Great question.

Especially as it seems indifferent to “how do you feel about the market and this macro thesis versus that macro thesis and how does it affect your trading”. Or at least that’s what I interpreted.

I’ll go through my stock picking portfolio* as I would have done so anyway tomorrow, albeit at however long it’ll take me here to document my thinking versus my usual about 15-20 minutes total for all positions.

I’ll look at the positions through my very own lens: can this company reliably pay and ideally grow dividends (and earnings!) for me?

I won’t skip positions I otherwise would skip because they’re “full” (for the purpose of income risk management in my portfolio) for the (potential) benefit of readers.

Further filters:

- mostly large caps (>$10 billion)

- fairly or undervalued (or at best slightly overvalued but interesting)

Macro comments as seasoning (ideally ignored by everyone) as I see fit.

I’ll add FASTgraphs, drawing the line from the current market price to the lower of the fair value line or the normal** value line.

Oh, and I’ll opine on my first bunch of positions from A to C before taking your pulse whether this is in any way useful before proceeding to waste your (or my) time with positions D and beyond.

The Laundry List – A to C

(Alphabetical Order)

ADM

Not the fastest growing company, but has been paying a reliable (since 2012) and growing dividend.

Earnings Yield* of >10%.

Earnings revisions by analysts have been coming down over the past 6 months by about 25%.

Analyst scorecard: company has been missing earnings about half the time. Kinda bad.

Other considerations: company had an accounting scandal about a year ago (CFO had to leave the company).

Macro considerations: I dunno. Would have to do further research, but I guess they’re impacted by threatened tariffs for input to the products they sell? Who knows.

Conclusion: Keep on watchlist, don’t yet promote to buying candidate.

AMGEN

Steadily growing company, averaging 10% over the past 20 years, a little slower recently.

Earnings Yield* of 6.81%

Earnings revisions by analysts have been steady over the past 6 months.

Analyst scorecard: company has been meeting or exceeding earnings expectations. Great.

Other considerations: Long term debt to capital is high, earnings growth going forward is slow. Dividend growth was great and still looks acceptable.

Macro considerations: I dunno. Orang

Utan Man might have a fit. Or not. Who knows.

Conclusion: Keep on watchlist, don’t yet promote to buying candidate.

Further Remarks: sold recently a small tranche when it looked overvalued.

ARE

Slowly growing company.

AFFO*** Yield of 9.22%

Earnings revisions by analysts have been steady over the past 6 months.

Analyst scorecard: company has been meeting or exceeding earnings ecpectations. Great.

Other considerations: Long term debt to capital is high, earnings growth going forward is slow. Dividend growth was great and still looks acceptable.

Macro considerations: n/a

Conclusion: Potential buy, given the dividend yield and the steady outlook. Full position in my portfolio, though.

BBY

Mostly slowly growing company.

Earnings* Yield of 10.52%

Earnings revisions by analysts have been going down slowly over the past 6 months.

Analyst scorecard: company has beat or met earnings most of the time. Great.

Other considerations: Long term debt to capital is 50% (a bit high). Dividend growth was slow’ish.

Macro considerations: I’m guessing they import a lot from countries that are supposedly hit by high tariffs. Bad if the tariffs stay, great if the tariffs drop. Who knows.

Conclusion: Keep on watchlist, don’t yet promote to buying candidate.

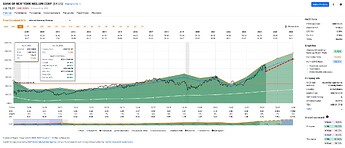

BK

Fast growing company.

Earnings* Yield of 8.3%

Earnings revisions by analysts have been going up over the past 6 months.

Analyst scorecard: company has met or beat earnings most of the time. Great.

Other considerations: Little term debt to capital, A rated by S&P.

Macro considerations: Bank. Who knows.

Conclusion: Buy if the dividend yield is acceptable.

BNS

Nicely growing company (going forward).

Earnings* Yield of 10%

Earnings revisions by analysts have been steady over the past 6 months.

Analyst scorecard: company has met or beat earnings 2/3 of the time. Fine.

Other considerations:

Very little long term debt to capital,

A+ rated by S&P.

Macro considerations: Bank. Who knows.

Conclusion: Buy.

Remark: This company is on my DRIP list and I’ve kept buying.

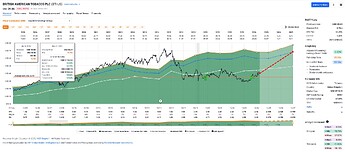

BTI

Nicely growing company (going forward).

Earnings* Yield of 11.4%

Earnings revisions by analysts have been slightly shrinking over the past 6 months.

Analyst scorecard: company has met or beat earnings 3/4 of the time. Fine.

Other considerations: Acceptable 38% long term debt to capital.

Macro considerations: Tobacco.

Lindy.

Conclusion: Buy.

Remark: I have a full position and yet I want to keep buying.

CI

Rather fast growing company.

Earnings* Yield of 8.7%

Earnings revisions by analysts have been slightly shrinking over the past 6 months.

Analyst scorecard: company has met or beat earnings most of the time. Great.

Other considerations: Acceptable 40% long term debt to capital, especially given their A- S&P credit rating.

Macro considerations: Well, boomers will need health care services.

Conclusion: Buy if you can accept the low dividend yield.

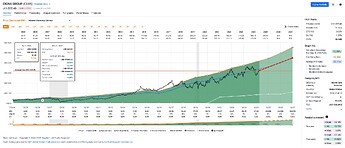

CM

Normal rate growing company.

Earnings* Yield of 9.5%

Earnings revisions by analysts have been slightly growing over the past 6 months.

Analyst scorecard: company has met or beat earnings 3/4 of the time. Fine.

Other considerations: Great 24% long term debt to capital, especially given their

A+ S&P credit rating.

Macro considerations: Bank. Who knows.

Conclusion: Buy.

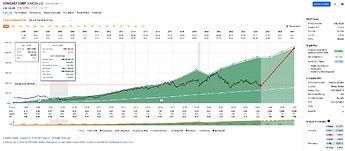

CMCSA

Relatively fast rate growing company.

Earnings* Yield of 13%

Earnings revisions by analysts have been mostly steady over the past 6 months.

Analyst scorecard: company has met or beat earnings 90% of the time. Awesome.

Other considerations: About 50% long term debt to capital, meh.

Macro considerations: N/A.

Conclusion: Strong Buy.

CMI

Fast growing company.

Earnings* Yield of 7.8%

Earnings revisions by analysts have been mostly steady over the past 6 months.

Analyst scorecard: company has met or beat earnings 3/4 of the time. Fine.

Other considerations: About 30% long term debt to capital. Nice. Also,

A S&P credit rating.

Macro considerations: Heavy machinery. Trump this, trump that, who knows.

Conclusion: Buy on further drops.

CVS

Fast growing company.

Earnings* Yield of 8.7%

Earnings revisions by analysts have been mostly downward over the past 6 months.

Analyst scorecard: company has met or beat earnings 80% of the time. Great.

Other considerations: About 50% long term debt to capital. Meh.

Macro considerations: Health Care Services. Trump this, trump that, who knows.

Conclusion: Buy on further drops if you don’t have a full position (like me).$

Glossary:

* Earnings Yield: If you owned the entire company outright, you would get the Earnings Yield as profit of what you paid for the company.

** Normal Value: The P/E line the company has traded at historically in the selected time frame of the FASTgraph depicted.

*** AFFO: Adjusted Funds From Operations, a metric used mostly (exlusively?) with REITs**** to reflect the peculiarities of them making profits due to the legal contraints for these (mostly) REIT companies.

**** REIT: Real Estate Investment Trust. Simple: owns and profits from real estate. Comes with a bunch of accounting and payout standards and obligations for the company. See e.g. REIT: What It Is and How to Invest

* See this post if you're interested: https://forum.mustachianpost.com/t/any-stockpickers-out-there/8203/28?u=your_full_name