What are your takes on USD/CHF evolution within the next months? The Swiss Franc has reached an all-time high since more than 10 years. Do you think the CHF will finally stabilize again and come back to a more reasonable value for exporters?

You can search “USDCHF futures” if you want to see the market’s prediction

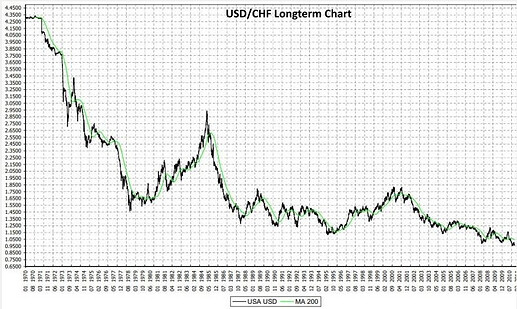

It has been at an all time high for quite a lot of the past 50 years ![]()

I’m glad I held onto my USD given the new context

This doesn’t mean its not a prediction. It still makes it the best guess of the market for where an FX pair will move over that time period.

If there is higher risk on one of the currencies or a big market bias then futures contracts will move away from the pure interest rate differential. USDCHF doesn’t have much of that though.

In my simple mind if market participants predict a different price than the USDCHF future there would be an arbitrage opportunity to make profit selling futures contracts

Spot rate and /or interest rate differentials would change due to supply and demand until the arbitrage opportunity is closed. Therefore the USDCHF would also change

But I am not an expert and stand to be corrected !

The only prediction in a futures contract price is the cost of carry. For currency futures, as @Koreba said, that is the expected interest rates of each currency.

If a currency comes with additional risk, this should be already reflected in the market interest rate. The big market bias I have observed in myself in S&P 500 futures, though.

That the price of currency futures points to the expected future price is incidential, I think. The costs of carry just entails the same calculation as interest rate parity demands. There is no such “prediction” in S&P 500 futures or oil futures.

S&P 500 futures are also just a function of interest rates (and expected dividend payments). In the end most of the flow will be hedged and require your counterparty to borrow the notional amount to take a true s&p 500 position. Of course they can get cheaper leverage than you can thanks to size and lower counterparty risk and you avoid the dividend tax drag so it can be nice in Switzerland if you do want leverage.

Commodity futures are a completely different game and ruled by supply and demand through time. A huge amount more complexity here on pricing (as well as much more volatility as market tries to find that fair value!)

But no matter how the different futures prices are derived and the complexity behind them, they are all still a “prediction” of where the market thinks the spot should be priced in x time.

As for the original question on USD/CHF: its mostly a function of whether you think fed will be able to lower rates sooner or if inflation will prove to be stickier in the US. If you think you have a better gauge on that than the market then speculate on some fx futures. Otherwise just assume market is pricing it pretty fairly ![]() .

.

According to everything I know, this is completely opposed to how futures are priced (theoretically and in reality). Are you sure about what you claim? How sure?

For a basic introduction have a look at Wikipedia. They are priced on spot of the underlying and expected cost of carry for any liquid underlying. There is nothing about expected spot. Spot prices in the future are only important if you can’t arbitrage by just buying and holding the underlying.

For practical example: Take S&P 500 price index futures (e.g., ES futures). If you account for dividends and interest, we are left with less than a percent above spot at quarterly roll (annualized average for the last 30 years).

But we know the S&P 500 price index returned much more than this cost of carry (+ risk free interest - dividends + the unexplained difference). You say the market has been severely and systematically underestimating the growth of the S&P 500 for over 30 years?

Isn’t it more likely that futures are actually priced like theory says? Spot + cost of carry (any expected cashflows for holding the underlying, but not the underlying itself)?

What you say is practically true but I don’t think disagrees with my point. Just a different way of framing it.

Spot underlying + cost of carry is true for fx/equity futures. But how is spot price determined today? Its the market consensus today of fair value.

Cost of carry for fx future is derived from interest rate differentials but where do those come from? Again, its the market dictating this (e.g. people are willing to buy swiss soverign bonds for far lower yield than US because they think the chf will hold its value better).

For s&p 500 you are taking extra risk and yes both futures or spot would have compensated you for that over the long run.

If you dont think a usdchf future represents markets best guess then you can make money off of it… Either with the future or with spot fx and then going long/short the bonds.

Yes, I agree on fair value today. But this is a property of the spot price today. Looking at the futures price today tells you nothing about the spot price tomorrow.

Let’s say you buy futures on the price of asset X in USD. From the spot price of asset X in USD and the interest on USD you can calculate the remaining expected cost of carry. That must be a property of asset X (and as seen with S&P 500 additional margin spread from arbitrageurs).

But you will not be able to say if asset X is more or less volatile than USD or if its total return is higher or lower than USD. The only thing you might assume (without even looking at any of this), is that more volatile assets should return more than less volatile assets. But you can’t say where on this curve asset X is (not from the futures price at least).

There is no information about the future spot prices in a singular spot price and consequently also none in comparing the futures price to it.

I already agreed that it looks the same as if it predicts anything. The only reason this “prediction” works (or is assumed to work) for (major) currencies is because interest parity demands them to (longterm) be in the same place on the curve regarding return / risk

I actually thought to give you a similar proposal with the S&P 500, but of course I can’t. Not because there is any prediction going on, but because futures are efficient regarding prices (and their baked in assumptions) at the current point in time / today. You can’t make more money for less risk with futures.

I would be able to if the futures price over spot was anywhere near its annual 10% . I would short it, hedge it, leverage it, and become richer than everybody, risk free.

If it is not the best prediction available, wouldn’t that imply a free lunch? For example to trade FX futures and make profit ?

The spot price is set by the market as are bond prices (interest rates). The futures price is a function of these 2 variables, it is also set by the market (?)

wouldn’t that imply a free lunch?

No, one asset of the asset pair involved in the futures contract could be more volatile. In ES futures that would be the S&P 500 which is much more volatile than the USD. Your free lunch is the risk that the S&P 500 does not actually go up but down this period. You also gain negative exposure to the stable return of USD.

Currency futures are not any special kind of futures. They work exactly the same. It just looks like there is a prediction because it is incidentally computed the same as interest rate parity.

To force this point: If interest rate parity was totally untrue, the calculations of futures price would not change.

Did you try to read and understand the Wikipedia article?

Thanks for taking the time to try to explain it. I will set some time to read the wikipedia article. S&P500 futures seems another level of complexity

In the example of USDCHF, if market participants have a better prediction of the exchange rate than the future, wouldn’t it still be possible to make money?

For example by selling (or buying) USDCHF futures at a higher price than what you predict the price will be?

Or by selling CHF bonds and buying USD bonds - without covering the FX because you believe the USDCHF is mispriced ?

Of course you can make money if things move in your favor? You could also sell ES futures and make money. You’d be long USD and short the S&P 500. That has expected return that is negative in the long term.

For futures, only what is part of the contract can actually return more or less. The cost of carry prediction is locked in at the price you buy, just like bond interest is locked in.

If the predictions on the market change, so will the price (and with futures you will pay or receive money, temporarily). But if you hold to maturity, you will still have exactly what was predicted when you bought.

For currency futures: The exchange rate can move, interest rates are locked in.

Of course you can make money if things move in your favor?

I mean in an efficient market.

If the consensus of the market is that USDCHF spot in one year will be different to the USDCHF future, wouldn’t it be possible for market participants to earn unlimited profits by borrowing in one currency and investing in the other and take advantage of the future to lock in excess profits ?

What do you think? The market certainly expects a higher return from the S&P 500 than from the USD. Therefore, ES futures are expected to close at a higher price than at present. Why can’t you make unlimited profits with ES futures? The answer is the same.

The falling franc is stressing me out ![]()

Next month‘s big bonus loses value by the day.

Thinking about borrowing CHF on margin to directly convert to USD to invest.