Happy New Year chaps - I hope all of you had a wonderful Christmas and NYE.

What an astonishing year 2020 turned out to be - A potential war with Iran, the Trump impeachment trials and subsequent US elections, the killing of George Floyd and ensuing global BLM protests, climate disruptions all over the world with sweeping wildfires and tropical storms, protests in Belarus, Brexit and last but not least the wretched Covid-19 Pandemic.

Who could have predicted the chaos and suffering 2020 would bring?..and yet, we survived - we adapted, we coped…we saw the best and worst of humanity and have made it to 2021. We truly are a resilient species.

This is one of the main reasons I never ever try and time the market and I completely ignore the so called pundits wheeled out on the financial news. If you are a long term investor none of this matters - we buy and hold and adjust our asset allocation according to our risk tolerance.

No matter what your investment philosophy is - index investing, active funds or even a concentrated portfolio of high growth stocks… In my opinion (and experience) consistency and discipline + increasing your savings rate are far more important in building wealth than arguing with strangers on the internet about reducing the TER of your portfolio by 0.001%. This thread on twitter really resonates with me.

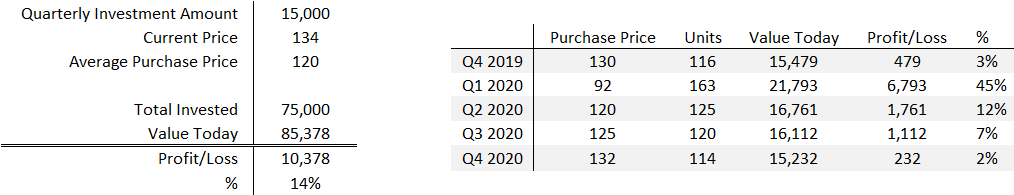

As mentioned in a previous post, my strategy in CH is really simple; I invest 15k every quarter via standing order in a simple MSCI World Tracker fund.

As you can see below - I ended the year up 14% with this strategy which is remarkable given where we were back in Feb. This is why sticking to your plan is so important… many of my friends panic sold in March taking a 30%+ hit on their portfolio and are YET to get back in the market because they feel its overvalued. This is the problem with timing the market, when do you get back in?

The table below also highlights the beauty of dollar cost averaging, my March investment luckily coincided with the market bottom and resulted in a 45% return alone.

Furthermore, reading between the lines in some of the other threads over the past year - It is apparent that this may have been the first crash that many of you have experienced (with skin in the game) - how did you feel you handled it?..any regrets?.. anything you would have done differently?

Cheers!