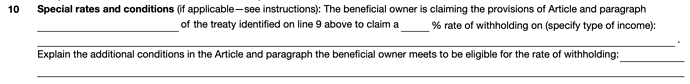

I’m trying to set up an account with TDA Ameritrade and wondering what exactly the special rates are between Switzerland and the USA that need to be filled in on the W-8BEN form. Does anyone know this?

It is 15% instead of the regular 30% without treaty. Literally half of this forum is about that.

15% on what exactly? There is also supposed to be an article and paragraph?

Convention entre la Confédération suisse et les États-Unis d’Amérique en vue d’éviter les doubles impositions en matière d’impôts sur le revenu. (it may be better to write the official name in english)

Art. 10, paragraph 2.

15% on the dividends received from the US

I don’t think you’re supposed to fill anything there, you’re just claiming the standard part of the treaty. Please read the instructions from the IRS, as indicated in the form…

Perfect. Exactly what I was after!

But that’s definitely not what you should write on that line ![]()

It’s all clearly spelled out in the instructions:

This line is generally not applicable to treaty benefits under an interest or dividends (other than dividends subject to a preferential rate based on ownership) article of a treaty.

Assuming you’re a Swiss-resident individual that does not have ties to the U.S., W8-BEN is in practice a mere formality: You just fill in your personal details, your country of residence, sign and send a copy to the bank/broker. That’s it.

Some of my banks gave their own unofficial guidance (such as checkmarking the fields they expected me to complete) indicating suchwise. Don’t overcomplicate - though keep in mind the U.S. date format (side-rant: why do the U.S. seem so exceptionally bad all of their units and data formats?).

I don’t think anyone anywhere even gives a second look at the form. They’ll only request one once expired. Unless you do get in trouble with the I.R.S., at which point they’ll might use it against you for making a false declaration.

Amen to that! Got today (01.03) a file with a long list of “3rd January” records… ![]()