Hello, is anybody USD exposed and thinking that could be risky? If you don’t consider it risky, would you explain why? Instead If so, would you share eventual strategies (for cash and/or USD ETFs)?

Thanks

It’s very unlikely to matter beyond those couple of days of potential high volatility (which has a bit of risk of breaking some backend stuff unintentionally). So yes I’m ignoring it since I care about long term ![]()

For fixed income and cash assets: I want my assets to be in the currency I intend to spend, so I personally wouldn’t keep them in USD (because I spend CHF and will for the forseeable future). If I were spending USD, I would keep the assets needed to cover my short term needs in something that I expect to stay liquid (short term treasuries may temporarily not be). I may want to hedge the assets designated for my long term needs out of pure treasuries if I were there and use globally diversified bonds (both government and investment grade corporate ones) or other assets like gold or CHF (which is a reserve currency).

For stocks, they represent part ownership of companies, so I wouldn’t stress over which currency they are denominated in: the value of the company is not dependent on it.

Both US and non-US companies may generate revenue and have expenses in USD, and/or be exposed to people whose buying capacity would be affected in case of a US debt crisis, so I would expect a temporary drop in value of my stocks (the few companies with no exposure to the USD at all could be contaminated by a global crisis), which could result in bankruptcy for some companies. I can’t evaluate which companies would be most affected, as I guess many of them just ran on the idea that US treasuries don’t have a credit risk and many may not have adjusted that view yet so I’m staying broadly diversified.

I can’t evaluate the impact a US debt crisis would have on the long run but I stay confident globally diversified stocks will at least maintain their value at a 30 years time horizon, so I don’t see a reason to change my long term strategy in that regard.

Other types of assets I may consider are gold, real estate in safe and politically stable places and trustworthy relationships (ideally also in different countries). I don’t have enough assets to protect to warrant doing that, so I don’t.

Thanks Wolverine for your extensive answer to the OP. Would you agree then that - for those of us with USD exposure - it would make sense to keep a brokerage account in USD, instead of converting into CHF/EUR? Especially if uncertain about whether to retire in CH.

To answer the OP: personally I am exposed and yes I do obviously consider it risky, given recent fluctuations in USD/CHF and USD/EUR values. At the same time, I find the forex mkt quite complicated and unpredictable (as if the rest of the market wasn’t) so I am not really sure how to approach this issue.

My policy is that I want cash to cover my very short term expenses, fixed income products (bonds, medium term notes and the like) to cover my slightly longer term but still short to medium term expenses and a mix of stocks and bonds to cover my longer term ones.

If I had short term expenses in another currency than CHF, then keeping part of my cash reserves in that currency would make sense to me. The same applies if I expected to have medium term expenses in that currency: I would consider keeping part of my bonds denominated in that currency, with an appropriate term matching my expected need.

I do not worry about the currency in which my broadly diversified stock funds are denominated: the value of the companies comprised within the fund doesn’t change depending on in which currency I trade them (while they do have liabilities and revenues tied to one or several currencies, which is part of the reason why we advocate broad worldly diversification).

Came across this today from the always funny Peter Zeihan and thought I’d share.

(longer winded video if you prefer that format)

Will the National Debt Kill the US Economy?

The US national debt is so high that it has exceeded 100% of GDP. We’re talking over $35 trillion. Nice little chunk of change there. So, what led us to this point and how do we move forward?

There are several things that have helped the US rack up that debt: Baby Boomers retiring and collecting from the system instead of paying into it, spending on wars, and recent administrations carrying larger and larger budgets…just to mention a few.

While the US debt is concerning, a healthy dose of perspective might help back you off that ledge. Europe is facing a severe demographic problem. China’s debt stems largely from corporations and is still massive. Japan has a debt-to-GDP ratio of a few hundred times GDP, and they’re doing…all right.

So yeah, the US has a problem, but we’re not quite in crisis mode. Give it about 30 years before you really start to worry (heck, maybe someone will even come along and fix the problem before we get there). In the meantime, the US could see massive capital flight from the collapse of other countries, and that would buy us some more time to figure out our issues.

Yes. 60% of net wealth is in USD assets.

Also yes. ![]()

Yes, it’s one of the better smelling trash in the dumpster.

The US of A ain’t going anywhere. But the value of the US$ may be going places.

Technically, it’s moving southwest about an inch per year.

I’ll see myself out …

Upping this, as I have some cash in USD currently in a MM fund, which has done fairly well in the past 18 months.

EUR/USD is at the lowest since a long time - except Oct’ 22. Time to cash in and convert to EUR, open a FT deposit and enjoy lower returns at a higher peace of mind? Any opinions?

Investing in foreign currency MMFs is basically speculating on Foreign exchange movement. It’s only good for experienced FX traders.

My recommendation would be to stick to local currency MMFs unless

- you actually need foreign currency for end use

- you are using some sort of tax efficient instrument

- You have extensive knowledge about FX markets

Yep, I bought is as a short-term liquidity solution and I was clearly lucky so far. Seems like it’s a good moment to move to a cash position and remove some USD exposure from the portfolio?

Actually decision to increase cash is more of an asset allocation discussion . But for whatever cash you have, I think Swiss instruments would be advisable.

I normally use PICTET MMF

But if you intend to take money in and out quite frequently, then you might lose money in trading fees. In that case savings accounts might be better

What does it mean?

New debt issuance?

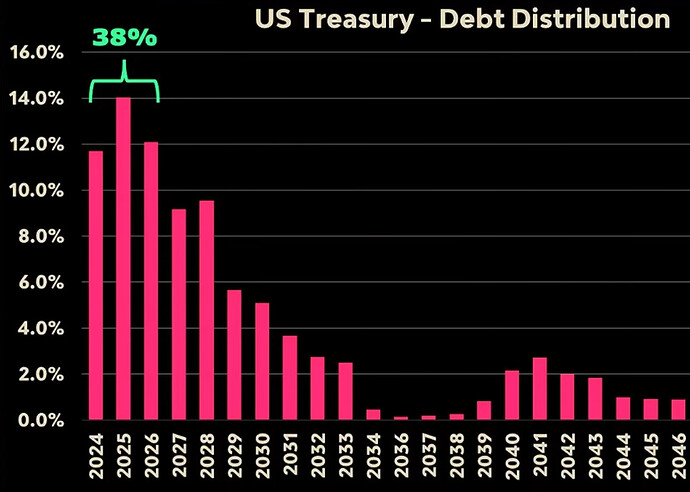

It means they have a ton of debt to rollover the next 4 years and likely resetting borrowing at higher rates.

They kept issuing short term debt in the past few years (started with Biden and at the time republicans complained about it, of course republicans are doing the same).

The idea is that they want to wait for rate to go down to avoid pushing long term rate.

Skewing its debt issuance to more shorter-dated bonds allows the government to step up its borrowing without sending yields on longer-dated bonds higher. The yields — which move inversely to prices — of longer-dated bonds determine interest rates across the economy, from the government’s borrowing costs to mortgage rates

Source: Client Challenge

Yes. Luckily stable coins will snap up the short term debt and soon the Fed will cut and JPOW will be replaced by someone more compliant.

I was always surprised that during the period of super low rates why they didn’t lock in more long term debt.