If you do everything properly, i.e. file the W8-BEN with your broker and do the tax declaration including DA-1, in the end you’ll effectively pay only the income tax (at your personal marginal income tax rate) on those dividends, as you should, and nothing else.

Correct with one caveat. If your effective (average) tax rate in Switzerland is lower than 15%, you still pay 15% in total on those US dividends, not your lower tax rate. The marginal tax rate is not considered for withholding tax credits.

I.e. DA-1 eliminates double taxation but you will always pay at least 15% because that’s the tax rate from the double taxation agreement.

Yeah, I know. My point was to make it as simple as possible, as purpleblau was getting even more confused with all the new information they were learning.

So, if you don’t care where exactly your tax money ends up and in which proportions, and how it’s routed on the way there, and all you care how much you pay, it’s as simple as paying income tax. Kind of ![]()

After reading @Patron post, I thought I could claim all 30% back. You guys shattered my dream.

I will make this as simple as I can: L1 will not be deducted when filed properly. L2 can be reclaimed when filing the DA-1 form. But you will still be taxed 15% on those dividend and not by the marginal tax rate (income tax rate).

My final question is: If I get taxed 15% anyway, why would I or people still have the incentive to file the DA-1 form? It’s deducted anyway, if I don’t file it. If I file it, it’s also deducted by the Swiss tax authority. What is the point of filing the DA-1 in the first place? Just to abide the law? C’mon…give me another good reason.

It’s starting to get repetitive. The normal case with Swiss brokers is that 30% are deducted (15% US WHT and 15% Swiss R-US). When you file DA-1 you get the whole 30% deposited into your bank account. You have to pay taxes on the dividend but that might be less than 30%.

I.e. with Swiss brokers it’s not much different to Swiss dividends with 35%.

This assumes the Swiss broker is a qualified intermediary (QI), W8-BEN has been filed and your effective tax rate is at least 15%.

Side-note: There are tons of ways to evade taxes. I’m sure some people do but I still expect most people to declare all their assets.

What you don’t understand (other that the fact that you must follow the law) is that if you have income that you didn’t declare, you will get catched one year or the other. That day you will have to pay the taxes for the last 10 years and you won’t be able to claim back the 15%

Thanks again.

And I get it that I pay taxes on dividends. I never said I wouldn’t pay taxes, that’s not the point. I just wanted to point out that the whole process is extremely cumbersome and complicated which doesn’t bring any benefits. I have to pay the more or less the same taxes on those dividends regardless if I declare them or not.

I’ve never said I wouldn’t pay taxes or wanted to evade taxes. That part I think I understood very well. I was just questioning the whole filing process. It didn’t make us the tax payers any easier. That’s all.

The declaration is not any more complicated than for Swiss stocks/ETFs. Or Irish ETFs where there is no (L2) withholding tax at all. It’s just a different form. In tax software it’s just one extra click or so. And W8-BEN is normally handled by the broker without any extra effort.

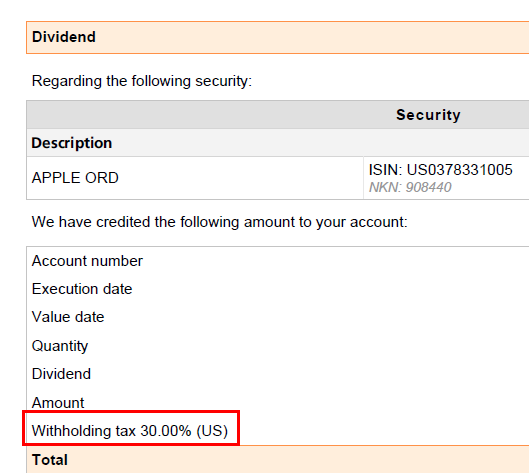

The funny thing is, Swissquote never let me fill out the W8-BEN when I opened the account. Being a QI, that’s kinda not so professional. Now, my US dividends from Swissquote all got cut by 30%. They expect the investors to file that form manually and submit it to them.

But that‘s how it‘s supposed to be, isn’t it?

15% will be withheld in the U.S. (to be offset against your Swiss taxes by DA-1).

15% will be withheld by the Swiss Intermediary (to be reclaimed from the CH tax authority by R-US).

Point being: Swiss-citizen swiss-resident investors with Swissquote will (generally) never receive more than 70% of the gross amount from U.S. dividends (though they may be able to reclaim the additional 15% deduction back).

The “non-US person” check in the account opening contract should suffice. Are you sure that your deduction is 30% US WHT and not the expected 15% US WHT + 15% Swiss?

Some US domiciled ETF pay 10%+ p.a. like QYLD. Also people are maybe interested in investing US stocks. Also US ETF like SPY simply beats VT. You bet on US economy. ![]()

Based on this and @violetblau’s screenshot, it appears this manual step is indeed required. Odd that Swissquote doesn’t do it automatically (like e.g. IBKR).

It is odd. Being a Qualified Intermediary, they never asked me to sign the W8-BEN during the account opening process.

Excerpt from FAQ about QI (Qualified Intermediary) | Swissquote

If you fail to provide us with the necessary information required under the QI Regime when you request the opening of an account or whenever the Bank is asking to renew your account’s documentation, you will not benefit from the reduced tax rate for your U.S. revenues as foreseen by the tax convention applicable in you residency country.

Consequently, your U.S. revenues will be taxed at a 30% rate.

To me this sounds like you should get the proper 15% US WHT rate as long as you fill out everything correctly, without an explicit extra step. Maybe it depends on how old your account is? Or the FAQ is misleading? No idea.

Did you specify the tax id when opening the account (OASI number)?

I opened the account roughly 2 years ago. They never gave me a W8-BEN. All they asked me to confirm is whether I define myself as a US person or not. Like any other FI these days, you just confirm that you’re a Non-resident alien.

I never got anything else. They should properly prepare that for the client. If they are a QI, I should not be signing a W8. They should get everything sorted out like IB does. Weird.

Usually, Swiss banks won’t offer it upfront. The client has to request it if he wants to get the benefits of the double tax treaty and the 15% US withholding tax (instead of 30%).

@CHRad thanks man, it’s never late to help or to contribute ![]()

What is this R-US form?

In theory, like you said, you can claim pretty much everything back. But in reality, the tax authority will still impose 15% or more on those dividends. In the end, it’s still 15%+ tax rate on the foreign dividends.