Yeah, they must use dividends to take their fees and buy futures for the leverage. And they probably have huge cash positions to use as a collateral for futures and as reserves to cover losses on futures positions. So I am actually surprised that there is anything left to distribute.

Thanks to all of you, very much appreciated!

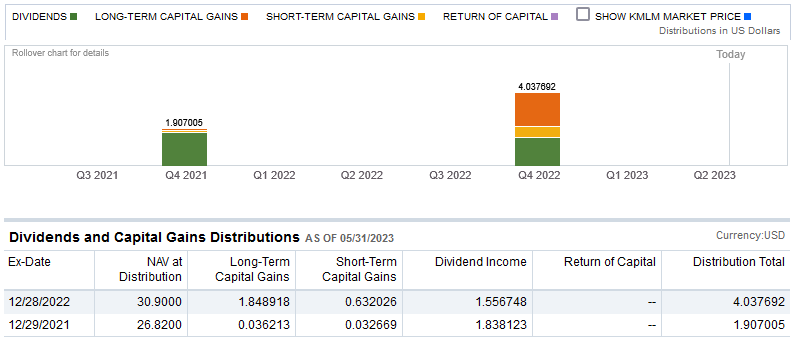

The screener looks much better 2022:

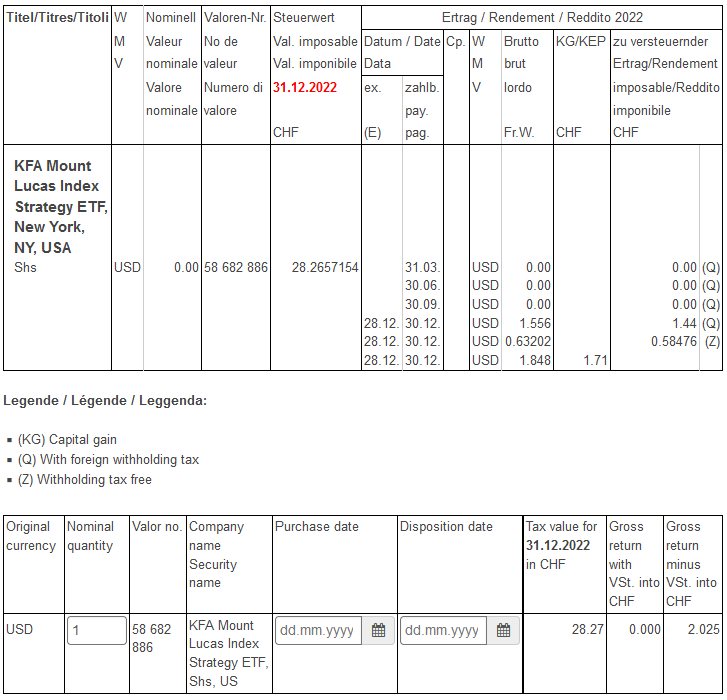

And ICTax agrees somewhat:

Apparently the short-term capital gains got added to taxable distributions. We are still taxed on about 7% per year.

Update: Submitted annual report 2023 today, let’s see if the magic’s happening ![]()

Edit: Magic has happened: Zu versteuernder Ertrag 2022: 0

I’ve provided my tax law argumentation from last year, along with the new annual report, so not too much work this year ![]()

But shouldn’t the interest on the T-Bill collateral in excess of costs be taxable?

That is what I assumed too at first, but according to Swiss tax law, returns from futures are 100% tax free, so this includes returns from futures collaterals.

No, no, they hold actual T-Bills that pay normal interest. They need some real assets as collaterals to buy futures. Or you say those are tax free too?

Yes, but that’s part of futures trading. You cannot hold futures without collateral. So you cannot view them seperately.