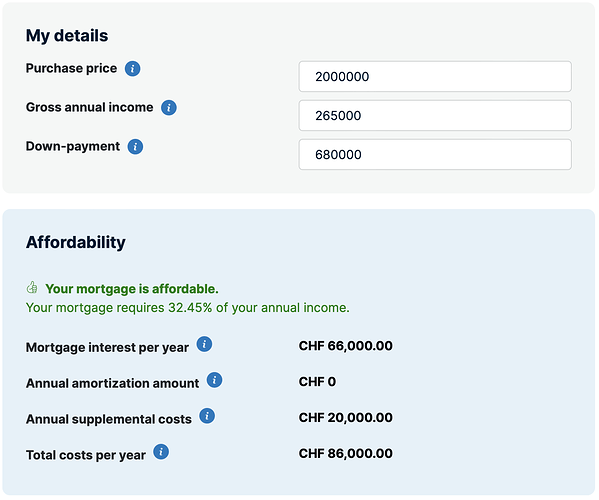

@Dr.PI I don’t think you’ve really answered the question. What does it mean against all of them? If I’m holding VWRL with 100% overnight margin requirement, TSLA with 55% and VT with 50%, what is my available margin? RegT is the minimum required by law, the broker can set a higher requirement per each stock.

I think probably the best is to play with the paper account, make a few trades, and see how the available margin changes.

Because there are some followup questions that come to my mind. E.g. if you have 3 positions, and use margin, is margin assigned to one position in particular, or to the entire portfolio? If the latter, which positions are going to get “trimmed” if you can’t meet your margin requirement? All of them, proportionally?

First, we seem to have a problem with definitions. The margin is not how much you can borrow, but how much net equity you should keep in your account to keep your stocks etc. positions open. Available funds are net equity minus margin. Your available funds in this case are 45% TSLA value + 50% VT value minus debt.

That seems to be unpredictable, however in Trader Workstation you can put a flag “Liquidate last” on a position, whatever it is worth.

@Giff @Dr.PI maybe it works like this?

The USD is the loan. The equity (green) has to stay above the initial margin (red), which is calculated as a sum of (current value * initial margin %) of all positions. Anybody here to confirm/correct this?

I would say overnight margin, although they seem to be always the same.

Adding together values of different magnitude (number of stocks and value of cash in USD) is what I typically kick my students for.

I don’t understand. What do you want to kick me for? Can you elaborate? Where did I add number of stock with cash? Can you point the exact location?

hehehe, I had a prof who had a stamp “non homogeneous” (in French it sounds better) when there was a mistake with unit dimensions

he meant you are making a sum of number of stocks (dimensionless) and amount of cash (unit dollars), which does not make sense (2nd column, last row)

But you would not sum them up, would you ?

Ah, that’s right, that sum makes no sense. I get it now. Will correct.

I just check that my Current Excess Liquidity is Positive.

The question is, how is it calculated. We know that Excess Liquidity = Equity with Loan Value - Margin Requirement. Equity with Loan Value is clear to me, but what about Margin Requirement? I guess it is the sum of margins for all positions held, like in my screenshot?

I still don’t understand to which securities my loan would be linked. What if I borrow even a small amount but IB for some reason considers the loan backed by this specific fund that needs 100% maintenance margin as of next week, even though I have hundreds of thousands of CHF’s worth in other funds with more “normal” settings, would they liquidate it then? Would be outrageous but I have not yet read anything which would assure me it can’t happen.