Dear Fellow Mustachian,

I apologize for starting a new thread, but I would like to focus on my personal situation. I am a 37-year-old male who has been living in Switzerland for six years. I was able to quickly transition from a B-Visa to a C-Permit due to my Spanish nationality. I earn a gross salary of approximately 160K, which includes a bonus, as an accounting manager. My base salary is 145K, and my company contributes 12% to the 2nd pillar while I contribute 6%, totaling 18%. We manage to save around 45%, including second pillar contributions. I have three children aged 8, 4, and 6 months.

My wife is currently receiving an unemployment salary of 2.6K gross per month and plans to return to work after this summer. She recently validated her studies in Switzerland, which will enable her to work in schools up to the Kantonal level. However, her salary may vary depending on the position (teacher assistant, main teacher) and the type of school (primary, secondary, or Kantonal). She would prefer a maximum workload of 60%, so it’s difficult to estimate her potential income at this moment.

Our current net worth is approximately 555K CHF, distributed as follows:

- My 2nd pillar: ~149K with AXA (I received the minimum 1% this year)

- My wife’s 2nd pillar: ~9K (Vested account in VIAC earning less than 1% interest income)

- My 3rd pillar: ~47K (VIAC Global 100 and Finpension 99% stocks)

- My wife’s 3rd pillar: ~21K (VIAC Global 100)

- Stock market: ~314K (mainly VT)

- Other assets: ~15K (primarily for emergencies and rental deposit)

We are currently renting a 4.5 room, 120 m2 apartment with a small terrace overlooking the Rhein. The apartment is in a prime location in Schaffhausen city and costs 1820 CHF per month, including Nebenkosten and two parking spaces. I mainly work from home so after the new born it is a bit small for all of us.

We are considering buying a property which is just 5-10 minutes from Schaffhausen. The property has a 300 m2 garden and 5.5 rooms in a 160 m2 space in a very nice location also by the Rhein. The asking price is 1,170,000 CHF, including parking. Similar properties are rented for around 2.6-2.8K CHF per month.

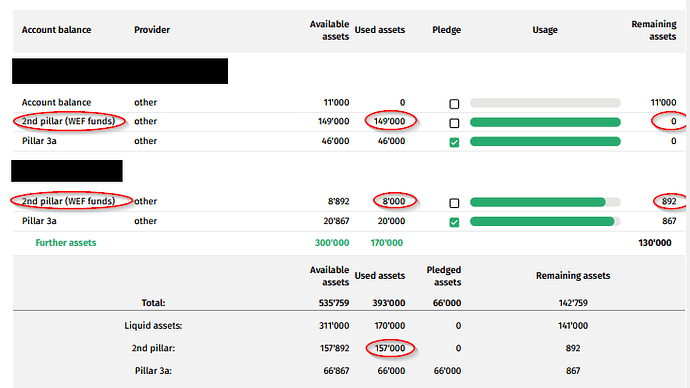

We had an initial meeting with Money Park, and it seems we can afford the property. However, we would have to withdraw the full amount from the 2nd pillar and contribute 170K in cash from our funds. This would require us to sell the majority of our VT shares. Additionally, we would have to pledge our 3rd pillars. The total down payment would be 327K, plus a ~66K 3rd pillar pledge. After this, our net worth would be primarily composed of ~60% real estate and ~40% stocks.

I understand that buying a property, especially in Switzerland, is often more of an emotional decision than a logical one. I am fond of the idea of FIRE, but buying a property and taking on a large mortgage could delay this goal. At the same time, my wife and I have always dreamed of having a large garden in a beautiful location where we can enjoy barbecues with our children and friends. We believe it’s important to find a balance: it doesn’t make sense to sacrifice our daily lives in the hope of achieving early FIRE. This is where I’m struggling… Perhaps it would be better to buy the property, enjoy the new space and garden while our children are still young, and adjust our FIRE plans accordingly.

The decision between choosing a SARON or fixed rate mortgage is also challenging. I appreciate all the comments on the other thread (Mortgage rates in Switzerland), but I’m still unsure. I always thought I would choose a SARON mortgage if I bought a property, but now that the time has come, I’m uncertain. I see a 5-year fixed rate at ~1.7% or a 2.28% SARON 3-month rate according to Money Park. It seems the market expects the SNB to lower the interest rate, so I might benefit from choosing SARON, but I’m still unsure.

I change my mind every minute, oscillating between buying the property and maintaining our current lifestyle. It’s a tough decision.

All my family lives in Spain, where the economic situation is vastly different. They lack financial education and are unable to save a single EUR at the end of the month, so I can’t discuss how things work in Switzerland with them. I need your advice. I’m not even sure what to ask you. I just need your comments. I need someone to provide reasons for or against proceeding with this decision. Why should I or shouldn’t I do it? Please share your thoughts.

Thank you very much in advance!